Reebok 2015 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2015 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TO OUR SHAREHOLDERS

Our Share

46

1

OUR SHARE

In 2015, international stock market performance was mixed, characterised by highly volatile

movements. While the DAX-30 increased by 10%, the MSCI World Textiles, Apparel & Luxury Goods

Index declined 3%. Following an underperformance versus the overall market in 2014, the adidas AG

share regained significant momentum in 2015. The positive share price development was supported

by the introduction of the adidas Group’s new strategic business plan ‘Creating the New’ as well

as strong operational momentum during the year. As a result, the adidas AG share reached a new

all-time high during the course of the year and ended 2015 as the top performer of the DAX-30 with an

increase of 56%. As a result of the stellar operational performance in 2015 as well as Management’s

confidence in the strength of the Group’s financial position and long-term growth aspirations, we

intend to propose a dividend per share of € 1.60 at our 2016 Annual General Meeting.

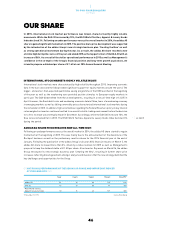

INTERNATIONAL STOCK MARKETS HIGHLY VOLATILE IN 2015

International stock markets were characterised by high volatility throughout 2015. Improving economic

data in the euro area and the USA provided significant support for equity markets around the world. The

bigger- and earlier-than-expected quantitative easing programme of the ECB launched at the beginning

of the year as well as the weakening euro provided positive stimulus to European equity markets in

particular. The DAX-30 benefited from these developments, resulting in a new all-time high of 12,375 in

April. However, the Greek debt crisis and weakening economic data in China, fears of a weakening economy

in emerging markets as well as falling commodity prices characterised international stock markets during

the remainder of 2015. In addition, high uncertainties regarding the Federal Reserve’s policy on key interest

rates weighed on investor sentiment and led to an overall volatile trading environment before the decision

for a first increase was eventually made in December. Accordingly, while the DAX-30 increased 10%, the

Dow Jones remained flat in 2015. The MSCI World Textiles, Apparel & Luxury Goods Index declined 3%

during the period.

ADIDASAG SHARE PRICE REACHES NEW ALL-TIME HIGH

Following an underperformance versus the overall market in 2014, the adidas AG share started to regain

momentum at the beginning of 2015. This was mainly due to the announcement of the divestiture of the

Rockport business as well as the preliminary results release for the 2014 financial year at the end of

January. Following the publication of the adidas Group’s full year 2014 financial results on March 5, the

adidas AG share increased more than 3%, driven by a robust outlook for 2015 as well as Management’s

proposal to keep the dividend stable at € 1.50 per share. At an Investor Day event on March 26, the adidas

Group introduced its new strategic business plan ‘Creating the New’, resulting in further share price

increases reflecting broad agreement amongst analysts and investors that the new strategy identified the

key challenges and opportunities for the Group.

see Table 01

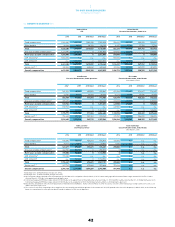

01 HISTORICAL PERFORMANCE OF THE ADIDASAG SHARE AND IMPORTANT INDICES

AT YEAR-END 2015IN %

1 year 3 years 5 years 10 years Since IPO 1

adidas AG 56 34 84 125 830

DAX-30 10 41 55 99 389

MSCI World Textiles,

Apparel & Luxury Goods (3) 16 40 139 380

1 November 17, 1995. Source: Bloomberg.