Reebok 2015 Annual Report Download

Download and view the complete annual report

Please find the complete 2015 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

20

15

ADIDAS GROUP

ANNUAL REPORT

Table of contents

-

Page 1

2 0 1 5 ADIDAS GROUP ANNUAL REPORT -

Page 2

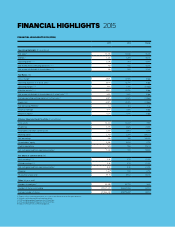

...- RESULTS - OUTLOOK TARGETS 2015 1, 2 RESULTS 2015 2, 3 OUTLOOK 2016 CURRENCY-NEUTRAL SALES DEVELOPMENT: adidas Group CURRENCY-NEUTRAL SALES DEVELOPMENT: adidas Group CURRENCY-NEUTRAL SALES DEVELOPMENT: adidas Group INCREASE AT A MID-SINGLEDIGIT RATE INCREASE OF 10% Group sales of INCREASE AT... -

Page 3

... 17.6% Net cash generated from operating activities 2 Dividend Share price at year-end Other (at year-end) Number of employees 1 Number of shares outstanding Average number of shares 1 2 3 4 5 Figures reï¬,ect continuing operations as a result of the divestiture of the Rockport business. Includes... -

Page 4

... of adidas Sport Performance is helping athletes to make a difference. In their game, in their world and in their life. The main focus is on key categories, such as football, running, basketball and training. Reebok-CCM Hockey is a leading designer and marketer of ice hockey equipment and apparel... -

Page 5

...ATHLETES MAKE A DIFFERENCE. FOR US, IT ALSO STARTS WITH THE ASPIRATION TO BE THE BEST. WE WANT TO BE THE BEST SPORTS COMPANY IN THE WORLD. THIS IS WHAT WE ARE HERE FOR. THIS IS WHAT WE WANT TO ACCOMPLISH. WE WANT TO WIN. WE MAKE THE RULES. WE ARE THE CREATORS. AND: WE ARE CREATING THE NEW. VALUE -

Page 6

... adidas Strategy Reebok Strategy TaylorMade-adidas Golf Strategy Reebok-CCM Hockey Strategy Global Operations Research and Development Our People Sustainability 54 61 67 69 72 74 80 87 94 3 GROUP MANAGEMENT REPORT - FINANCIAL REVIEW Internal Group Management System Group Business Performance... -

Page 7

... the Management Report of adidas AG. 256 260 263 264 PUBLICATIONS FOR THE 2015 FINANCIAL YEAR 2 0 1 5 ADIDAS GROUP MAGAZINE 2 0 1 5 ADIDAS GROUP ANNUAL REPORT HOW 2 0 1 5 RESP ONSI BL Y WE CRE ATE ADIDAS GROUP SUSTAINABILITY PROGRESS REPORT M AGA ZI N E HOW WE CREATE THE NEW A N NUAL REPORT... -

Page 8

-

Page 9

TO Operational and Sporting Highlights Letter from the CEO Executive Board Supervisory Board Supervisory Board Report Corporate Governance Report including the Declaration on Corporate Governance Compensation Report Our Share 6 10 16 18 20 28 36 46 OUR SHARE - HOLD - ERS -

Page 10

.... MARCH 04.03. Reebok presents to the world's media the ZPump Fusion, a game-changing running shoe that uniquely conforms to any foot and provides runners with a locked-in custom fit. 26.03. The adidas Group introduces its new strategic business plan 'Creating the New' at the Investor Day 2015 in... -

Page 11

... home two awards at the 2015 Cannes Lions International Festival of Creativity for the creation of the 'Be More Human' digital experience. 30.06. adidas and Parley for the Oceans present the first shoe developed in their collaboration at a UN Climate Change event in New York City. The shoe's upper... -

Page 12

...a seven-year partnership starting with the 2017/18 season. Shortly afterwards, adidas announces a multi-year partnership with NHL All-Star Sidney Crosby. 03.08. The adidas Group opens a new office building, PITCH, at the World of Sports in Herzogenaurach. The building will be used to test the Group... -

Page 13

... football boot. With Laceless, players will be able to experience a new level of fit and pure touch. 05.11. adidas unveils Futurecraft Leather, a revolutionary combination of a high-tech manufacturing process and traditional material to create a completely seamless upper that enables flex, support... -

Page 14

1 TO O U R S H A RE H O L D E RS Letter from the CEO HERBERT HAINER ADIDAS GROUP CEO LETTER FROM THE CEO 10 -

Page 15

... step up marketing investments to spur revenue growth and drive long-term brand desire. With an increase of 56%, our share was not only the top performer in the DAX-30 in 2015, but also outperformed all major peers and reached a new all-time high towards the end of the year. These financials... -

Page 16

... the prestigious Footwear News 'Shoe of the Year' award. It is product launches like these that helped adidas Originals to become the world's most relevant and best sneaker brand and deliver strong double-digit growth in every quarter of 2015. 2015 saw the complete reset of our Women's business. As... -

Page 17

...fitness positioning across the globe, underlined by doubledigit growth in nearly all markets in 2015. At the same time, the brand continues to face challenges in its home market. To reset the brand in North America and deliver sustainable and profitable business growth going forward, we have started... -

Page 18

... of strong and profitable growth, TaylorMade-adidas Golf experienced two very difficult years in 2014 and 2015, caused by a number of structural, commercial and operational issues. As a result, halfway through last year we started analysing future options for our golf business. This strategic review... -

Page 19

... become the best sports company in the world and achieve the Group's long-term financial ambition. Our brands are benefiting from the ever-increasing relevance of sport in the lives of people around the globe. Our products are in high demand with consumers in every part of the world. Our order books... -

Page 20

1 TO O U R S H A RE H O L D E RS E xe cuti ve B o a rd EXECUTIVE BOARD 2 1 3 4 5 16 -

Page 21

...management positions at adidas America, including Director of Footwear Marketing and Vice President Brand Marketing. In 2006, he moved to the adidas Group headquarters in Germany. In 2011, he became Senior Vice President adidas Sport Performance, responsible for all adidas sports categories globally... -

Page 22

... of the Supervisory Board, Windeln.de AG, Munich, Germany 1 DIETER HAUENSTEIN * residing in Herzogenaurach, Germany Full-time member of the Works Council Herzogenaurach, adidas AG DR. WOLFGANG JÄGER * residing in Bochum, Germany Managing Director in charge of Public Relations and Scholarships... -

Page 23

... Board ROLAND NOSKO * residing in Wolnzach, Germany Trade Union Official, IG BCE, Headquarter Nuremberg, Nuremberg, Germany HANS RUPRECHT * residing in Herzogenaurach, Germany Vice President Customer Service Central Europe West, adidas AG HEIDI THALER-VEH * residing in Uffenheim, Germany Member... -

Page 24

...successful financial year. Thanks to strong brands and partnerships in the world of sport, as well as first-class innovations, the adidas Group was able to achieve strong sales and earnings growth. Despite the continuing weakness of the golf market worldwide and the resulting unsatisfactory business... -

Page 25

... Board Report in North America, this primarily reflects double-digit growth rates in Western Europe, Greater China and numerous other emerging markets in which the Group is superbly positioned. Additionally, in the past year, the company introduced its new strategic business plan 'Creating the New... -

Page 26

...global economic developments as well as the development of our individual brands and markets. In February 2015, the Executive Board presented us with details of the new strategic business plan Creating the New for the period until 2020, established on the three key strategic pillars of Speed, Cities... -

Page 27

... the new Long Term Incentive Plan LTIP 2015/2017 that is measured over a three-year period and the 2015 Performance Bonus Plan as well as the individual bonus target amounts, and then resolved upon them for each Executive Board member. In line with the German Corporate Governance Code (hereinafter... -

Page 28

... end of the year under review, in December 2015 and under exclusion of the Supervisory Board member concerned, by way of circular resolution we approved the conclusion of a new framework contract starting in January 2016. Further information on corporate governance at the adidas Group can be found... -

Page 29

... the 2015 financial year, such as the LTIP 2015/2017 and the 2015 Performance Bonus Plan. The committee furthermore prepared the resolution of the Supervisory Board on reviewing the appropriateness of Executive Board compensation and on setting a target figure for the future representation of women... -

Page 30

... Supervisory Board Report As in previous years, the meeting in September focused on examining the efficiency of the internal audit system, the internal control system and the risk and compliance management system. In the context of this examination, the committee members reviewed in depth the main... -

Page 31

... of the year under review as agreed with the Audit Committee and was available for questions and the provision of additional information. The auditor did not report any significant weaknesses with respect to the internal control and risk management system relating to the accounting process. We also... -

Page 32

... shareholders, business partners, employees and the ï¬nancial markets. The following report includes the Corporate Governance Report and the Declaration on Corporate Governance issued by the Executive Board and Supervisory Board. DUAL BOARD SYSTEM As a globally operating public listed company with... -

Page 33

... Supervisory Board including members with international background shall be maintained to the current extent. Diversity in terms of expertise and experience on the grounds of origin, education or professional activity shall continue to be taken into account in the future. • The number of women on... -

Page 34

... Board member. To this end, the relation between Executive Board compensation and that of senior management and employees overall is taken into account, also in terms of its development over time. Further information on Executive Board compensation is compiled in the Compensation Report. In order... -

Page 35

...BOARD AND SUPERVISORY BOARD At the end of the 2015 financial year, the individual ownership of shares in the company or related financial instruments held by members of the Executive Board and the Supervisory Board was below 1% of the shares issued by adidas AG. The same applies for the total number... -

Page 36

...a defined target level of provision. In the view of the Supervisory Board, the new pension plan arrangement leads to a higher degree of control and future planning capability with regard to the company's expenses for pension plans. The pension plans of the Executive Board members initially appointed... -

Page 37

... members, Supervisory Board members and our employees and have been incorporated into our Code of Conduct which we completely revised in 2014. Our business activities are oriented towards the legal systems in the various countries and markets in which we operate. This implies a high level of social... -

Page 38

... in this report can be found on our website at including: W W W. AD I DAS- G RO UP.CO M Code of Conduct Sustainability Social commitment Risk and opportunity management and compliance Information and documents on the Annual General Meeting Directors' dealings Accounting and annual audit 34 -

Page 39

... live on the company's website. www.adidas-group.com/ investors see Our Share, p. 46 ACCOUNTING AND ANNUAL AUDIT adidas AG prepares the annual financial statements in accordance with the provisions of the German Commercial Code (Handelsgesetzbuch - HGB) and the Stock Corporation Act. The annual... -

Page 40

... for the year under review are described in the Supervisory Board Report. The compensation system is geared towards creating an incentive for successful, sustainably value-oriented corporate development and management. In determining the Executive Board members' compensation particularly in terms of... -

Page 41

.... The variable components are structured as follows: • The Performance Bonus serves as compensation for the Executive Board's performance in the past financial year in line with the short-term development of the company. It is determined by the Supervisory Board in a two-stage process: • At the... -

Page 42

...member. For the ultimate evaluation of the Executive Board's performance, qualitative criteria determined by the Supervisory Board when establishing the LTIP 2015/2017, such as the further development of company health management as well as occupational health and safety, are also taken into account... -

Page 43

... the same structure as the existing 'adidas Management Pension Plan' for managers. An amount (currently) equalling 50% of the individual annual fixed salary is credited by the company to the virtual pension account of the individual Executive Board member each year. The pension assets yield a fixed... -

Page 44

... 6, 2015, the service cost in the 2014 financial year comprised the 2014 service cost and the 2014 past service cost. COMMITMENTS TO EXECUTIVE BOARD MEMBERS UPON PREMATURE TERMINATION OF TENURE Executive Board service contracts are usually agreed with a contractual term of three years. This term... -

Page 45

...2014 financial year as, in the 2014 financial year, the service costs were increased by the past service costs resulting from the increase 9 of the targeted provision level. The recommendation of the Code to individually disclose the compensation components for each Executive Board member and to use... -

Page 46

... Liedtke Executive Board member, Global Brands Since March 6, 2014 2015 (max.) 2014 2015 2015 (min.) 2015 (max.) 2014 1 2015 2 2015 (min.) Fixed compensation Other benefits Total One-year variable compensation 3 Multi-year variable compensation LTIP 2012/2014 4 LTIP 2015/2017 Total Service cost... -

Page 47

... J. Stalker Chief Financial Ofï¬cer Erich Stamminger Executive Board member, Global Brands Until March 6, 2014 2015 2014 2015 2014 Fixed compensation Other benefits Total One-year variable compensation 3 Multi-year variable compensation LTIP 2012/2014 4 LTIP 2015/2017 Other Total 5 Service cost... -

Page 48

... review found that the compensation meets the requirements of the German Stock Corporation Act and the Code. As the review revealed a need for action regarding the pensions granted to the Executive Board members compared to the pensions granted to executive board members of other companies in order... -

Page 49

...from the 2015 financial year. OTHER BENEFITS AND ADDITIONAL COMMITMENTS The Supervisory Board members have not received any loans or advance payments from adidas AG. 04 COMPENSATION OF THE SUPERVISORY BOARD MEMBERS IN â,¬ 2015 Fixed compensation 2015 Attendance fees 2014 Supervisory Board members... -

Page 50

... World Textiles, Apparel & Luxury Goods Index declined 3%. Following an underperformance versus the overall market in 2014, the adidas AG share regained signiï¬cant momentum in 2015. The positive share price development was supported by the introduction of the adidas Group's new strategic business... -

Page 51

... AG - DAX-30 - MSCI World Textiles, Apparel & Luxury Goods Index 03 THE ADIDAS AG SHARE 2015 2014 Important indices Number of shares outstanding 1 Basic earnings per share Cash generated from operating activities per share Year-end price Year high Year low Market capitalisation 4 Dividend per... -

Page 52

... as well as profit taking by some investors. As a result, the adidas AG share closed 2015 at â,¬ 89.91, representing a 56% increase over the year and making the adidas AG share the top performer of the DAX-30. This implies a market capitalisation of â,¬ 18.0 billion at the end of 2015 versus â,¬ 11... -

Page 53

...year-end 2015 compared to 5.9 million at the end of 2014. The average daily trading volume increased to 92,100 ADRs in 2015 (2014: 80,800). Further information on our ADR Programme can be found on our website. www.adidas-group.com/adr ADIDAS AG SHARE MEMBER OF IMPORTANT INDICES The adidas AG share... -

Page 54

... 220 DIRECTORS' DEALINGS REPORTED ON CORPORATE WEBSITE The purchase or sale of adidas AG shares (ISIN DE000A1EWWW0) or related financial instruments, as defined by § 15a WpHG, conducted by members of our Executive or Supervisory Boards, by key executives or by any person in close relationship with... -

Page 55

... February 2016. SUCCESSFUL INVESTOR RELATIONS ACTIVITIES adidas AG strives to maintain close contact to institutional and private shareholders as well as analysts. In 2015, Management and the Investor Relations team further intensified communication with financial market participants. In total, we... -

Page 56

-

Page 57

OUR Group Strategy adidas Strategy Reebok Strategy TaylorMade-adidas Golf Strategy Reebok-CCM Hockey Strategy Global Operations Research and Development Our People Sustainability 54 61 67 69 72 74 80 87 94 GROUP Group Management Report This report contains the Group Management Report of the ... -

Page 58

...and Latin America, as well as building our market share in the USA and Western Europe. • Creating a ï¬,exible supply chain: Speed and agility are key to outpacing the competition, providing a constant flow of new and relevant products for our consumers and high service levels for our customers. We... -

Page 59

...value: Creating long-term value for our shareholders through strong and consistent operating cash flow generation drives our overall decision-making process. Therefore, we are focused on rigorously managing those factors under our control, making strategic choices that will drive sustainable revenue... -

Page 60

...currency-neutral Group revenues annually by a high-single-digit rate on average. This performance will be driven by high-single-digit currency-neutral growth rates per year on average at both the adidas and Reebok brand. • To win signiï¬cant market share across key categories and markets: We have... -

Page 61

..., executed through global product launches and campaigns. • Retail experiences: Holistic development of the omni-channel approach across the various consumer touchpoints. • Activation: Activation of sports marketing assets and consumer communities. We are refining our focus on consumers in key... -

Page 62

... in New York City, where we will open doors in 2016 to fuel innovation in sports in a constant way, outside our own seasonal product creation calendars. • Athlete collaborations: The strategic initiatives of athlete collaborations aim to build communities of athletes that help shape the future of... -

Page 63

... Global Sales function drives the commercial performance of the adidas Group by converting brand desire into profitable and sustainable business growth. It is our ambition to deliver the best branded shopping experience across all consumer touchpoints. In 2015, we advanced our Global Sales strategy... -

Page 64

... global key accounts. Strategic partnerships will enable us to deliver a premium consumer experience in a multi-branded environment, through the power of managed space. ROLE OF OUR GLOBAL MARKETS Our Global Sales strategy is crafted by a centralised Sales Strategy & Excellence team, which supports... -

Page 65

... as product launch and communication activities are managed centrally before they are executed locally by the markets. Creator archetype: Based on the rapid evolution of sport and sports culture, with Creating the New, adidas evolved its consumer segmentation strategy to better account for market... -

Page 66

... be prioritised throughout the value chain, highly leveraging and benefiting from the Group's strategic choices of Speed, Cities and Open Source. By 2017, adidas expects its top franchises to represent at least a 30% share of the footwear business. In 2016, key adidas franchises will include a blend... -

Page 67

... of its marketing investments on partnership assets, with the remainder on brand marketing activities such as digital, advertising, point-of-sale and grassroots activations. With its new strategy, adidas intends to decrease the ratio of marketing investments spent on promotion partnerships by around... -

Page 68

... of Runtastic in 2015 brought adidas access to over 80 million users. • In terms of partnership assets, while reducing the ratio of marketing spend and number of partnerships, adidas will nonetheless continue to bring its products to the biggest stages in the world through: • Events: such as... -

Page 69

... its franchise strategy for the male and female athlete, increase its investment in running communities and grassroots activations such as the Boston Runbase, as well as play a central role in driving the future of digital in sport in cooperation with Runtastic. see Research and Development, p. 80... -

Page 70

...the high visibility of its products in all markets, this category plays a central role in amplifying the brand message and DNA. Authenticate To be the best sports brand in the world, adidas needs to be true to sports on a local level. As such, adidas will continue to offer a wide range of sports and... -

Page 71

...humans to live a full life. This is not only the brand's guiding principle, but also the essence of Reebok's global marketing campaign 'Be More Human', launched in 2015, a new and fully integrated marketing campaign, continuing the brand's mission to change how people perceive and experience fitness... -

Page 72

... a number of highly influential athletes such as Kendrick Lamar and Ronda Rousey who share the brand's values. In 2010, Reebok entered into a long-term partnership with CrossFit, one of the fastest-growing fitness movements in the world. Reebok is the official supplier of CrossFit footwear, apparel... -

Page 73

... world's major professional golf tours. • A clear focus on marketing innovation and excellence in execution. • Creation and execution of new retail initiatives, as well as improving global distribution. LEVERAGING BRAND STRENGTH TaylorMade-adidas Golf is focused on a multi-brand strategy with... -

Page 74

... range of golf products at substantial value to the consumer. TAYLORMADE-ADIDAS GOLF ACTIVELY TACKLES THE CHALLENGES IN THE GOLF MARKET Following a decade of strong and profitable growth, TaylorMade-adidas Golf experienced two very difficult years in 2014 and 2015, caused by a number of structural... -

Page 75

... product life cycles. • Management will further optimise trade terms with its retail partners through a focus on full-price sellthrough. Promotions will be very closely linked to the individual customer performance. Product cost and supply chain TaylorMade-adidas Golf aims to reduce supply chain... -

Page 76

... in the high-end performance segment of the ice hockey market. In this context, CCM is positioned across all key categories including skates, sticks, helmets and protective equipment, with a clear focus on performance, while Reebok Hockey is mainly focused on the licensed apparel business. Strategic... -

Page 77

...as the official NHL locker room performance apparel supplier and its exclusive rights related to the NHL Players' Association (NHLPA) for name and numbered apparel and headwear. PRICING STRATEGY MIRRORS PRODUCT POSITIONING Reebok-CCM Hockey's pricing strategy is consistent with its high-performance... -

Page 78

... at competitive costs. Additionally included under the banner of Global Operations, Global IT manages all digital platforms for the adidas Group's business solutions. It enhances the core systems to be future-proof, builds an open digital platform to connect to consumers and internal employees, and... -

Page 79

... Strategy, p. 54 see Research and Development, p. 80 01 GLOBAL OPERATIONS IN GO-TO-MARKET PROCESS Global Operations Marketing Design Product Development Sourcing Supply Chain Management & Market IT Distribution Sales Subsidiaries Briefing Concept Product Creation Manufacturing Sales... -

Page 80

... speed of service with 180 own-retail stores benefiting from next-day product replenishment. Global Operations is developing further IT capabilities to build platforms that support key initiatives which drive brand desire such as personalised footwear tools. With the close collaboration of Global IT... -

Page 81

... our supply chain. Global Operations manages product development, sourcing and distribution for adidas and Reebok as well as for adidas Golf and Ashworth. Due to the specific sourcing requirements in their respective fields of business, TaylorMade, Reebok-CCM Hockey, Adams Golf and the Sports... -

Page 82

...). Of our independent manufacturing partners, 79% were located in Asia (2014: 83%), 12% in Europe (2014: 7%) and 9% in the Americas (2014: 9%). see Diagram 02 VIETNAM SHARE OF FOOTWEAR PRODUCTION INCREASES 96% of our total 2015 footwear volume for adidas, Reebok and adidas Golf was produced in Asia... -

Page 83

... manufactured in Asia (more than 99%). CHINA SHARE OF HARDWARE PRODUCTION DECLINES In 2015, 76% of adidas and Reebok branded hardware products, such as balls and bags, was produced in Asia (2014: 78%). European countries accounted for 20% (2014: 22%), while the Americas represented 3% of the total... -

Page 84

... world, our culture and passion for innovation and consistent investment in research and development (R&D) is essential to the development of new product concepts, processes, production methods and digital applications that are beneï¬cial to our business objectives and our long-term sustainability... -

Page 85

... new strategic business plan 'Creating the New' we identified five strategic pillars within our R&D principles, which enable us to develop the best product for our athletes, while at the same time drive game-changing innovations in the field of manufacturing, digital and sustainability. Consequently... -

Page 86

..., this field will remain one of our core areas. To enhance our digital capabilities, in 2015 the adidas Group acquired Runtastic, one of the leading global players in the health and fitness app market. Major recent innovations in the digital landscape include: miCoach Train and Run: One... -

Page 87

...Crown 2015 - #2 Best Sneaker Outdoor Industry Award - Gold Outdoor Industry Award - Winner Pertex Polartec APEX award Men's Fitness - Best CrossFit shoe ISPO Award Communication - Gold Mudrunguide.com, Obstacle Course Racing Industry - Best New Product Women's Running Magazine - Sole Mate Award Golf... -

Page 88

...) adidas Originals x Kanye West Yeezy Season 1 apparel collection adidas neo Selena Gomez collections ZPump Fusion TR running shoe Nano 5.0 training shoe Skyscape walking shoe Reebok Classics x Kendrick Lamar Ventilator shoe M1 driver line R15 driver Aeroburner metalwoods adidas adipower Boost golf... -

Page 89

... represented 80% of total hardware sales in 2015 (2014: 66%). Products that had been brought to market three or more years ago accounted for 7% of sales in 2015 (2014: 7%). Despite ongoing challenges in the golf industry, TaylorMade-adidas Golf retained its status as the world's leading golf company... -

Page 90

... 50K Pump Skate, CCM released an innovative product which integrates Reebok's pump technology in CCM's traditional Ribcor skate line. The brand strongly promoted the new product on digital and social media platforms, meeting with very positive response from the ice hockey world. • R&D EXPENSES... -

Page 91

... and minds. The People Strategy was developed by a cross-functional group of employees from different levels and locations. The extensive research this group conducted included the exploration of the personal meaning of work, global human resources megatrends that our company will be facing and... -

Page 92

... to attract, retain and engage industry-leading talent to sustain the company's success and growth. In 2015, adidas Group locations around the world leveraged our employer brand attributes for attraction, retention and engagement strategies. This work contributed to several Top 10 rankings worldwide... -

Page 93

...: In order to ensure sustainable financial success, retain our top leadership and promote continuous commitment, the adidas Group offers a Long-Term Incentive Plan (LTIP) for leaders and Executive Board members. Other benefits include our 401(k) retirement plans in the USA and the adidas Group... -

Page 94

... structure to a set-up that best supports strategy execution. Implementation of the new set-up started in 2015. It improves collaboration for our Group business functions and enables clear accountabilities as well as faster and more effective support for the organisation. In 2016, our HR team... -

Page 95

... to promote communication and the sharing of best practices and insights. • We have regular events highlighting diversity as a key topic, such as our global Diversity Day. • We provide diversity training to our employees. • Within our Group, for example, we support the 500-member strong 'Women... -

Page 96

...women in management positions is targeted to be increased globally from 29% today to 32% by 2017. Irrespective of that, German law states that, from January 1, 2016, at least 30% of Supervisory Board representatives of publicly listed companies such as adidas AG shall be women. Since the 2014 Annual... -

Page 97

... 9% Marketing 7% Sales 2% Production 2% IT 2% Research & development Rounding differences may arise. 1 At year-end. 1 At year-end. 11% Western Europe 19% North America 15 10 2 9 24 3 11 19 6 6% Greater China 24% Russia/CIS 9% Latin America 2% Japan 10% MEAA 15% Group functions 3% Other Businesses... -

Page 98

... the performance of our suppliers. These ratings are a non-financial KPI for our Group. www.adidas-group.com/s/ standards-and-policies see Global Operations, p. 74 see Internal Group Management System, p. 102 MATERIALITY ANALYSIS More information about our materiality analysis can be found on... -

Page 99

... 2015, we conducted 1,255 factory visits (2014: 1,320 visits) comprising different types of audits (including chemical management audits), trainings and meetings with factory management as well as employees at various levels in our supply chain. In addition to our own monitoring activities, we value... -

Page 100

... our business relationship with three suppliers for compliance reasons (2014: 13 terminations). Further information about our supply chain management can be found on our website. www.adidas-group.com/s/ supply-chain-approach SUPPORTING COMMUNITIES WITH DEDICATED APPROACH For many years, the adidas... -

Page 101

..., adhesive-free process. As a result, sporting goods could be constantly recycled. Sport Infinity is the next step in the Group's commitment to innovation and adds to our goal of closing the sustainability loop. Further information can be found on our website. www.adidas-group.com/s/ sport-infinity... -

Page 102

... communication is the disclosure of our global supplier factory list on our website. First published in 2007 and updated twice a year, it is complemented with factories that manufactured products for major sport events such as the FIFA World Cup or Olympic Games. www.adidas-group.com/s/ supply-chain... -

Page 103

... global sustainability index family tracking the performance of the leading sustainability-driven companies worldwide. In the sector 'Textiles, Apparel & Luxury Goods', adidas AG scored industry-best ratings in the category Innovation Management and received far above-average scores in Supply Chain... -

Page 104

-

Page 105

... Income Statement Statement of Financial Position and Statement of Cash Flows Treasury Financial Statements and Management Report of adidas AG Disclosures pursuant to § 315 Section 4 and § 289 Section 4 of the German Commercial Code Business Performance by Segment Western Europe North America... -

Page 106

... our current performance and to align future strategic and investment decisions to best utilise commercial and organisational opportunities. OPERATING CASH FLOW AS INTERNAL GROUP MANAGEMENT FOCUS We believe operating cash flow is the most important driver to increase shareholder value. To support... -

Page 107

... activities, while at the same time increasing full-price share of sales. Optimising our product mix. Improving the quality of distribution, with a particular focus on controlled space. Realising supply chain efficiency initiatives. see Glossary, p. 260 Operating expense control: Management... -

Page 108

... long-term success but are, however, not directly reflected in the Group's financial statements. These non-financial KPIs are assessed on a regular basis and managed by the respective Group functions. Non-financial KPIs include market share and Net Promoter Score, our customer delivery performance... -

Page 109

...RE P O RT - F INA NCIA L RE VIE W Internal Group Management System Market share and Net Promoter Score (NPS): Maintaining and enhancing brand image and reputation through the creation of strong brand identities is crucial for sustaining and driving revenue and profit growth. It is also an important... -

Page 110

... of any relevant recent market and consumer research are assessed as available. see Glossary, p. 260 ENHANCED INTEGRATED BUSINESS PLANNING AND MANAGEMENT APPROACH In order to further optimise profitability and working capital efficiency as well as operating cash flow development, we continue to... -

Page 111

... labour markets and credit conditions, developing economies recorded disappointing results, due to subdued global trade, low commodity prices, rising borrowing costs and uncertainties regarding monetary and fiscal policies. GDP in Western Europe grew 1.7% in 2015, supported by lower energy prices... -

Page 112

... In Latin America, GDP remained stable versus the prior year with divergences across the region's major countries. Argentina's economy recorded positive GDP growth, driven by improvements in the labour market as well as increased government spending. In Brazil, low investment activity, weak consumer... -

Page 113

... throughout the year, technical running and marquee performance basketball slowed somewhat. On the athletic apparel side, sales were negatively impacted by unfavourable weather conditions. In addition, hardware sales remained challenged as participation levels in team sports continued to decline. On... -

Page 114

..., sales in sports apparel saw a modest decline and were negatively impacted by unfavourable weather conditions. Although further signs of a slow recovery in the golf market appeared during the second half of 2015 due to unseasonably warm weather and new product introductions, structural changes... -

Page 115

...Reebok sales were up 6% versus the prior year, mainly as a result of double-digit sales increases in the training and studio categories as well as high-singledigit growth in the running category and in Classics. Revenues at TaylorMade-adidas Golf decreased 13% currency-neutral, due to sales declines... -

Page 116

.... High-single-digit sales increases at Reebok-CCM Hockey and double-digit sales increases in Other centrally managed businesses were more than offset by sales declines at TaylorMade-adidas Golf. With the exception of Russia/CIS and Latin America, currency translation effects had a positive impact... -

Page 117

...Income Statement GROUP SALES DEVELOPMENT SUPPORTED BY DOUBLE-DIGIT GROWTH IN RETAIL In 2015, retail revenues increased 11% on a currency-neutral basis, mainly as a result of double-digit sales growth at adidas. Reebok revenues increased at a low-single-digit rate. Concept stores and factory outlets... -

Page 118

... increased 0.6 percentage points to 48.3% (2014: 47.6%), driven by a more favourable pricing, channel and product mix at adidas and Reebok, which more than offset negative currency effects, higher input costs as well as lower product margins at TaylorMade-adidas Golf. see Diagram 13 see Diagram 14... -

Page 119

... expenses for promotion partnerships, advertising, public relations and other communication activities. In absolute terms, expenditure for point-of-sale and marketing investments increased 22% to â,¬ 2.348 billion in 2015 from â,¬ 1.923 billion in the prior year. This development mainly reflects the... -

Page 120

...L RE VIE W Group Business Performance - Income Statement NUMBER OF GROUP EMPLOYEES UP 3% At the end of 2015, the Group employed 55,555 people. This represents an increase of 3% versus the prior year level of 53,731. New hirings related to the Group's global marketing and sales organisation aimed at... -

Page 121

... of sales, which more than offset the increase in the gross margin. see Diagram 20 see Diagram 21 NET FINANCIAL EXPENSES DECREASE STRONGLY Financial income increased to â,¬ 46 million in 2015 from â,¬ 19 million in the prior year, mainly as a result of positive exchange rate effects. Financial... -

Page 122

...million, net of tax, related to the Rockport operating segment (2014: losses of â,¬ 68 million). Losses from discontinued operations in 2015 were mainly due to the loss from the sale, net of tax, in the amount of â,¬ 32 million and the loss from Rockport's operating activities of â,¬ 13 million. see... -

Page 123

...concrete plan to sell this operating segment. see Note 11, p. 205 ASSETS At the end of December 2015, total assets increased 7% to â,¬ 13.343 billion versus â,¬ 12.417 billion in the prior year, mainly as a result of an increase in non-current assets. The share of current assets within total assets... -

Page 124

... RT - F INA NCIA L RE VIE W Group Business Performance - Statement of Financial Position and Statement of Cash Flows Total current assets increased 2% to â,¬ 7.497 billion at the end of December 2015 compared to â,¬ 7.347 billion in 2014. Cash and cash equivalents decreased 19% to â,¬ 1.365 billion... -

Page 125

... F INA NCIA L RE VIE W Group Business Performance - Statement of Financial Position and Statement of Cash Flows LIABILITIES AND EQUITY Total current liabilities increased 23% to â,¬ 5.364 billion at the end of December 2015 from â,¬ 4.378 billion in 2014. Accounts payable increased 23% to â,¬ 2.024... -

Page 126

... expenditure was related to the Group's controlled space initiatives. Investments in new or remodelled own-retail and franchise stores as well as in shop-in-shop presentations of our brands and products in our customers' stores accounted for 45% of total capital expenditure (2014: 36%). Expenditure... -

Page 127

... W Group Business Performance - Statement of Financial Position and Statement of Cash Flows acquisition of Runtastic, partly offset by proceeds from the divestiture of the Rockport business and lower purchases of property, plant and equipment. The majority of investing activities in 2015 related to... -

Page 128

... management of intercompany cash flows. Responsibilities are arranged in a three-tiered approach: • The Treasury Committee consists of members of the Executive Board and other senior executives who decide on the Group's Treasury Policy and provide strategic guidance for managing treasury-related... -

Page 129

...Group Business Performance - Treasury GROUP FINANCIAL FLEXIBILITY The adidas Group's financial flexibility is ensured by the availability of unutilised credit facilities of â,¬ 1.906 billion at the end of 2015 (2014: â,¬ 1.846 billion), consisting of committed and uncommitted bilateral credit lines... -

Page 130

... Events and Outlook, p. 148 GROSS BORROWINGS DECREASE Gross borrowings decreased 2% to â,¬ 1.830 billion at the end of 2015 from â,¬ 1.873 billion in the prior year. This development was mainly due to the repayment of a US private placement of US $ 115 million, partly offset by an increase in short... -

Page 131

...RE VIE W Group Business Performance - Treasury EURO DOMINATES CURRENCY MIX The vast majority of our Group's gross borrowings are denominated in euros and US dollars. At the end of 2015, gross borrowings denominated in euros accounted for 80% of total gross borrowings (2014: 80%). The share of gross... -

Page 132

...O RT - F INA NCIA L RE VIE W Group Business Performance - Treasury 43 FINANCING STRUCTURE 1 â,¬ IN MILLIONS 2015 2014 Cash and short-term financial assets Bank borrowings Commercial paper Private placements Eurobonds Convertible bond Gross total borrowings Net borrowings 1 Rounding differences may... -

Page 133

... borrowings at the end of the year (2014: 10%). see Diagram 47 47 INTEREST RATE DEVELOPMENT 1 IN % 2015 2014 2013 2012 2011 1 Weighted average interest rate of gross borrowings. 2.4 3.1 3.8 4.4 4.9 EFFECTIVE CURRENCY MANAGEMENT A KEY PRIORITY As a globally operating company, the adidas Group is... -

Page 134

... Business Performance - Financial Statements and Management Report of adidas AG FINANCIAL STATEMENTS AND MANAGEMENT REPORT OF ADIDAS AG adidas AG is the parent company of the adidas Group. It includes operating business functions, primarily for the German market, as well as corporate headquarter... -

Page 135

... adidas and Reebok products generated by adidas Germany, external revenues from Y-3 products as well as Group-internal revenues from foreign subsidiaries. Reported revenues also include royalty and commission income, mainly from affiliated companies, and other revenues. In 2015, adidas AG net sales... -

Page 136

... Business Performance - Financial Statements and Management Report of adidas AG FINANCIAL RESULT IMPROVES SIGNIFICANTLY The financial result of adidas AG improved to â,¬ 394 million in 2015 from â,¬ 128 million in 2014. This increase was due to higher income from investments in affiliated companies... -

Page 137

... Business Performance - Financial Statements and Management Report of adidas AG TOTAL ASSETS UP 1% At the end of December 2015, total assets grew 1% to â,¬ 7.517 billion versus â,¬ 7.415 billion in the prior year. The increase in financial assets was largely offset by the decrease in current assets... -

Page 138

...on the Code of Conduct in conjunction with an internal guideline of adidas AG, however, particular lock-up periods do exist for members of the Executive Board with regard to the purchase and sale of adidas AG shares. These lock-up periods are connected with the publication of quarterly and full year... -

Page 139

... VIE W Group Business Performance - Disclosures pursuant to § 315 Section 4 and § 289 Section 4 of the German Commercial Code As adidas AG is subject to the regulations of the German Co-Determination Act (Mitbestimmungsgesetz - MitbestG), the appointment of Executive Board members and also their... -

Page 140

... hypothetical market value of these bonds and the number of shares to be issued does not exceed 10% of the nominal capital. The issuance of new shares or the use of treasury shares must be taken into account when calculating the limit of 10% in certain other specific cases. The Executive Board has... -

Page 141

... General Meeting on May 8, 2014, the Executive Board is furthermore authorised to conduct the share buyback also by using equity derivatives which are arranged with a credit institution or financial services institution in close conformity with market conditions. adidas AG may acquire call options... -

Page 142

...Korea, Southeast Asia/Paciï¬c, TaylorMade-adidas Golf, Reebok-CCM Hockey, Runtastic and Other centrally managed businesses. While the business segments Western Europe, North America, Greater China, Russia/CIS, Latin America and Japan are reported separately, the markets Middle East, South Korea and... -

Page 143

... RE VIE W Business Performance by Segment - Western Europe WESTERN EUROPE REVENUES IN WESTERN EUROPE UP 17% In 2015, sales in Western Europe increased 17% on a currency-neutral basis, due to double-digit sales growth at both adidas and Reebok. From a market perspective, the main contributors to the... -

Page 144

...36.6% in 2015 from 35.5% in 2014. This development was mainly due to the positive effects from a more favourable channel, product and pricing mix, partly offset by higher input costs as well as negative currency effects. Gross profit in North America increased 28% to â,¬ 1.008 billion versus â,¬ 787... -

Page 145

... percentage points to 57.1% in 2015 (2014: 57.1%). This development was driven by a more favourable pricing, channel and product mix, partly offset by higher input costs as well as negative currency effects. Gross profit in Greater China increased 38% to â,¬ 1.411 billion versus â,¬ 1.019 billion in... -

Page 146

... L RE VIE W Business Performance by Segment - Russia/CIS RUSSIA/CIS RUSSIA/CIS REVENUES DECLINE In 2015, sales in Russia/CIS decreased 11% on a currency-neutral basis, mainly due to sales declines at adidas. Currency translation effects negatively impacted revenues in euro terms. Revenues in Russia... -

Page 147

... basis in Latin America in 2015. This increase was supported by double-digit sales increases in the training, basketball and outdoor categories as well as at adidas Originals and adidas neo. In addition, mid-single-digit sales growth in the running category contributed to this development. Currency... -

Page 148

...-digit growth at adidas Originals as well as high-single-digit increases in the running category were offset by declines in the training and football categories, the latter being mainly due to the non-recurrence of sales related to the 2014 FIFA World Cup. Currency translation effects had a positive... -

Page 149

... development was mainly due to double-digit sales increases in the training and running categories as well as at adidas Originals. Currency translation effects had a positive impact on revenues in euro terms. adidas sales in MEAA increased 23% to â,¬ 2.091 billion (2014: â,¬ 1.693 billion). Reebok... -

Page 150

... were mixed amongst the Group's regions. Revenues in Western Europe were up 17% on a currency-neutral basis, driven by strong double-digit sales increases at both Reebok-CCM Hockey and in Other centrally managed businesses, which more than offset double-digit sales declines at TaylorMade-adidas Golf... -

Page 151

... 09 09 OTHER BUSINESSES AT A GLANCE â,¬ IN MILLIONS 2015 2014 Change Change (currency-neutral) Net sales 1 TaylorMade-adidas Golf Reebok-CCM Hockey Other centrally managed businesses Gross profit Gross margin Operating profit Operating margin 1 Rounding differences may arise in totals. 1,467 902... -

Page 152

... pipeline of new and innovative products, increased brand-building activities and the positive effects from major sporting events, including the UEFA EURO 2016, we project signiï¬cant top- and bottom-line improvements in our Group's ï¬nancial results in 2016. We forecast adidas Group sales to... -

Page 153

... monetary policies. In India, GDP is expected to expand by 7.8%, fuelled by strong private domestic demand, strengthened investment, low commodity prices and growing consumer and government spending. In Latin America, GDP is expected to increase 0.4% in 2016. Growth in several countries is... -

Page 154

...-digit rate in 2016. In particular, the industry is projected to benefit from major sporting events, such as the UEFA EURO 2016 as well as the Rio 2016 Olympic Games. Consumer spending on sporting goods in the emerging economies is expected to grow faster than in the more developed markets. Private... -

Page 155

... performance credentials to consumers globally. At Reebok, we project the brand to continue its growth path in 2016, leveraging its strong positioning in 'Tough Fitness' and addressing the most relevant fitness movements in the sporting goods industry. The sales development at TaylorMade-adidas Golf... -

Page 156

... of product launches while at the same time focusing on full-price sell-through. Currency-neutral sales at Reebok-CCM Hockey are projected to grow at a mid-single-digit rate, supported by new product introductions in key categories such as skates and sticks. see TaylorMade-adidas Golf Strategy... -

Page 157

... sporting events such as the UEFA EURO 2016 to leverage the strong visibility of the adidas brand during the event as well as on innovative product launches and engaging grassroots events. In addition, we will support Reebok's growth strategy in key fitness categories, leveraging partnership assets... -

Page 158

... the adidas Group in 2016. We focus on continuously anticipating the operating cash flows of our operating segments, as this represents the main source of liquidity within the Group. Liquidity is planned on a rolling monthly basis under a multi-year financial and liquidity plan. Long-term liquidity... -

Page 159

... outdoor jacket ZPump Fusion 2.0 running shoe Nano 6.0 training shoe Combat training apparel Urban yoga apparel FuryLite shoe M2 drivers, fairway woods and hybrids OS putters Tour 360 Boost golf shoe CCM Super Tacks skate CCM FitLite 3DS helmet CCM RBZ revolution stick adidas adidas adidas adidas... -

Page 160

... reflect the structure as well as company and management culture of the adidas Group. This system focuses on the identification, evaluation, handling, monitoring and reporting of risks and opportunities. The key objective of the risk and opportunity management system is to support business success... -

Page 161

... and developments in the sporting goods industry, as well as internal processes, to identify risks and opportunities as early as possible. Our Group-wide network of Risk Owners (i.e. all direct reports to the adidas AG Executive Board, including the Managing Directors of all our markets) ensures... -

Page 162

... and mitigation. Short-term risks and opportunities may affect the achievement of the Group's objectives already in the current financial year, mid-term risks and opportunities would impact the Group's target achievement in the next financial year, while long-term risks and opportunities... -

Page 163

... are overseen by the Group's Chief Compliance Officer who reports directly to the Group's Chief Executive Officer. We see compliance as all-encompassing, spanning all business functions throughout the entire value chain, from supply chain through to the end consumer. As a result, the identification... -

Page 164

...SECTION 2 NO. 5 GERMAN COMMERCIAL CODE (HANDELSGESETZBUCH - HGB) The internal control and risk management system relating to the consolidated financial reporting process of the adidas Group represents a process embedded within the Group-wide corporate governance system. It aims to provide reasonable... -

Page 165

...laws and regulations despite identified financial reporting risks. To monitor the effectiveness of ICoFR, the Group Policies & Internal Controls department and the Group Internal Audit department regularly review accounting-related processes. Additionally, as part of the year-end audit, the external... -

Page 166

... Table 03 03 CORPORATE RISKS OVERVIEW Potential impact Change (2014 rating) Likelihood Change (2014 rating) Strategic Risks Risks related to organisational structure and change Risks related to distribution strategy Competition risks Risks related to media and stakeholder activities Macroeconomic... -

Page 167

... business plan model, taking into account our many years of own-retail experience and best practices from around the world. In addition, we conduct specific trainings for our sales force to appropriately manage product distribution and ensure that the right product is sold at the right point of sale... -

Page 168

...-retail stores, more conservative product purchasing, tight working capital management and an increased focus on cost control. In addition, by building on our leading position within the sporting goods industry, we actively engage in supporting policymakers and regulators to liberalise global trade... -

Page 169

... of business partner risks. Injuries to individual athletes or poor on-field performance on the part of sponsored teams or athletes could reduce their consumer appeal and eventually result in lower sales and attractiveness of our brands. Failure to cement and maintain strong relationships with... -

Page 170

... costs. Data leakage could trigger in-depth forensic investigation resulting in temporary unavailability of key systems and business interruption. Key business processes, including product marketing, order management, warehouse management, invoice processing, customer support and financial reporting... -

Page 171

... products while trying to avoid excess inventories. see Internal Group Management System, p. 102 see Global Operations, p. 74 LEGAL & COMPLIANCE RISKS Risks related to customs and tax regulations Numerous laws and regulations regarding customs and taxes affect the adidas Group's business practices... -

Page 172

...risks. Due to our strong global position, we are able to partly minimise currency risk by utilising natural hedges. Our gross US dollar cash flow exposure after natural hedges calculated for 2016 was roughly â,¬ 6.3 billion at year-end 2015, which we hedged using forward exchange contracts, currency... -

Page 173

... assets (including trademarks). Deterioration in the business performance, and particularly in future business prospects, as well as significant exchange rate fluctuations could require corrections of these book values by incurring impairment charges. In addition, increases in market interest rates... -

Page 174

...ageing. At the end of 2015, no customer accounted for more than 10% of accounts receivable. The Group Treasury department arranges currency, commodity and interest rate hedges, and invests cash, with major banks of a high credit standing throughout the world. adidas Group companies are authorised to... -

Page 175

..., 2015. Fair values for derivative interest rate instruments accounted for as cash flow hedges were then re-evaluated based on the hypothetical market interest rates with the resulting effects on net income and equity included in the sensitivity analysis. However, the effect on the income statement... -

Page 176

... In 2015, interest rates in Europe and North America remained at low levels. Given the central banks' current interest rate policies and macroeconomic uncertainty, we do not foresee any major interest rate increases in Europe in 2016. Due to the positive macroeconomic development in the USA, however... -

Page 177

...-executed campaigns and marketing initiatives could increase brand desire and consumer appeal, which may drive full-price sell-through and result in higherthan-expected sales and profit. In addition, outstanding competitive performance of promotion partners such as individual athletes, club teams... -

Page 178

... macroeconomic developments, which support increased private consumption, can have a positive impact on our sales and profitability. In addition, legislative and regulatory changes, e.g. the elimination of trade barriers, can potentially open up new channels of distribution or create cost savings... -

Page 179

.... In light of our highly attractive and innovative product launches, significant investments in consumerengaging and brand-building activities as well as the presentation of the Group's new strategic business plan 'Creating the New', the adidas Group enjoyed strong momentum, which accelerated during... -

Page 180

...see Internal Group Management System, p. 102 see TaylorMade-adidas Golf Strategy, p. 69 see Global Operations, p. 74 see Research and Development, p. 80 see Sustainability, p. 94 01 ADIDAS GROUP TARGETS VERSUS ACTUAL KEY METRICS 2014 Results 1 2015 Targets 1 2015 Results 2016 Outlook Sales (year... -

Page 181

... resources necessary to pursue the opportunities available to the Group. see Risk and Opportunity Report, p. 156 see Treasury, p. 124 ASSESSMENT OF FINANCIAL OUTLOOK In March 2015, the Group unveiled its 2020 strategic business plan named 'Creating the New', which defined strategies and objectives... -

Page 182

-

Page 183

...Consolidated Income Statement Consolidated Statement of Comprehensive Income Consolidated Statement of Changes in Equity Consolidated Statement of Cash Flows Notes Notes to the Consolidated Statement of Financial Position Notes to the Consolidated Income Statement Additional Information Statement of... -

Page 184

... financial statements give a true and fair view of the assets, liabilities, financial position and profit or loss of the Group, and the Group Management Report, which has been combined with the Management Report of adidas AG, includes a fair review of the development and performance of the business... -

Page 185

... are taken into account in the determination of audit procedures. The effectiveness of the accounting-related internal control system and the evidence supporting the disclosures in the consolidated financial statements and the Group management report are examined primarily on a test basis... -

Page 186

...Financial Position CONSOLIDATED STATEMENT OF FINANCIAL POSITION ADIDAS AG CONSOLIDATED STATEMENT OF FINANCIAL POSITION (IFRS) â,¬ IN MILLIONS Note Dec. 31, 2015 Dec. 31, 2014 Change in % Assets Cash and cash equivalents Short-term financial assets Accounts receivable Other current financial assets... -

Page 187

...Statement of Financial Position ADIDAS AG CONSOLIDATED STATEMENT OF FINANCIAL POSITION (IFRS) â,¬ IN MILLIONS Note Dec. 31, 2015 Dec. 31, 2014 Change in % Liabilities and equity Short-term borrowings Accounts payable Other current financial liabilities Income taxes Other current provisions Current... -

Page 188

... L STAT E M E NT S Consolidated Income Statement CONSOLIDATED INCOME STATEMENT ADIDAS AG CONSOLIDATED INCOME STATEMENT (IFRS) â,¬ IN MILLIONS Note Year ending Dec. 31, 2015 Year ending Dec. 31, 2014 Change Net sales Cost of sales Gross profit (% of net sales) Royalty and commission income Other... -

Page 189

... to profit or loss when specific conditions are met Other comprehensive income Total comprehensive income Attributable to shareholders of adidas AG Attributable to non-controlling interests 1 Includes actuarial gains or losses relating to defined benefit obligations, return on plan assets (excluding... -

Page 190

..., 2015 1 Reserves for remeasurements of defined benefit plans (IAS 19), option plans and acquisition of shares from non-controlling interest shareholders. Rounding differences may arise in percentages and totals. The accompanying notes are an integral part of these consolidated financial statements... -

Page 191

... CON S OLI DAT E D F INA NCIA L STAT E M E NT S Consolidated Statement of Changes in Equity Cumulative currency translation differences Hedging reserve Other reserves 1 Retained earnings Shareholders' equity Non-controlling interests Total equity (363) 106 106 (34) 210 210 (59) (57) 4,959... -

Page 192

...and other business units net of cash acquired Proceeds from disposal of discontinued operations net of cash disposed (Purchase of)/proceeds from sale of short-term financial assets Purchase of investments and other long-term assets Interest received Net cash used in investing activities - continuing... -

Page 193

... 'Group') design, develop, produce and market a broad range of athletic and sports lifestyle products. As at December 31, 2015, the operating activities of the adidas Group are divided into 13 operating segments: Western Europe, North America, Greater China, Russia/CIS, Latin America, Japan, Middle... -

Page 194

... in the statement of financial position such as financial instruments valued at fair value through profit or loss, available-for-sale financial assets, derivative financial instruments, plan assets and receivables, which are measured at fair value. The consolidated financial statements are presented... -

Page 195

... The consolidated financial statements include the financial statements of adidas AG and all its direct and indirect subsidiaries, which are prepared in accordance with uniform accounting principles. A company is considered a subsidiary if it is controlled by adidas AG. Control exists when... -

Page 196

... principle Assets Cash and cash equivalents Short-term financial assets Accounts receivable Inventories Assets classified as held for sale Property, plant and equipment Goodwill Intangible assets (except goodwill): With definite useful life With indefinite useful life Other financial assets... -

Page 197

... commodity price and interest rate risks. In accordance with its Treasury Policy, the Group does not enter into transactions with derivative financial instruments for trading purposes. Derivative financial instruments are initially recognised in the statement of financial position at fair value, and... -

Page 198

... current receivables and other financial assets. For non-current receivables and other financial assets, the fair value is estimated as the present value of future cash flows discounted at the market rate of interest at the balance sheet date. Subsequently, these are measured at amortised cost using... -

Page 199

... sell and value in use. Non-financial instruments measured at the recoverable amount primarily relate to impaired property, plant and equipment being measured at Level 3 according to IFRS 13 'Fair Value Measurement' and taking unobservable inputs (e.g. profit or cash flow planning) into account. An... -

Page 200

... residual value. Expenditures during the development phase of internally generated intangible assets are capitalised as incurred if they qualify for recognition under IAS 38 'Intangible Assets'. Estimated useful lives are as follows: ESTIMATED USEFUL LIVES OF INTANGIBLE ASSETS Years Trademarks... -

Page 201

... to calculate their present value, and the fair value of any plan assets is deducted in order to determine the net liability. The discount rate is set on the basis of yields of high-quality corporate bonds at the balance sheet date provided there is a deep market for high-quality corporate bonds in... -

Page 202

... the right to use the adidas, Reebok and TaylorMade brands as well as various other trademarks to third parties. The related royalty and commission income is recognised based on the contract terms on an accrual basis. Advertising and promotional expenditures Production costs for media campaigns are... -

Page 203

... and judgements The preparation of financial statements in conformity with IFRS requires the use of assumptions and estimates that affect reported amounts and related disclosures. Although such estimates are based on Management's best knowledge of current events and actions, actual results may... -

Page 204

... cash flow method. As per December 31, 2015, the fair value increased by US $ 1 million since July 31, 2015. The results of the Rockport operating segment are shown as discontinued operations in the consolidated income statement: DISCONTINUED OPERATIONS â,¬ in millions Year ending Dec. 31, 2015 Year... -

Page 205

... associated with these assets. Future cash flows were measured on the basis of the expected net sales by deducting variable and sales-related imputed costs for the use of contributory assets. Subsequently, the outcome was discounted using the appropriate discount rate and adding a tax amortisation... -

Page 206

... for the year ending December 31, 2015. Effective January 2, 2015, Reebok International Limited completed the acquisition of Refuel (Brand Distribution) Limited ('Refuel') and consequently owns 100% of the voting rights. Based in London (UK), Refuel mainly markets and distributes apparel of Mitchell... -

Page 207

... for the year ending December 31, 2014. NOTES TO THE CONSOLIDATED STATEMENT OF FINANCIAL POSITION 05 CASH AND CASH EQUIVALENTS Cash and cash equivalents consist of cash at banks, cash on hand, short-term deposits and investments in money market funds. Short-term financial assets are only shown... -

Page 208

... to the Consolidated Statement of Financial Position 07 ACCOUNTS RECEIVABLE Accounts receivable consist mainly of the currencies US dollar, euro, Chinese renminbi as well as Japanese yen and are as follows: ACCOUNTS RECEIVABLE â,¬ in millions Dec. 31, 2015 Dec. 31, 2014 Accounts receivable, gross... -

Page 209

... which were reported as assets/liabilities held for sale since December 31, 2014 due to the concrete plans to sell the operating segment are consequently derecognised from the consolidated statement of financial position as of July 31, 2015. The Rockport operating segment is part of Other Businesses... -

Page 210

...and equipment Trademarks Other intangible assets Total non-current assets Total assets Accounts payable Other current provisions Current accrued liabilities Other current liabilities Total current liabilities Total liabilities 49 1 88 139 7 112 1 121 260 37 1 6 2 46 46 The non-recurring fair value... -

Page 211

... cash flows. This calculation uses cash flow projections based on the financial planning covering a five-year period in total. The planning is based on long-term expectations of the adidas Group and reflects in total for the cash-generating units an average annual mid- to high-single-digit sales... -

Page 212

...the regional markets which are responsible for the joint distribution of adidas and Reebok as well as the other operating segments TaylorMade-adidas Golf, Reebok-CCM Hockey and Runtastic. The regional markets are: Western Europe, North America, Greater China, Russia/CIS, Latin America, Japan, Middle... -

Page 213

... and the respective discount rates applied to the cash flow projections are as follows: ALLOCATION OF GOODWILL Goodwill â,¬ in millions Dec. 31, 2015 Jan. 1, 2015 Dec. 31, 2015 Discount rate after taxes Jan. 1, 2015 Western Europe Greater China TaylorMade-adidas Golf Other Total 632 226 292 240... -

Page 214

... rates of 1.7% (2014: 1.7%). The growth rates do not exceed the long-term average growth rate of the business to which the trademarks are allocated. The discount rate is based on a weighted average cost of capital calculation derived using a five-year average market-weighted debt/equity structure... -

Page 215

...through profit or loss' and recorded at fair value. This equity security does not have a quoted market price in an active market. Therefore, existing contractual arrangements were used in order to calculate the fair value as at December 31, 2015. The line item 'Investments and other financial assets... -

Page 216

... The weighted average interest rate on the Group's gross borrowings decreased to 2.4% in 2015 (2014: 3.1%). As at December 31, 2015, the Group had cash credit lines and other long-term financing arrangements totalling â,¬ 3.7 billion (2014: â,¬ 3.7 billion); thereof unused credit lines accounted for... -

Page 217

... Finance lease obligations Sundry Other current financial liabilities 2 59 - 3 79 143 0 50 3 3 35 91 The increase in the line item 'Sundry' mainly relates to purchase price obligations for non-controlling interests. For further information about currency options, forward exchange contracts and... -

Page 218

...Consolidated Statement of Financial Position Marketing provisions mainly consist of provisions for promotion contracts. Provisions for personnel mainly consist of provisions for short- and long-term variable compensation components as well as of provisions for social plans relating to restructuring... -

Page 219

...31, 2015 Dec. 31, 2014 Currency options Forward exchange contracts Finance lease obligations Sundry Other non-current financial liabilities 0 0 6 12 18 2 - 7 0 9 The increase in the line item 'Sundry' mainly relates to the earn-out components for Runtastic. For further information about currency... -

Page 220

... pension entitlements of members of the Executive Board of adidas AG are contained in the Compensation Report SE E CO M P E N SAT I O N R E P O RT, P. 36 . The final salary defined benefit pension scheme in the UK is closed to new entrants and to future accrual. The benefits are mainly paid out in... -

Page 221

... of Financial Position AMOUNTS FOR DEFINED BENEFIT PENSION PLANS RECOGNISED IN THE CONSOLIDATED STATEMENT OF FINANCIAL POSITION â,¬ in millions Dec. 31, 2015 Dec. 31, 2014 Present value of funded obligation from defined benefit pension plans Fair value of plan assets Funded status Present value of... -

Page 222

... Consolidated Statement of Financial Position PENSION EXPENSES FOR DEFINED BENEFIT PENSION PLANS â,¬ in millions Year ending Dec. 31, 2015 Year ending Dec. 31, 2014 Current service cost Net interest expense Thereof: interest cost Thereof: interest income Past service cost Gain on plan settlement... -

Page 223

... for the 2016 financial year amount to â,¬ 13 million. Thereof, â,¬ 7 million relates to benefits directly paid to pensioners by the Group companies and â,¬ 5 million to employer contributions paid into the plan assets. In 2015, the actual return on plan assets was â,¬ 5 million (2014: â,¬ 6 million... -

Page 224

... 31, 2014 Cash and cash equivalents Equity instruments Bonds Real estate Pension plan reinsurance Insurance policies Other assets Fair value of plan assets 45 57 29 0 29 13 1 173 31 51 41 1 27 5 0 157 All equities and bonds are traded freely and have a quoted market price in an active market. At... -

Page 225

... 14, 2017, adidas AG may conduct an early redemption of the bond, if, on 20 of 30 consecutive trading days, the share price of adidas AG exceeds the current conversion price of â,¬ 82.00 by at least 30%. The bonds are listed on the Open Market segment of the Frankfurt Stock Exchange. Moreover, the... -

Page 226

... shares in the company for the total amount or a part amount instead of payment of the amount due and insofar as no cash settlement, treasury shares or shares of another public listed company are used to serve these rights. The new shares will be issued at the respective option or conversion price... -

Page 227

...Family Trust, Montréal, Canada 2 FMR LLC, Wilmington, DE, USA 3 Capital Research and Management Company, Los Angeles, CA, USA 4 The Capital Group Companies, Inc., Los Angeles, CA, USA 5 adidas AG, Herzogenaurach, Germany 6 O. Mason Hawkins, USA 7 February 10, 2016 January 14, 2016 December 2, 2015... -

Page 228

...to the Consolidated Statement of Financial Position Capital management The Group's policy is to maintain a strong capital base so as to uphold investor, creditor and market confidence and to sustain future development of the business. The Group seeks to maintain a balance between a higher return on... -

Page 229

... entity name Principle place of business Ownership interests held by non-controlling interests in % Dec. 31, 2015 Dec. 31, 2014 H E RZOGE N AUR ACH, P. 250 ) . adidas Levant Limited adidas Levant Limited - Jordan Life Sport Ltd. Reebok India Company Levant Jordan Israel India 45% 45% 49% 6.85... -

Page 230

... 32 Net assets attributable to non-controlling interests according to the consolidated statement of financial position Net cash generated from/(used in) operating activities Net cash used in investing activities Net cash generated from financing activities Net increase of cash and cash equivalents... -

Page 231

... and information technology functions, for which it has entered into long-term contracts. Financial commitments under these contracts mature as follows: FINANCIAL COMMITMENTS FOR SERVICE ARRANGEMENTS â,¬ in millions Dec. 31, 2015 Dec. 31, 2014 Within 1 year Between 1 and 5 years After 5 years Total... -

Page 232

... value Dec. 31, 2015 Financial assets Cash and cash equivalents Short-term financial assets Accounts receivable Other current financial assets Derivatives being part of a hedge Derivatives not being part of a hedge Other financial assets Long-term financial assets Other equity investments Available... -

Page 233

... value Dec. 31, 2014 Financial assets Cash and cash equivalents Short-term financial assets Accounts receivable Other current financial assets Derivatives being part of a hedge Derivatives not being part of a hedge Other financial assets Long-term financial assets Other equity investments Available... -

Page 234

... to the Consolidated Statement of Financial Position FAIR VALUE HIERARCHY OF FINANCIAL INSTRUMENTS ACCORDING TO IFRS 13 AS AT DECEMBER 31, 2015 â,¬ in millions Fair value Dec. 31, 2015 Level 1 Level 2 Level 3 Short-term financial assets Derivative financial instruments Derivatives being part of... -

Page 235

... expected future cash flows using current interest rates for debt of similar terms and remaining maturities and adjusted by an adidas Group specific credit risk premium. Fair values of long-term financial assets classified as 'Available-for-sale' are based on quoted market prices in an active market... -

Page 236

... rate. Due to their short-term maturities, it is assumed that their respective fair value is equal to the notional amount. The fair value is based on the market price of the assets as at December 31, 2015. For EUR/USD, the adidas Group applies the par method, which uses actively traded forward rates... -

Page 237

... to the Consolidated Statement of Financial Position NET GAINS/LOSSES ON FINANCIAL INSTRUMENTS RECOGNISED IN THE CONSOLIDATED INCOME STATEMENT â,¬ in millions Year ending Dec. 31, 2015 Year ending Dec. 31, 2014 Financial assets or financial liabilities at fair value through profit or loss Thereof... -

Page 238

... As at December 31, 2015, no ineffective part of the hedges was recorded in the income statement. In order to determine the fair values of its derivatives that are not publicly traded, the adidas Group uses generally accepted quantitative financial models based on market conditions prevailing at the... -

Page 239

... directly assigned to the production costs. OTHER OPERATING EXPENSES â,¬ in millions Year ending Dec. 31, 2015 Year ending Dec. 31, 2014 Expenditure for marketing investments Expenditure for point-of-sale investments Marketing overhead 1 Sales force 1 Logistics 1 Research and development 1 Central... -

Page 240

...statement. Supplementary information on the expenses by nature is detailed below. Cost of materials The total cost of materials relating to the amount of inventories recognised as an expense during the period was â,¬ 8.602 billion and â,¬ 7.478 billion for the years ending December 31, 2015 and 2014... -

Page 241

...). Information regarding the Group's available-for-sale investments, borrowings and financial instruments is also included in these Notes SE E N OT E S 0 6, 15, 18 AN D 2 9 . 34 INCOME TAXES adidas AG and its German subsidiaries are subject to German corporate and trade taxes. For the years ending... -

Page 242

... foreseeable future, appropriate tax structuring measures are also taken into consideration. Deferred tax assets for which the realisation of the related tax benefits is not probable increased from â,¬ 524 million to â,¬ 653 million for the year ending December 31, 2015. These amounts mainly relate... -

Page 243

... per share in 2015 as the conversion right does not have any value as at the balance sheet date SE E N OT E 18 . The average share price reached â,¬ 73.07 per share during 2015 and thus did not exceed the conversion price of â,¬ 82.00 per share. As a consequence of contractual provisions relating to... -

Page 244

...: Western Europe, North America, Greater China, Russia/CIS, Latin America, Japan, Middle East, South Korea, Southeast Asia/Pacific, TaylorMade-adidas Golf, Reebok-CCM Hockey, Runtastic and Other centrally managed businesses. Due to the divestiture of the Rockport operating segment on July 31, 2015... -

Page 245

... Information The operating segment TaylorMade-adidas Golf comprises the brands TaylorMade, adidas Golf, Adams Golf and Ashworth. Rockport predominantly designs and distributes leather footwear for men and women. Reebok-CCM Hockey designs, produces and distributes ice hockey equipment such as sticks... -

Page 246

... Segmental assets 2 Segmental liabilities 2 2015 2014 2015 2014 2015 2014 2015 2014 Western Europe North America Greater China Russia/CIS Latin America Japan MEAA Other Businesses (continuing operations) Other Businesses (discontinued operations) Other Businesses (total) Total 1 Year ending... -

Page 247

...and distribution management for the brands adidas and Reebok), central treasury and global sourcing as well as other headquarter departments, is shown under HQ/Consolidation. CAPITAL EXPENDITURE â,¬ in millions Year ending Dec. 31, 2015 Year ending Dec. 31, 2014 Reportable segments Other Businesses... -

Page 248

.... 31, 2015 Dec. 31, 2014 Accounts payable of reportable segments Accounts payable of Other Businesses Segmental liabilities Non-segmental accounts payable Current financial liabilities Other current liabilities Non-current liabilities Reclassification to liabilities as held for sale Total 566 117... -

Page 249

...Rockport operating segment. Cash outflows from financing activities mainly related to the dividend paid to shareholders of adidas AG and to the repurchase of treasury shares. NET CASH (USED IN)/GENERATED FROM DISCONTINUED OPERATIONS â,¬ in millions Year ending Dec. 31, 2015 Year ending Dec. 31, 2014... -

Page 250