Reebok 2015 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2015 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270

|

|

TO OUR SHAREHOLDERS

Our Share

48

1

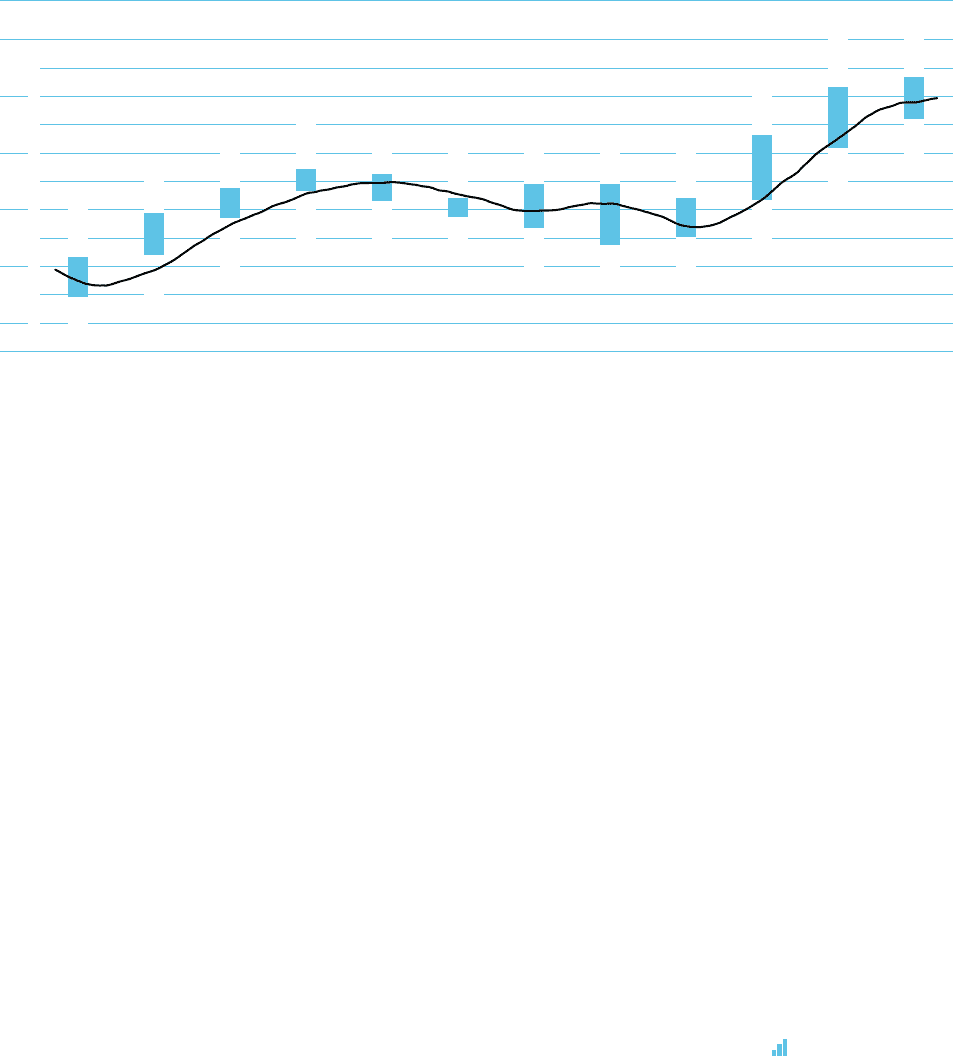

In addition, the financial objectives outlined during the day were positively perceived by the financial

community and were above market expectations.

At the beginning of the second quarter, the adidas AG share continued its positive trend, supported by

subsequent management roadshow activities. On May 5, the adidas Group released strong first quarter

results which were above market expectations. However, the overall negative market sentiment resulting

from ongoing concerns with regard to a Greek default weighed on both the adidas AG share and international

equity markets during the day and for the remainder of the second quarter. On June 24, the adidas Group

held its first IR Tutorial Workshop. While the event was very well received by market participants, the adidas

AG share was not able to escape the overall negative market sentiment.

At the beginning of the third quarter of 2015, extensive roadshow activities as well as positive analyst

commentary prior to the adidas Group’s first half results release provided positive stimulus to the share

price in July. While the publication of the adidas Group’s first half results was positively perceived by market

participants, the adidas AG share came under pressure from mid-August onwards, reflecting the overall

challenging market environment caused by weakening economic data from China. During the first half of

September, the adidas AG share stabilised and traded sideways, supported by positive company-specific

as well as sector-related newsflow. On November 5, following the publication of a very strong set of third

quarter results, together with increased guidance for the 2015 financial year and a better-than-expected

initial outlook for 2016, the adidas AG share rose 9% during the day. Subsequent management roadshows

and positive analyst feedback provided further momentum to the share price, resulting in a new all-time

high of € 93.41 on December 2. The remaining weeks of December were characterised by macroeconomic

uncertainties as well as profit taking by some investors. As a result, the adidas AG share closed 2015 at

€ 89.91, representing a 56% increase over the year and making the adidas AG share the top performer of

the DAX-30. This implies a market capitalisation of € 18.0 billion at the end of 2015 versus € 11.8 billion

at the end of 2014.

see Table 03

042015 ADIDASAG HIGH AND LOW SHARE PRICES PER MONTH 1IN €

| Jan. Feb. Mar. Apr. May Jun. Jul. Aug. Sep. Oct. Nov. Dec. |

90

80

70

60

50

—

30- day moving average

■

High and low share prices Source: Bloomberg.

1 Based on daily Xetra closing prices.

61.57

69.43

73.80

77.21

76.33

72.09

74.47

74.48

72.01

83.20

91.59

93.41

54.61

61.79

68.44

73.25

71.53

68.65

66.80

63.68

65.18

71.70

80.80

85.93