Reebok 2015 Annual Report Download - page 216

Download and view the complete annual report

Please find page 216 of the 2015 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

212

4

CONSOLIDATED FINANCIAL STATEMENTS

Notes – Notes to the Consolidated Statement of Financial Position

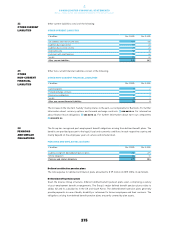

Borrowings are denominated in a variety of currencies in which the Group conducts its business. The

largest portions of effective gross borrowings (before liquidity swaps for cash management purposes) as at

December 31, 2015 are denominated in euros (2015: 80%; 2014: 80%) and US dollars (2015: 15%; 2014: 12%).

The weighted average interest rate on the Group’s gross borrowings decreased to 2.4% in 2015

(2014: 3.1%).

As at December 31, 2015, the Group had cash credit lines and other long-term financing arrangements

totalling € 3.7 billion (2014: € 3.7 billion); thereof unused credit lines accounted for € 1.9 billion

(2014: € 1.8 billion). In addition, as at December 31, 2015, the Group had separate lines for the issuance of

letters of credit and guarantees in an amount of approximately € 0.2 billion (2014: € 0.2 billion).

The Group’s outstanding financings are unsecured and may include standard financial covenants, which

are reviewed on a quarterly basis. These covenants may include limits on the disposal of fixed assets, the

maximum amount of debt secured by liens, cross default provisions and change of control. In addition,

certain financial arrangements contain equity ratio covenants, minimum equity covenants as well as net

loss covenants.

As at December 31, 2015, and December 31, 2014, shareholders’ equity and the equity ratio were well

above the agreed minimum values. Likewise, the relevant amount of net income clearly exceeded net loss

covenants.

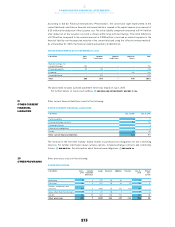

The amounts disclosed as gross borrowings represent outstanding borrowings under the following

arrangements with aggregated expiration dates as follows:

GROSS BORROWINGSASAT DECEMBER 31, 2015

€ in millions Up to

1 year

Between

1 and 3 years

Between

3 and 5 years

More than

5 years

Total

Bank borrowings incl.

commercial paper 229 – – – 229

Private placements 138 – – – 138

Eurobond – – – 981 981

Convertible bond – 483 – – 483

Total 366 483 –981 1,830

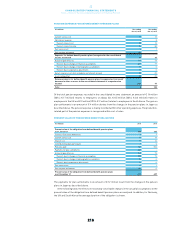

The above table includes two Eurobonds amounting to € 1 billion in total issued on October 1, 2014.

The seven-year Eurobond of € 600 million matures on October 8, 2021 and has a coupon of 1.25%. The

twelve-year Eurobond of € 400 million matures on October 8, 2026 and has a coupon of 2.25%. The

Eurobonds have denominations of € 1,000 each and were priced with a spread of 68 basis points and

100 basis points, respectively, above the corresponding euro mid-swap rate. The issue price was fixed at

99.145% and 99.357%, respectively.

In addition, gross borrowings include a convertible bond for an aggregate nominal amount of € 500 million

divided into denominations of € 200,000 which was issued on March 21, 2012. The bond has a maximum

maturity (including prolongation options) until June 14, 2019. The coupon of the bond amounts to 0.25%

and is payable annually, commencing on June 14, 2013. The bond is, at the option of the respective holder,

convertible at any time from and including May 21, 2012, up to and including June 5, 2019, into up to

6.10 million new or existing adidas AG shares. The convertible bond has a conversion premium of 40%

above the reference price of € 59.61, which resulted in an initial conversion price of € 83.46 per share. As

a consequence of contractual provisions relating to dividend protection, the conversion price was adjusted

from € 82.56 to € 82.00 per share. This adjustment became effective on May 8, 2015. On June 14, 2017, the

bondholders have the right to call the bond at nominal value plus interest accrued on the nominal amount.

adidas AG is entitled to redeem the remaining bonds in whole if, at any time, the aggregate principal

amount of bonds outstanding falls below 15% of the aggregate principal amount of the bonds that were

initially issued. Furthermore, as of July 14, 2017, adidas AG is entitled to redeem the bonds in whole if on

20 of 30 consecutive trading days, the share price of adidas AG exceeds the current conversion price of

€ 82.00 by at least 30%.

18

BORROWINGSAND

CREDIT LINES