Reebok 2015 Annual Report Download - page 220

Download and view the complete annual report

Please find page 220 of the 2015 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

216

4

CONSOLIDATED FINANCIAL STATEMENTS

Notes – Notes to the Consolidated Statement of Financial Position

In Germany, adidas AG grants its employees contribution-based and final salary defined benefit pension

schemes, which provide employees with entitlements in the event of retirement, disability and death. In

general, German pension plans operate under the legal framework of the German Company Pensions Act

(‘Betriebsrentengesetz’) and under the German Labour Act. A large proportion of the pension plans are

closed to new entrants. New employees are entitled to benefits in accordance with the adidas Pension

Plan or the adidas Management Pension Plan. The adidas Pension Plan is a matching contribution plan;

the contributions to this pension plan are partly paid by the employee and partly paid by the employer.

The contributions are transferred into benefit building blocks. The benefits are paid out in the form of a

pension, a lump sum or instalments. The pension plans in Germany are financed using book reserves, a

contractual trust arrangement (CTA) and a pension fund (‘Pensionsfonds’) in combination with a reinsured

provident fund (‘Unterstützungskasse’) for certain current and former members of the Executive Board of

adidas AG. Further details about the pension entitlements of members of the Executive Board of adidas AG

are contained in the Compensation Report SEE COMPENSATION REPORT, P. 36.

The final salary defined benefit pension scheme in the UK is closed to new entrants and to future accrual.

The benefits are mainly paid out in the form of pensions. The scheme operates under UK trust law as well

as under the jurisdiction of the UK Pensions Regulator and therefore is subject to a minimum funding

requirement. The Trustee Board is responsible for setting the scheme’s funding objective, agreeing the

contributions with the company and determining the investment strategy of the scheme.

The subsidiaries in South Korea grant a final pay pension plan to certain employees. This plan is closed

to new entrants. The benefits are paid out in the form of a lump sum. The pension plan operates under the

Employee Retirement Benefit Security Act (ERSA). This regulation requires a minimum funding amounting

to 80% of the present value of the vested benefit obligation. Both subsidiaries annually contribute at least

the minimum amount in order to meet the funding requirements.

The defined benefit plan in Japan was closed effective as of March 31, 2015 and a new defined contribution

plan was established. For each employee, the present value of the entitlement from the defined benefit

plan was calculated as at March 31, 2015. The employees can opt either to transfer the calculated lump

sum to the new defined contribution plan over a four-year period (until 2019) or to receive the lump sum

when leaving the company. Future accruals can only be made through the defined contribution plan. Due to

this change, the respective defined benefit obligation according to IAS 19 largely ceased at the end of 2015.

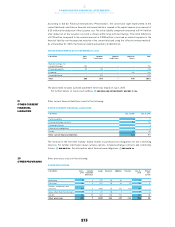

BREAKDOWN OF THE PRESENT VALUE OF THE OBLIGATION ARISING FROM DEFINED BENEFIT

PENSION PLANS IN THE MAJOR COUNTRIES

€ in millions Dec. 31, 2015 Dec. 31, 2014

Germany UK South Korea Germany UK South Korea

Active members 177 – 14 178 – 12

Former employees with vested rights 52 52 – 49 50 –

Pensioners 73 4 – 78 4 –

Total 302 56 14 305 54 12

The Group’s pension plans are subject to risks from changes in actuarial assumptions, such as the discount

rate, salary and pension increase rates, and risks from changes in longevity. A lower discount rate results

in a higher defined benefit obligation and/or in higher contributions to the pension funds. Lower than

expected performance of the plan assets could lead to an increase in required contributions or to a decline

of the funded status.

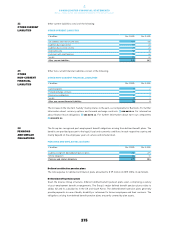

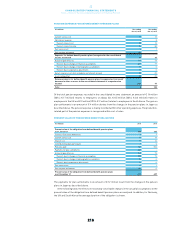

The following tables analyse the defined benefit plans, plan assets, present values of the defined benefit

pension plans, expenses recognised in the consolidated income statement, actuarial assumptions and

further information.