Reebok 2015 Annual Report Download - page 176

Download and view the complete annual report

Please find page 176 of the 2015 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270

|

|

172

3

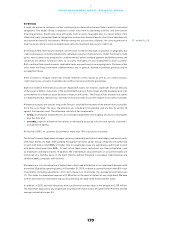

GROUP MANAGEMENT REPORT – FINANCIAL REVIEW

Risk and Opportunity Report – Illustration of Material Risks

The interest rate sensitivity analysis assumes a parallel shift of the interest yield curve for all currencies and

was performed on the same basis for both 2014 and 2015. As in the prior year, a 100 basis point increase

or decrease in interest rates at December 31, 2015 would have had no major impact on shareholders’

equity and net income.

To reduce interest rate risks and maintain financial flexibility, a core tenet of our Group’s financial strategy

is to continue to use surplus cash flow from operations to reduce gross borrowings. Beyond that, the adidas

Group is constantly looking for adequate hedging strategies through interest rate derivatives in order to

mitigate interest rate risks.

In 2015, interest rates in Europe and North America remained at low levels. Given the central banks’

current interest rate policies and macroeconomic uncertainty, we do not foresee any major interest rate

increases in Europe in 2016. Due to the positive macroeconomic development in the USA, however, we

believe a slight increase in US interest rates is likely. At December 31, 2015, 80% of the Group’s financing

was denominated in euros.

Financing and liquidity risks

Liquidity risks arise from not having the necessary resources available to meet maturing liabilities with

regard to timing, volume and currency structure. In addition, the adidas Group faces the risk of having

to accept unfavourable financing terms due to liquidity restraints. Our Group Treasury department uses

an efficient cash management system to manage liquidity risk. At December 31, 2015, Group cash and

cash equivalents together with marketable securities amounted to € 1.370 billion (2014: € 1.688 billion).

Moreover, our Group maintains € 2.134 billion bilateral credit lines. In 2015, the syndicated loan facility

of € 500 million was terminated and replaced by € 700 million in committed bilateral credit lines. The

€ 2.134 billion in credit lines are designed to ensure sufficient liquidity at all times.

see Treasury, p. 124

see Treasury, p. 124

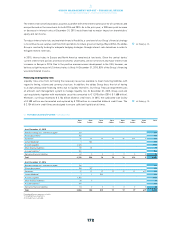

07FUTURE CASH OUTFLOWS€ IN MILLIONS

Up to

1 year

Up to

2 years

Up to

3 years

Up to

4 years

Up to

5 years

Up to

6 years

Up to

7 years

Total

As at December 31, 2015

Bank borrowings incl. commercial paper 229 229

Private placements 1142 142

Eurobond 116 16 16 16 16 616 9 705

Convertible bond 11 502 503

Accounts payable 2,024 2,024

Other financial liabilities 58 18 76

Accrued liabilities 2596 596

Derivative financial liabilities 60 0 0 0 0 0 0 60

Total 3,126 536 16 16 16 616 94,335

As at December 31, 2014

Bank borrowings incl. commercial paper 194 194

Private placements 1108 127 235

Eurobond 117 17 17 17 17 17 617 719

Convertible bond 11 1 502 504

Accounts payable 1,652 1,652

Other financial liabilities 38 7 44

Accrued liabilities 2491 491

Derivative financial liabilities 53 0 0 0 0 0 0 55

Total 2,554 152 519 17 17 17 617 3,894

Rounding difference may arise in totals.

1 Including interest payments.

2 Accrued interest excluded.