Reebok 2015 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2015 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

124

3

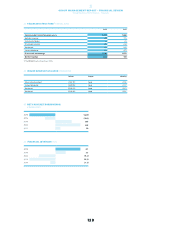

GROUP MANAGEMENT REPORT – FINANCIAL REVIEW

Group Business Performance – Treasury

TREASURY

GROUP FINANCING POLICY

In order to be able to meet the Group’s payment commitments at all times, the major goal of our financing

policy is to ensure sufficient liquidity reserves, while at the same time minimising the Group’s financial

expenses. The operating activities of our Group segments and the resulting cash inflows represent the

Group’s main source of liquidity. Liquidity is planned on a rolling monthly basis under a multi-year financial

and liquidity plan. This comprises all consolidated Group companies. Our in-house bank concept takes

advantage of any surplus funds of individual Group companies to cover the financial requirements of

others, thus reducing external financing needs and optimising our net interest expenses. By settling

intercompany transactions via intercompany financial accounts, we are able to reduce external bank account

transactions and thus bank charges. Effective management of our currency exposure and interest rate

risks are additional goals and responsibilities of our Group Treasury department.

TREASURYSYSTEM AND RESPONSIBILITIES

Our Group’s Treasury Policy governs all treasury-related issues, including banking policy and approval of

bank relationships, financing arrangements and liquidity/asset management, currency and interest risk

management as well as the management of intercompany cash flows. Responsibilities are arranged in a

three-tiered approach:

•The Treasury Committee consists of members of the Executive Board and other senior executives who

decide on the Group’s Treasury Policy and provide strategic guidance for managing treasury-related

topics. Major changes to our Treasury Policy are subject to the prior approval of the Treasury Committee.

•The Group Treasury department is responsible for specific centralised treasury transactions and for

the global implementation of our Group’s Treasury Policy.

•

On a subsidiary level, where applicable and economically reasonable, local managing directors and

financial controllers are responsible for managing treasury matters in their respective subsidiaries.

Controlling functions on a Group level ensure that the transactions of the individual business units are

in compliance with the Group’s Treasury Policy.

CENTRALISEDTREASURY FUNCTION

In accordance with our Group’s Treasury Policy, all worldwide credit lines are directly or indirectly managed

by the Group Treasury department. Portions of those lines are allocated to the Group’s subsidiaries and

backed by adidas AG guarantees. As a result of this centralised liquidity management, the Group is well

positioned to allocate resources efficiently throughout the organisation. The Group’s debt is generally

unsecured and may include standard financial covenants, which are reviewed on a quarterly basis. We

maintain good relations with numerous partner banks, thereby avoiding a high dependency on any single

financial institution. Banking partners of the Group and our subsidiaries are required to have at least a

BBB+ long-term investment grade rating by Standard & Poor’s or an equivalent rating by another leading

rating agency. Only in exceptional cases are Group companies authorised to work with banks with a lower

rating. To ensure optimal allocation of the Group’s liquid financial resources, subsidiaries transfer excess

cash to the Group’s headquarters in all instances where it is legally and economically feasible. In this regard,

the standardisation and consolidation of the Group’s global cash management and payment processes,

including automated domestic and cross-border cash pools, is a key priority for Group Treasury.

see Risk and Opportunity

Report, p. 156

see Glossary, p. 260