Reebok 2015 Annual Report Download - page 214

Download and view the complete annual report

Please find page 214 of the 2015 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

210

4

CONSOLIDATED FINANCIAL STATEMENTS

Notes – Notes to the Consolidated Statement of Financial Position

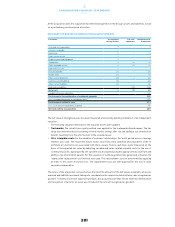

Trademarks and other intangible assets consist of the following:

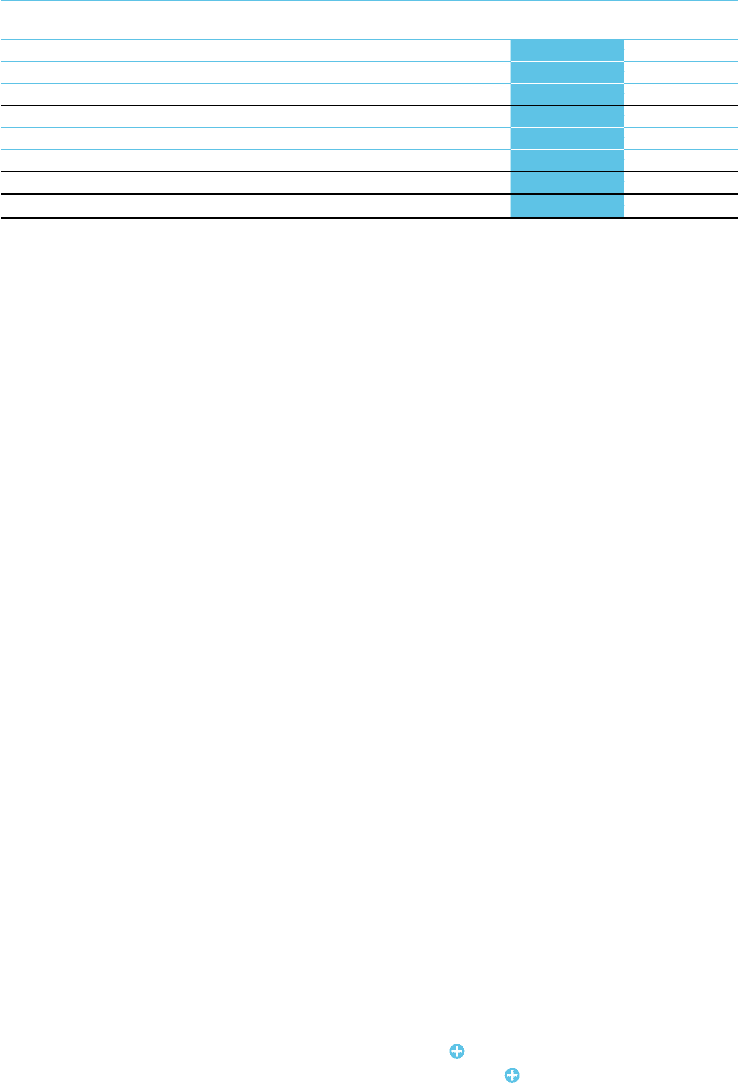

TRADEMARKSAND OTHER INTANGIBLE ASSETS

€ in millions Dec. 31, 2015 Dec. 31, 2014

Reebok 1,423 1,276

Reebok-CCM Hockey 118 107

Other 86 49

Trademarks 1,628 1,432

Software, patents and concessions 885 772

Less: accumulated amortisation and impairment losses (697) (609)

Other intangible assets 188 162

Trademarks and other intangible assets 1,816 1,594

At December 31, 2015, trademarks, mainly related to the acquisition of Reebok International Ltd. (USA)

in 2006, Ashworth, Inc. in 2008 and runtastic GmbH in 2015, have indefinite useful lives. This is due to the

expectation of permanent use of the acquired brand names.

Other trademarks mainly relate to the brand names Ashworth, Adams Golf, Five Ten and Runtastic.

The Group tests at least on an annual basis whether trademarks with indefinite useful lives are impaired.

This requires an estimation of the fair value less costs to sell of the trademarks. As part of this estimation,

the Group is required to make an estimate of the expected future trademark-specific sales and appropriate

arm’s length notional royalty rates and also to choose a suitable discount rate in order to calculate the

present value of those cash flows.

During the impairment test for trademarks, the recoverable amount is determined on the basis of fair

value less costs to sell (costs to sell are calculated with 1% of the fair value). The fair value is determined

by discounting notional royalty savings after tax and adding a tax amortisation benefit, resulting from the

amortisation of the acquired asset (‘relief-from-royalty method’). These calculations use projections of

net sales related royalty savings, based on financial planning which covers a period of five years in total.

The level of the applied royalty rate for the determination of the royalty savings is based on contractual

agreements between the adidas Group and external licensees as well as publicly available royalty rate

agreements for similar assets. Notional royalty savings beyond this period are extrapolated using steady

growth rates of 1.7% (2014: 1.7%). The growth rates do not exceed the long-term average growth rate of

the business to which the trademarks are allocated.

The discount rate is based on a weighted average cost of capital calculation derived using a five-year

average market-weighted debt/equity structure and financing costs referencing the Group’s major

competitors. The discount rate used is an after-tax rate and reflects the specific equity and country risk.

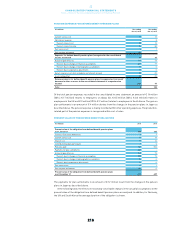

The applied discount rate depends on the respective intangible asset being valued and ranges between

6.8% and 8.4% (2014: between 6.7% and 8.4%).

The adidas Group determined that there was no impairment necessary for any of its trademarks

with indefinite useful lives in the years ending December 31, 2015 and 2014. In addition, an increase

in the discount rate of up to approximately one percentage point or a reduction of cash inflows of up to

approximately 13% would not result in any impairment requirement. However, future changes in expected

cash flows and discount rates may lead to impairments of the accounted trademarks in the future.

As part of the goodwill impairment test, the Reebok trademark is allocated on a pro rata basis to the

cash-generating units. Thereof, the major shares relate to North America (€ 361 million), Western Europe

(€ 312 million), Russia/CIS (€ 239 million) and Latin America (€ 189 million).

Amortisation expenses for intangible assets with definite useful lives were € 60 million and € 58 million

for the years ending December 31, 2015 and 2014, respectively SEE NOTE 31.

For details see Attachment I to the consolidated financial statements SEE STATEMENTOF MOVEMENTS

OF INTANGIBLE ANDTANGIBLE ASSETS, P. 248.

14

TRADEMARKSAND

OTHER INTANGIBLE

ASSETS