Reebok 2015 Annual Report Download - page 171

Download and view the complete annual report

Please find page 171 of the 2015 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

167

3

GROUP MANAGEMENT REPORT – FINANCIAL REVIEW

Risk and Opportunity Report – Illustration of Material Risks

Similarly, underestimating demand can lead to product shortfalls at the point of sale. In this situation,

the Group faces the risk of missed sales opportunities and/or customer and consumer disappointment,

which could lead to a reduction in brand loyalty and hurt our reputation as an On-Time In-Full supplier. In

addition, the Group faces potential profitability impacts from additional costs such as airfreight in efforts

to speed up replenishment.

In order to mitigate these risks, we actively manage inventory levels, for example by continuous monitoring

of stock levels as well as centralising stock holding and clearance activities. We also continuously strive

to improve our forecasting and material planning processes. Our integrated business planning process

ensures alignment of demand and supply planning on a monthly basis and thus facilitates inventory and

order book management. In addition, our Global Operations function is continuously improving the agility

and flexibility of our planning environment in order to shorten order-to-delivery times and ensure availability

of products while trying to avoid excess inventories.

LEGAL & COMPLIANCE RISKS

Risks related to customs and tax regulations

Numerous laws and regulations regarding customs and taxes affect the adidas Group’s business practices

worldwide. Non-compliance with regulations concerning product imports (including calculation of customs

values), intercompany transactions or income taxes could lead to substantial financial penalties and

additional costs as well as negative media coverage and therefore reputational damage, for example in

case of understatements or underpayments of corporate income taxes or customs duties.

To proactively manage such risks, we constantly seek expert advice from specialised law or tax advisory

firms. We closely monitor changes in legislation in order to properly adopt regulatory requirements

regarding customs and taxes. In addition, our internal legal, customs or tax departments advise our

operational management teams to ensure appropriate and compliant business practices. Furthermore, we

work closely with customs authorities and governments worldwide to make sure we adhere to customs and

import regulations and obtain the required clearance of products to fulfil sales demand. In order to reduce

the financial risk, we also create provisions in our financial statements in accordance with the relevant

accounting regulations to account for potential disputes with customs or tax authorities.

FINANCIAL RISKS

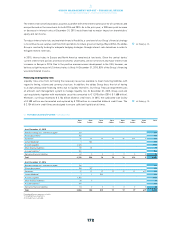

Currency risks

Currency risks for the adidas Group are a direct result of multi-currency cash flows within the Group.

Furthermore, translation impacts from the conversion of non-euro-denominated results into our Group’s

functional currency, the euro, might lead to a material negative impact on our Group’s financial performance.

The biggest single driver behind this risk results from the mismatch of the currencies required for sourcing

our products versus the denominations of our sales. The vast majority of our sourcing expenses are in US

dollars, while sales are denominated in other currencies to a large extent – most notably the euro. Our main

exposures are presented in the table. The exposure from firm commitments and forecasted transactions

was calculated on a one-year basis.

see Internal Group Management

System, p. 102

see Global Operations, p. 74

see Table 04