Reebok 2015 Annual Report Download - page 227

Download and view the complete annual report

Please find page 227 of the 2015 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

223

4

CONSOLIDATED FINANCIAL STATEMENTS

Notes – Notes to the Consolidated Statement of Financial Position

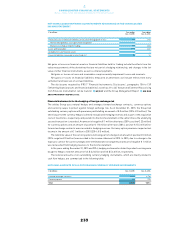

On March 6, 2015, the share buyback programme was resumed in the form of a second tranche. In March

2015, 1,140,735 shares were repurchased for an average price of € 71.15, corresponding to a notional

amount of € 1,140,735 in the nominal capital and consequently to 0.55% of the nominal capital. In April

2015, the company repurchased 1,032,568 shares for an average price of € 75.07, corresponding to a

notional amount of € 1,032,568 in the nominal capital and consequently to 0.49% of the nominal capital.

On April 9, 2015, adidas AG (including the shares repurchased in 2014) exceeded the reportable threshold

of 3% of the shares in adidas AG as defined by § 26 section 1 sentence 2 German Securities Trading Act

(Wertpapierhandelsgesetz – WpHG). The share of voting rights amounted to 3.002% (6,281,429 shares) at that

time. In May 2015, the company repurchased 913,606 shares at an average price of € 74.11, corresponding

to a notional amount of € 913,606 in the nominal capital and consequently to 0.44% of the nominal capital.

Between June 1, 2015 and June 15, 2015, 1,042,718 shares were repurchased for an average price of € 70.60,

corresponding to a notional amount of € 1,042,718 in the nominal capital and consequently to 0.50% of the

nominal capital. On June 15, 2015, the second tranche of the share buyback programme was concluded.

Under the granted authorisation, adidas AG repurchased a total of 4,129,627 shares for a total price of

€ 299,999,992 (excluding incidental purchasing costs), i.e. for an average price of € 72.65 per share, in

a second tranche between March 6, 2015 and June 15, 2015. This corresponded to a notional amount of

€ 4,129,627 in the nominal capital and consequently to 1.97% of the nominal capital. The company reserves

the right to continue with or to resume the share buyback programme in the future in alignment with the

published parameters. For details SEE DISCLOSURES PURSUANT TO § 315 SECTION 4 AND § 289 SECTION 4

OF THE GERMAN COMMERCIALCODE, P. 134.

Changes in the percentage of voting rights

Pursuant to § 160 section 1 no. 8 AktG, existing shareholdings which have been notified to the company in

accordance with § 21 section 1 or section 1a WpHG need to be disclosed.

The following table reflects reportable shareholdings in adidas AG, Herzogenaurach, as at the balance

sheet date and up to and including February 15, 2016 which have each been notified to the company in

written form. The respective details are taken from the most recent voting rights notification received by

the company. All voting rights notifications disclosed by the company in the year under review and up to

and including February 15, 2016 are available on the adidas Group website WWW.ADIDAS-GROUP.COM/S/

VOTING-RIGHTS-NOTIFICATIONS. The details on the percentage of shareholdings and voting rights may no

longer be up to date.

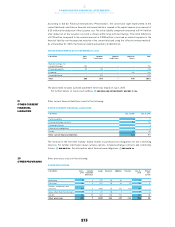

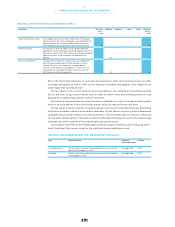

NOTIFIED REPORTABLE SHAREHOLDINGSASAT FEBRUARY 15, 2016

Notifying party Date of reaching, exceeding

or falling below

Reporting threshold Attributions in accordance

with WpHG

Shareholdings

in %

Number of

voting rights

BlackRock, Inc., Wilmington, DE, USA 1February 10, 2016 Exceeding 5% §§ 22, 25 sec. 1 no. 1 6.85 14,336,927

Albert Frère / Desmarais Family Trust,

Montréal, Canada 2

January 14, 2016 Exceeding 5% § 22 5.0001 10,461,000

FMR LLC, Wilmington, DE, USA 3December 2, 2015 Exceeding 3% § 22 3.27 6,842,201

Capital Research and Management Company,

Los Angeles, CA, USA 4

July 22, 2015 Exceeding 3% § 22 sec. 1 sent. 1 no. 6 3.02 6,325,110

The Capital Group Companies, Inc.,

Los Angeles, CA, USA 5

July 22, 2015 Exceeding 3% § 22 sec. 1 sent. 1 no. 6

in conjunction with § 22

sec. 1 sent. 2 and 3

3.02 6,325,110

adidas AG, Herzogenaurach, Germany 6April 9, 2015 Exceeding 3% 3.002 6,281,429

O. Mason Hawkins, USA 7March 24, 2015 Exceeding 3% § 22 sec. 1 sent. 1 no. 6

in conjunction with § 22

sec. 1 sent. 2

3.01 6,298,523

Southeastern Asset Management, Inc.,

Memphis, TN, USA 7

March 24, 2015 Exceeding 3% § 22 sec. 1 sent. 1 no. 6 3.01 6,298,523

1 The company’s disclosure is planned for February 18, 2016.

2 See the company’s disclosure dated January 22, 2016.

3 See the company’s disclosure dated December 10, 2015 and correction dated February 8, 2016.

4 See the company’s disclosure dated July 29, 2015.

5 See the company’s disclosure dated July 28, 2015.

6 See the company’s disclosure dated April 10, 2015.

7 See the company’s disclosure dated March 26, 2015.