Reebok 2015 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2015 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TO OUR SHAREHOLDERS

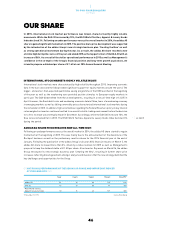

Our Share

50

1

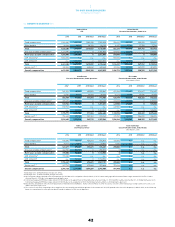

SHAREHOLDER RETURN PROGRAMME CONTINUED

On October 1, 2014, adidas AG announced a multi-year shareholder return programme of up to € 1.5 billion

in total to be completed by December 31, 2017. The shareholder return programme is being executed

primarily by buying back shares via the stock exchange under the authorisation given by the Annual General

Meeting on May 8, 2014, for the period through to May 7, 2019. The authorisation covers the repurchase of

up to 10% of the company’s share capital on the stock exchange, subject to advantageous market conditions.

On March 5, 2015, adidas AG announced the commencement of the second tranche of the share buyback

programme with an aggregate acquisition cost of up to € 300 million (excluding incidental purchasing

costs). Within the second tranche up to and including June 15, 2015, adidas AG bought back 4,129,627

shares. This corresponds to a notional amount of € 4,129,627 in the nominal capital and consequently

1.97% of the company’s nominal capital. The average purchase price per share for this second tranche was

€ 72.65. The total number of shares bought back by adidas AG within the framework of the shareholder

return programme amounted to 9,018,769 shares as of December 31, 2015. This corresponds to a notional

amount of € 9,018,769 in the nominal capital and consequently 4.31% of the company’s nominal capital.

As of year-end 2015, the adidas AG had successfully completed 40% of its multi-year shareholder return

programme.

STRONG INTERNATIONAL INVESTOR BASE

Based on our share register, we estimate that adidas AG currently has slightly more than 70,000

shareholders. In our latest ownership analysis conducted in February 2016, we identified almost 100% of

our shares outstanding. Institutional investors represent the largest investor group, holding 87% of shares

outstanding. Private investors and undisclosed holdings account for 8 %. Current members of the adidas

Group Executive and Supervisory Boards hold less than 1% in total. Lastly, as a result of shares purchased

so far as part of our share buyback programme, adidas AG currently holds 4% of the company’s shares

as treasury shares.

In terms of geographical distribution, the North American market currently accounts for 33% of institutional

shareholdings, followed by the UK with 26%. Identified German institutional investors hold 9% of shares

outstanding. Switzerland and France account for 6% and 5%, respectively. 21% of institutional shareholders

were identified in other regions of the world.

VOTING RIGHTS NOTIFICATIONS PUBLISHED

All voting rights notifications received in 2015 and thereafter in accordance with §§ 21 et seq. of the

German Securities Trading Act (Wertpapierhandelsgesetz – WpHG) can be viewed on our corporate website.

Information on reportable shareholdings that currently exceed or fall below a certain threshold can also

be found in the Notes section of this Annual Report.

DIRECTORS’ DEALINGS REPORTED ON CORPORATE WEBSITE

The purchase or sale of adidas AG shares (ISIN DE000A1EWWW0) or related financial instruments, as

defined by § 15a WpHG, conducted by members of our Executive or Supervisory Boards, by key executives

or by any person in close relationship with these persons, is reported on our website. In 2015, adidas AG

received no notifications pursuant to § 15a WpHG.

ADIDASAG SHARE RECEIVES STRONGANALYSTSUPPORT

The adidas Group and the adidas AG share continued to receive strong analyst support in 2015. Around

35 analysts from investment banks and brokerage firms regularly published research reports on our Group.

The vast majority of analysts are confident about the medium- and long-term potential of the Group. This is

reflected in the recommendation split for our share as at December 31, 2015. 38% of analysts recommended

investors to ’buy’ our share (2014: 24%). 48% advised to ‘hold’ our share (2014: 57%) and 14% of the analysts

recommended to ‘sell’ our share (2014: 19%).

see Diagram 05

see Diagram 06

www.adidas-group.com/

voting_rights_notifications

see Note 26, p. 220