Reebok 2015 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2015 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270

|

|

126

3

GROUP MANAGEMENT REPORT – FINANCIAL REVIEW

Group Business Performance – Treasury

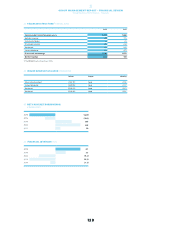

BILATERALCREDIT LINESABOVE PRIOR YEAR LEVEL

At the end of 2015, committed and uncommitted bilateral credit lines grew 40% to € 2.134 billion compared

to € 1.520 billion in the prior year, thus more than offsetting the termination of the syndicated loan facility

of € 500 million on June 1, 2015. Committed and uncommitted credit lines represent approximately 47%

and 53% of total short-term bilateral credit lines, respectively (2014: 15% and 85%, respectively).

STANDARD FINANCIALCOVENANTS

In the case of our committed credit facilities, we have entered into various covenants. These covenants may

include limits on the disposal of fixed assets, the amount of debt secured by liens, cross default provisions

and change of control. In addition, certain financial arrangements contain equity ratio covenants, minimum

equity covenants as well as net loss covenants. If we failed to meet any covenant and were unable to obtain

a waiver from a majority of partner banks, borrowings would become due and payable immediately. As at

December 31, 2015, we were in full compliance with all of our covenants, with ample coverage above all

stipulated minimum requirements. As a result of our cash flow expectations, we are fully confident we

will continue to be compliant with these covenants going forward. We believe that cash generated from

operating activities, together with access to external sources of funds, will be sufficient to meet our future

operating and capital needs.

GROSS BORROWINGS DECREASE

Gross borrowings decreased 2% to € 1.830 billion at the end of 2015 from € 1.873 billion in the prior year.

This development was mainly due to the repayment of a US private placement of US $ 115 million, partly

offset by an increase in short-term borrowings. Bank borrowings amounted to € 229 million compared to

€ 194 million in the prior year. At the end of 2015, no commercial paper was outstanding (2014: € 20 million).

Private placements decreased 37% to € 138 million in 2015 (2014: € 218 million). Convertible bonds

outstanding increased 2% to € 483 million from € 471 million in the prior year, as a result of accruing

the debt component. At issuance in 2012, the convertible bond was split – after deducting the issuance

costs – into the equity component amounting to € 55 million and the debt component amounting to

€ 441 million. The debt component is accrued to its nominal value amounting to € 500 million until 2017

by use of the effective interest method. The total amount of bonds outstanding at the end of 2015 was

€ 1.463 billion (2014: € 1.461 billion).

see Diagram 40

see Subsequent Events

and Outlook, p. 148

see Diagram 42

see Table 43

40BILATERALCREDIT LINES€ IN MILLIONS

2015 2014

Committed 1,008 235

Uncommitted 1,126 1,285

Total 2,134 1,520

■

2014

■

2015