Reebok 2015 Annual Report Download - page 211

Download and view the complete annual report

Please find page 211 of the 2015 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

207

4

CONSOLIDATED FINANCIAL STATEMENTS

Notes – Notes to the Consolidated Statement of Financial Position

As a general principle, it is regularly assessed whether there are any indications that furniture and fixtures

might be impaired. Irrespective of the existence of such indications, furniture and fixtures in own-retail

stores are annually tested for impairment whereby the recoverable amount is calculated using the

discounted cash flow method as part of determining the profitability of the respective own-retail stores.

Impairment losses amounted to € 19 million and € 17 million for the years ending December 31, 2015 and

2014, respectively SEE NOTE 31. These are related to other equipment, furniture and fixtures as well as

buildings and leasehold improvements, mainly in the Group’s own-retail activities, for which contrary to

expectations there will be an insufficient flow of future economic benefits. In 2015, reversals of impairment

losses were recorded in an amount of € 1 million (2014: € 1 million).

The increase in ‘Land, land leases, buildings and leasehold improvements’ mainly relates to the

acquisition of a warehouse in Chekhov, Russia, which was previously leased.

For details see Attachment I to the consolidated financial statements SEE STATEMENTOF MOVEMENTS

OF INTANGIBLE ANDTANGIBLE ASSETS, P. 248.

Goodwill primarily relates to the Group’s acquisitions of the Reebok, TaylorMade and Runtastic businesses

as well as acquisitions of subsidiaries, primarily in the USA, Australia/New Zealand, the Netherlands,

Denmark and Italy.

GOODWILL

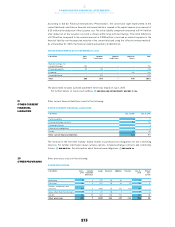

€ in millions Dec. 31, 2015 Dec. 31, 2014

Goodwill, gross 1,878 1,588

Less: accumulated impairment losses (486) (419)

Goodwill, net 1,392 1,169

The majority of goodwill, which primarily relates to the acquisition of the Reebok business in 2006, is

denominated in US dollars. A currency translation effect of positive € 65 million and positive € 73 million

was recorded for the years ending December 31, 2015 and 2014, respectively.

The Group determines whether goodwill impairment is necessary at least on an annual basis. The

impairment test for goodwill is performed based on cash-generating units which represent the lowest

level within the Group at which goodwill is monitored for internal management purposes. This requires

an estimation of the recoverable amount of the cash-generating units to which the goodwill is allocated.

The recoverable amount of a cash-generating unit is determined on the basis of value in use. Estimating

the value in use requires the Group to make an estimate of the expected future cash flows from the

cash-generating units and also to choose a suitable discount rate in order to calculate the present value

of those cash flows.

This calculation uses cash flow projections based on the financial planning covering a five-year period

in total. The planning is based on long-term expectations of the adidas Group and reflects in total for the

cash-generating units an average annual mid- to high-single-digit sales increase with varying forecasted

growth prospects for the different units. Furthermore, the Group expects the operating margin to expand,

primarily driven by an improvement in the gross margin as well as lower operating expenses as a percentage

of sales. The planning for capital expenditure and working capital is primarily based on past experience.

The planning for future tax payments is based on current statutory corporate tax rates of the individual

cash-generating units. Cash flows beyond this five-year period are extrapolated using steady growth rates

of 1.7% (2014: 1.7%). According to the Group’s expectations, these growth rates do not exceed the long-term

average growth rate of the business sector in which each cash-generating unit operates.

13

GOODWILL