MoneyGram 2011 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2011 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

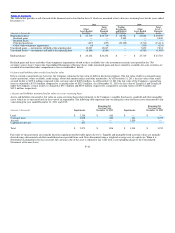

to contractual arrangements and Company policy. Assets restricted for regulatory or contractual reasons are not available to satisfy working capital or other

financing requirements. Consequently, the Company considers a significant amount of cash and cash equivalents, receivables and investments to be

restricted to satisfy the liability to pay the principal amount of regulated payment service obligations upon presentment. Cash and cash equivalents,

receivables and investments exceeding payment service obligations are generally available; however, management considers a portion of these amounts as

providing additional assurance that business needs and regulatory requirements are maintained during the normal fluctuations in the value of the Company’s

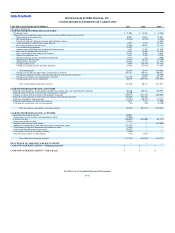

payment service assets and obligations. The following table shows the amount of assets in excess of payment service obligations at December 31:

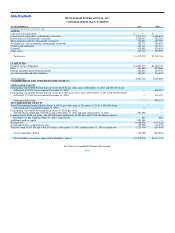

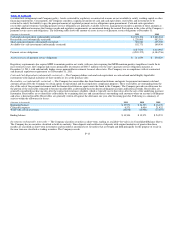

(Amounts in thousands) 2011 2010

Cash and cash equivalents (substantially restricted) $ 2,572,174 $ 2,865,941

Receivables, net (substantially restricted) 1,220,065 982,319

Short−term investments (substantially restricted) 522,024 405,769

Available−for−sale investments (substantially restricted) 102,771 160,936

4,417,034 4,414,965

Payment service obligations (4,205,375) (4,184,736)

Assets in excess of payment service obligations $ 211,659 $ 230,229

Regulatory requirements also require MPSI to maintain positive net worth, with one state requiring that MPSI maintain positive tangible net worth. In its

most restrictive state, the Company had excess permissible investments of $445.7 million over the state’s payment service obligations measure at

December 31, 2011, with substantially higher excess permissible investments for most other states. The Company was in compliance with its contractual

and financial regulatory requirements as of December 31, 2011.

Cash and Cash Equivalents (substantially restricted) — The Company defines cash and cash equivalents as cash on hand and all highly liquid debt

instruments with original maturities of three months or less at the purchase date.

Receivables, net (substantially restricted) — The Company has receivables due from financial institutions and agents for payment instruments sold and

amounts advanced by the Company to certain agents for operational and local regulatory compliance purposes. These receivables are outstanding from the

day of the sale of the payment instrument until the financial institution or agent remits the funds to the Company. The Company provides an allowance for

the portion of the receivable estimated to become uncollectible as determined based on known delinquent accounts and historical trends. Receivables are

generally considered past due one day after the contractual remittance schedule, which is typically one to three days after the sale of the underlying payment

instrument. Receivables are evaluated for collectability by examining the facts and circumstances surrounding each customer where an account is delinquent

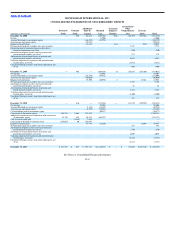

and a loss is deemed possible. Receivables are generally written off against the allowance one year after becoming past due. Following is a summary of

activity within the allowance for losses:

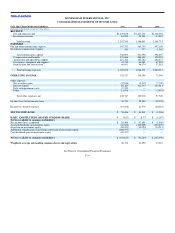

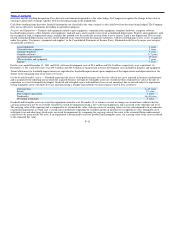

(Amounts in thousands) 2011 2010 2009

Beginning balance $ 19,971 $ 24,535 $ 16,178

Charged to expense 6,571 6,404 21,432

Write−offs, net of recoveries (16,038) (10,968) (13,075)

Ending balance $ 10,504 $ 19,971 $ 24,535

Investments (substantially restricted) — The Company classifies securities as short−term, trading, or available−for−sale in its Consolidated Balance Sheets.

The Company has no securities classified as held−to−maturity. Time deposits and certificates of deposits with original maturities of greater than three

months are classified as short−term investments and recorded at amortized cost. Securities that are bought and held principally for the purpose of resale in

the near term are classified as trading securities. The Company records

F−13