Reebok 2015 Annual Report Download - page 212

Download and view the complete annual report

Please find page 212 of the 2015 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.208

4

CONSOLIDATED FINANCIAL STATEMENTS

Notes – Notes to the Consolidated Statement of Financial Position

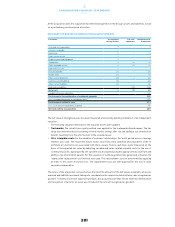

Discount rates are based on a weighted average cost of capital calculation considering a five-year average

market-weighted debt/equity structure and financing costs referencing the Group’s major competitors for

each cash-generating unit. The discount rates used are after-tax rates and reflect the specific equity and

country risk of the relevant cash-generating unit.

Due to the implementation of an omni-channel distribution approach in connection with the new

organisational structure and the associated change in segmental reporting, the carrying amounts of

acquired goodwill have been reallocated to the new groups of cash-generating units.

The groups of cash-generating units are defined as the regional markets which are responsible for the

joint distribution of adidas and Reebok as well as the other operating segments TaylorMade-adidas Golf,

Reebok-CCM Hockey and Runtastic. The regional markets are: Western Europe, North America, Greater

China, Russia/CIS, Latin America, Japan, Middle East, South Korea and Southeast Asia/Pacific.

Due to the cessation of the subdivision into the distribution channels Wholesale and Retail in the

regional markets as well as the consolidation of the former markets Brazil and SLAM (Latin America

excluding Brazil) into the new market Latin America, the number of groups of cash-generating units to

which goodwill is allocated decreased from 22 to 11 compared to December 31, 2014. This did not result

in a new composition of cash-generating units. However, the monitoring of goodwill is not performed

on the same level anymore. Through the acquisition of runtastic GmbH, the number of cash-generating

units increased to 12.

The allocation of goodwill to the new groups of cash-generating units was performed in the first quarter

of 2015 by aggregating goodwill so far allocated to Wholesale and Retail within the regional markets.

Due to the change in the composition of the Group’s operating segments and associated cash-generating

units respectively, the Group assessed in the first quarter of 2015 whether goodwill impairment was

required. The underlying value drivers and key assumptions for impairment testing purposes remained in

principle unchanged compared to the impairment test performed for the consolidated financial statements

at December 31, 2014. Goodwill impairment losses in the first quarter of 2015 amounted to € 18 million. Due

to the consolidation of the groups of cash-generating units Retail SLAM and Retail Brazil with Wholesale

SLAM and Wholesale Brazil as well as Retail Russia/CIS with Wholesale Russia/CIS, the carrying amount

of the respective new groups of cash-generating units Latin America and Russia/CIS was determined

to be higher than the recoverable amount of € 438 million and € 130 million, respectively. The goodwill

impairment amount comprises impairment losses of € 15 million within the segment Latin America and

€ 3 million within the segment Russia/CIS.

Goodwill arising from a preliminary purchase price allocation in connection with the Runtastic acquisition

was allocated to the groups of cash-generating units of the regional markets based on the expected

synergy potential.

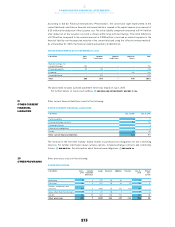

In the course of the annual impairment test, the Group assessed whether goodwill impairment was

required. In this context, goodwill impairment losses amounted to € 16 million. The goodwill impairment

amount comprises impairment losses of € 1 million within the segment North America, € 3 million within

the segment Russia/CIS and € 13 million within the segment Latin America. Goodwill allocated to these

groups of cash-generating units was completely impaired. Goodwill allocated to the cash-generating unit

Reebok-CCM Hockey was already fully impaired at December 31, 2014.