Reebok 2015 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2015 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.GROUP MANAGEMENT REPORT – FINANCIAL REVIEW

Subsequent Events and Outlook

149

3

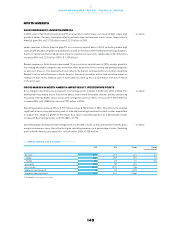

GLOBAL ECONOMY TO GROW IN 2016 1

Global GDP is projected to grow moderately by 2.9% in 2016. At 2.1%, developed economies are expected to

grow faster than last year, supported by robust domestic demand and ongoing accommodative monetary

policies. GDP in developing countries is forecasted to rise 4.8% in 2016, benefiting from the strengthened

recovery in high-income markets as well as the expected stabilisation of commodity prices.

In Western Europe, the region’s recovery is expected to continue, supported by lower energy and oil prices

fuelling domestic demand. In addition, further accommodative monetary easing by the ECB is predicted to

support economic activity, gradually lifting inflation from current low levels. Moreover, low interest rates

are expected to spur private consumption and further support household borrowing. However, slow wage

growth as well as high unemployment rates and public debt in a number of countries across the region are

expected to slow down the region’s recovery. As a result, the region’s GDP is expected to expand at a rate

of 1.4%. In Germany, the economy is projected to grow 1.5% in 2016, with buoyant domestic and private

consumer demand as well as robust labour markets and increased government spending prevailing as

the major drivers of growth.

European emerging markets are expected to grow at a moderate rate of 1.2% in 2016, as persistent

geopolitical tensions and uncertainties will weigh on investment and consumer spending. In addition,

adverse currency movements, high inflationary pressures and weak oil prices will negatively impact

domestic demand. In particular, Russia’s economy is forecasted to contract 0.8% this year, as sluggish

business sentiment, weak domestic demand and a tight fiscal policy will continue to weigh on the country’s

economy.

In the USA, despite higher inflationary pressures, consumer spending and domestic demand are projected to

remain the major source of growth, supported by low unemployment rates as well as declining energy and

oil prices. However, the strong US dollar will continue to weigh on exports. The Federal Reserve is expected

to continue to gradually lift interest rates. As a result, the US economy is forecasted to grow at 2.2% in 2016.

Asia’s GDP is projected to increase 5.1% in 2016. With the exception of Japan, growth is expected to

remain relatively high during the year, supported by healthy industrial activity, weak oil prices, declining

inflationary pressures and significant wage increases, which should bolster consumer spending. While

concerns regarding a slowdown in the Chinese economy grew throughout the past year, the nation’s GDP

is still forecasted to expand by 6.7% in 2016, fuelled by accommodative fiscal and monetary policies, low oil

prices as well as robust private consumption. However, export growth is forecasted to weaken, weighing

on industrial production and investment growth. Japan is predicted to show signs of economic recovery

and grow 1.2%, supported by private consumption, low inflationary pressures, wage and export growth as

well as accommodative monetary policies. In India, GDP is expected to expand by 7.8%, fuelled by strong

private domestic demand, strengthened investment, low commodity prices and growing consumer and

government spending.

In Latin America, GDP is expected to increase 0.4% in 2016. Growth in several countries is forecasted

to compensate for Brazil’s deepened recession, where political instability, muted consumer confidence,

high inflationary pressures and rising unemployment are expected to weigh on domestic demand and to

dampen the country’s economic activity. In contrast, Mexico and Colombia are projected to record GDP

growth in 2016, due to improving domestic demand and export growth. In Argentina, higher inflation as

well as sluggish export growth are forecasted to slow down the country’s economic activity.

1 Sources: World Bank, HSBC Global

Research, Namura Global Market

Research, Morgan Stanley Global

Economics.