Reebok 2015 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2015 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270

|

|

62

2

GROUP MANAGEMENT REPORT – OUR GROUP

Group Strategy – adidas Strategy

•NPS introduced as key KPI: To drive its consumer-obsessed ambition in a measurable and objective

manner, for the first time in 2015, adidas included a key KPI of its brand advocacy programme, the

Net Promoter Score (NPS), in its employee incentive system. Investing in and rolling out a global NPS

ecosystem, top down and bottom up, is one of the key change pillars of Creating the New for driving

better execution at a consumer level across the brand’s touchpoints.

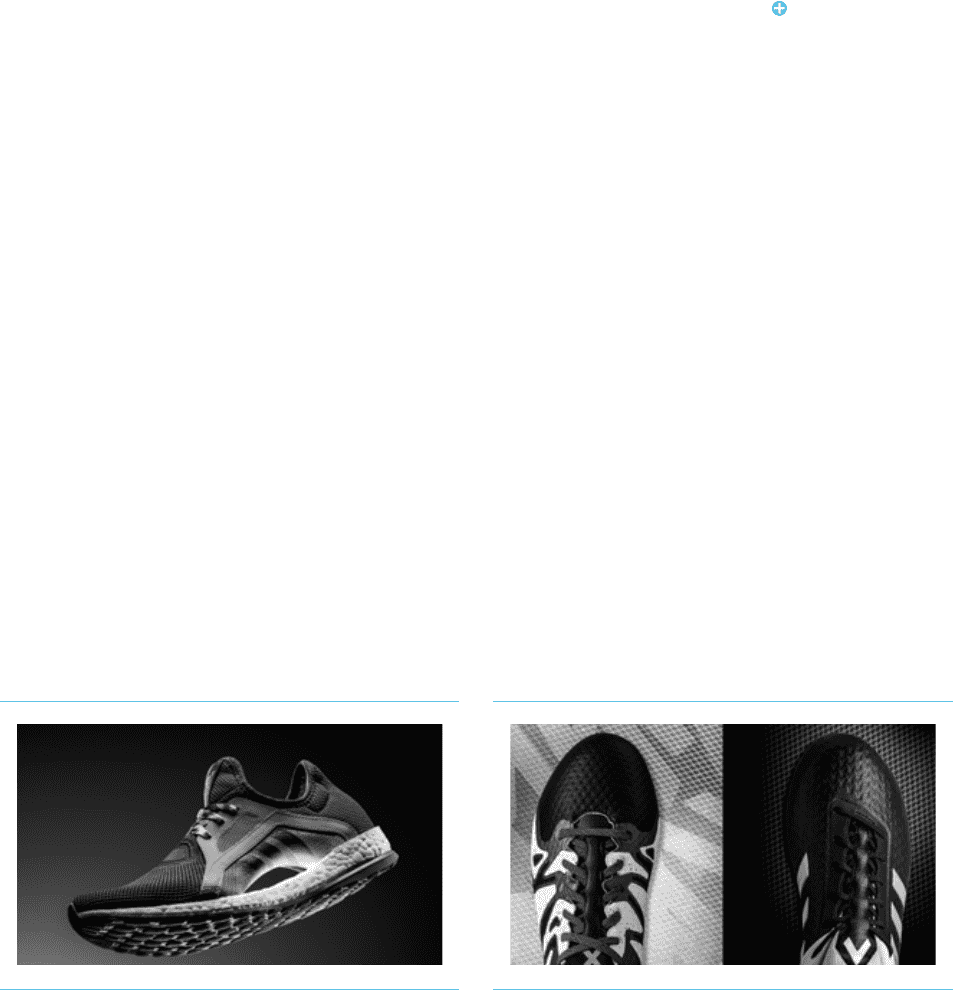

FOOTWEAR FRANCHISES: BUILDINGTHE BRAND FROM THE FEET UP

We are convinced that footwear has the highest influence on brand perception and, more importantly, on

innovation, on creativity and on design confidence. Footwear is also the best driver of Net Promoter Score,

which in turn correlates directly into purchase intent and potential to grow market share. Therefore, until

2020, adidas is placing a higher emphasis in terms of investment and resources into footwear. In addition,

adidas also has a clear strategy to reduce the number of footwear models, putting a stronger focus on a

few key franchises that can really make a difference for the brand.

Footwear franchises are defined as long-term concepts that adidas commits to for a multi-year period. The

goal of franchises is not only to shape sport, but also to influence culture. They are built to create trends,

not follow. They are targeted directly at the creator through iconic features, stories and function, and have

the potential to be iterated and expanded over time. The mix of franchises is expected to be representative

of the brand’s annual category priorities, and their life cycles will be carefully managed, to ensure longevity

and make sure they are not overheated.

In addition, franchises will be prioritised throughout the value chain, highly leveraging and benefiting from

the Group’s strategic choices of Speed, Cities and Open Source. By 2017, adidas expects its top franchises

to represent at least a 30% share of the footwear business. In 2016, key adidas franchises will include a

blend of past icons such as the Stan Smith and Superstar as well as future icons such as the UltraBOOST,

PureBOOST X, Ace and NMD.

see Internal Group Management

System, p. 102

02 ADIDAS SPORT PERFORMANCE

PUREBOOST X RUNNING SHOE

03 ADIDAS SPORT PERFORMANCE

X ANDACE FOOTBALL BOOTS