Reebok 2015 Annual Report Download - page 200

Download and view the complete annual report

Please find page 200 of the 2015 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CONSOLIDATED FINANCIAL STATEMENTS

Notes

196

4

Leases

Under finance lease arrangements, the substantial risks and rewards associated with an asset

are transferred to the lessee. At the beginning of the lease arrangement, the respective asset and a

corresponding liability are recognised at the fair value of the asset or, if lower, the net present value of

the minimum lease payments. For subsequent measurement, minimum lease payments are apportioned

between the finance expense and the reduction of the outstanding liability. The finance expense is allocated

to each period during the lease term so as to produce a constant periodic interest rate on the remaining

balance of the liability. In addition, depreciation and any impairment losses for the associated assets are

recognised. Depreciation is performed over the lease term or, if shorter, over the useful life of the asset.

Under operating lease agreements, rent expenses are recognised on a straight-line basis over the

term of the lease.

Goodwill

Goodwill is an asset representing the future economic benefits arising from assets acquired in a business

combination that are not individually identified and separately recognised. This results when the purchase

cost exceeds the fair value of acquired identifiable assets, liabilities and contingent liabilities. Goodwill

arising from the acquisition of a foreign entity and any fair value adjustments to the carrying amounts

of assets, liabilities and contingent liabilities of that foreign entity are treated as assets, liabilities and

contingent liabilities of the respective reporting entity, and are translated at exchange rates prevailing at the

date of the initial consolidation. Goodwill is carried in the functional currency of the acquired foreign entity.

Acquired goodwill is valued at cost and is tested for impairment on an annual basis and additionally

when there are indications of potential impairment.

Intangible assets (except goodwill)

Intangible assets are valued at amortised cost. Amortisation is calculated on a straight-line basis taking

into account any potential residual value.

Expenditures during the development phase of internally generated intangible assets are capitalised

as incurred if they qualify for recognition under IAS 38 ‘Intangible Assets’.

Estimated useful lives are as follows:

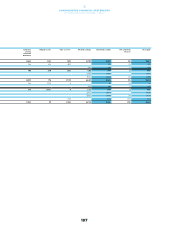

ESTIMATED USEFUL LIVES OF INTANGIBLE ASSETS

Years

Trademarks indefinite

Software 5 – 7

Patents, trademarks and concessions 2 – 15

Research and development

Research costs are expensed in full as incurred. Development costs are also expensed as incurred if they

do not meet the recognition criteria of IAS 38 ‘Intangible Assets’.

Financial assets

All purchases and sales of financial assets are recognised on the trade date. Costs of purchases include

transaction costs. Available-for-sale financial assets include non-derivative financial assets which are not

allocable under another category of IAS 39. If their respective fair value can be measured reliably, they

are subsequently carried at fair value. If this is not the case, these are measured at cost. Realised and

unrealised gains and losses arising from changes in the fair value of financial assets are included in the

income statement for the period in which they arise, except for available-for-sale financial assets where

unrealised gains and losses are recognised in equity unless they are impaired.