Reebok 2015 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2015 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

121

3

GROUP MANAGEMENT REPORT – FINANCIAL REVIEW

Group Business Performance – Statement of Financial Position and Statement of Cash Flows

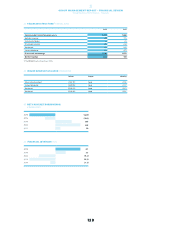

LIABILITIESAND EQUITY

Total current liabilities increased 23% to € 5.364 billion at the end of December 2015 from € 4.378 billion in

2014. Accounts payable increased 23% to € 2.024 billion at the end of December 2015 versus € 1.652 billion

in 2014. On a currency-neutral basis, accounts payable grew 22%, reflecting the growth in inventories

compared to the prior year. At the end of December 2015, other current financial liabilities grew 56% to

€ 143 million from € 91 million in 2014, driven by purchase price obligations for non-controlling interests.

Short-term borrowings increased 27% to € 366 million at the end of December 2015 (2014: € 288 million).

This development was mainly due to a reclassification of private placements from long-term borrowings to

short-term borrowings. Other current provisions were down 3% to € 456 million at the end of December

2015 versus € 470 million in 2014, mainly as a result of a decrease in provisions for marketing expenditure

which was partly offset by negative currency effects of € 12 million. Current accrued liabilities grew 35%

to € 1.684 billion at the end of December 2015 from € 1.249 billion in 2014, mainly due to an increase in

accruals for customer discounts, invoices not yet received, marketing expenditure and personnel. Currency

translation effects of € 39 million also contributed to the increase in current accrued liabilities. Other

current liabilities were up 15% to € 331 million at the end of December 2015 from € 287 million in 2014,

mainly due to an increase in customers with credit balances as well as payables due to personnel.

Total non-current liabilities decreased 4% to € 2.332 billion at the end of December 2015 from € 2.422 billion

in the prior year. Long-term borrowings decreased 8% to € 1.463 billion at the end of December 2015

from € 1.584 billion in the prior year. This development was mainly due to the reclassification of private

placements from long-term borrowings to short-term borrowings. Other non-current provisions grew

30% to € 50 million at the end of December 2015 versus € 38 million in 2014. This primarily related to

an increase in other operational provisions. Non-current accrued liabilities grew 48% to € 120 million at

the end of December 2015 from € 81 million in 2014, mainly due to an increase in accruals for personnel.

Other non-current liabilities increased 17% to € 40 million at the end of December 2015 from € 35 million

in 2014. Other non-current financial liabilities more than doubled to € 18 million at the end of December

2015 from € 9 million in 2014, mainly due to the earn-out components for Runtastic.

Shareholders’ equity increased 1% to € 5.666 billion at the end of December 2015 versus € 5.624 billion

in 2014. The net income generated during the last twelve months as well as positive currency translation

effects of € 134 million were partly offset by the repurchase of treasury shares in an amount of € 301 million,

the dividend of € 303 million paid to shareholders for the 2014 financial year as well as a decrease in

hedging reserves of € 117 million. The Group’s equity ratio at the end of December 2015 decreased to

42.5% compared to 45.3% in the prior year.

OPERATINGWORKING CAPITAL

Operating working capital increased 11% to € 3.138 billion at the end of December 2015 compared to

€ 2.821 billion in 2014. Average operating working capital as a percentage of sales decreased 1.9 percentage

points to 20.5% (2014: 22.4%), reflecting the strong revenue growth in 2015 as well as the company’s

continued focus on tight working capital management.

see Note 19, p. 213

see Note 21, p. 214

see Note 22, p. 215

see Diagram 31

see Note 18, p. 212

see Note 25, p. 220

see Note 26, p. 220

see Diagram 32

see Glossary, p. 260

see Diagram 33

32 SHAREHOLDERS’ EQUITY 1

€ IN MILLIONS

2015 5,666

2014 5,624

2013 5,489

2012 5,304

2011 5,137

1 2011 restated according to IAS 8 in the 2012 consolidated financial statements.

33 AVERAGE OPERATINGWORKING CAPITAL 1, 2

IN % OF NETSALES

2015 20.5%

2014 22.4%

2013 21.3%

2012 20.0%

2011 20.4%

1 2015, 2014 and 2013 reflect continuing operations as a result of the divestiture of the

Rockport business.

2 2011 restated according to IAS 8 in the 2012 consolidated financial statements.