Reebok 2015 Annual Report Download - page 179

Download and view the complete annual report

Please find page 179 of the 2015 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GROUP MANAGEMENT REPORT – FINANCIAL REVIEW

Management Assessment of Performance, Risks and Opportunities, and Outlook

175

3

MANAGEMENTASSESSMENT

OF PERFORMANCE, RISKS

AND OPPORTUNITIES, AND

OUTLOOK

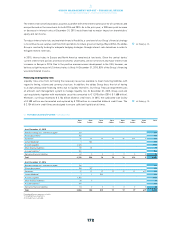

ASSESSMENTOF PERFORMANCE VERSUSTARGETS

We communicate our Group’s financial targets on an annual basis. We also provide updates throughout

the year as appropriate. In 2015, the adidas Group delivered a stellar financial performance. Group sales

development was favourably impacted by rising consumer spending on sporting goods, supported by the

robust athleisure trend as well as increased health awareness and sports participation in most geographical

areas. In light of our highly attractive and innovative product launches, significant investments in consumer-

engaging and brand-building activities as well as the presentation of the Group’s new strategic business

plan ‘Creating the New’, the adidas Group enjoyed strong momentum, which accelerated during the course

of 2015. As a result, we increased our top- and bottom-line guidance for the full year 2015 in November,

compared to our initial expectations.

In 2015, Group revenues rose 10% on a currency-neutral basis, driven by strong growth at both adidas

and Reebok. Currency-neutral Group sales grew in most market segments, with double-digit growth

in Western Europe, Greater China, Latin America and MEAA. As a result, Group revenues increased

significantly above our initial guidance of a mid-single-digit currency-neutral increase. Gross margin

increased 0.6 percentage points to 48.3% and was in line with our initial expectations of 47.5% to 48.5%.

This development was driven by the positive effects from a more favourable pricing, channel and category

mix, more than offsetting negative currency effects and higher input costs. Operating margin excluding

goodwill impairment losses declined 0.1 percentage points to 6.5%, in line with our guidance of between

6.5% and 7.0%. This development was primarily due to higher other operating expenses as a percentage of

sales in connection with the planned increase in expenditure for point-of-sale and marketing investments

to strengthen brand desirability, which more than offset the increase in gross margin. Net income from

continuing operations excluding goodwill impairment losses grew 12% to € 720 million. This was above

our initial guidance of an improvement between 7% and 10%, despite the fact that the effective tax rate

for 2015 was 32.9%, and thus – mainly due to the non-recognition of deferred tax assets – well above the

initially expected level of around 29.5%.

In 2015, operating working capital developed positively throughout the year. While we had initially expected

average operating working capital as a percentage of sales to decrease moderately compared to the prior

year level of 22.4%, average operating working capital as a percentage of sales improved significantly in

2015 and ended the year at 20.5%, thus exceeding our initial expectations. Capital expenditure (excluding

acquisitions) amounted to € 513 million in 2015, thus below our guidance of around € 600 million. Investments

were mainly focused on adidas and Reebok controlled space initiatives, aimed at further strengthening

the Group’s own-retail activities, franchise store presence as well as shop-in-shop presentations. Other

areas of investments included the Group’s logistic infrastructure and IT systems as well as the further

development of our Group headquarters in Herzogenaurach, Germany.

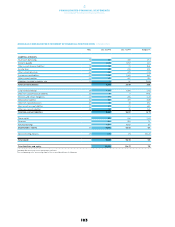

see Table 01

see Economic and Sector

Developmant, p. 107

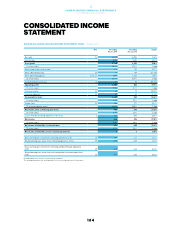

see Income Statement, p. 111

see Statement of

Cash Flows, p. 119