MoneyGram 2011 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2011 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

The regulatory requirements in the United States are similar to our internal measure of assets in excess of payment service obligations set forth in Assets in

Excess of Payment Service Obligations. The regulatory payment service assets measure varies by state. The most restrictive states may exclude assets held

at banks that do not belong to a national insurance program, varying amounts of accounts receivable balances and/or assets held in the SPEs. The regulatory

payment service obligation measure varies by state, but in all cases is substantially lower than our payment service obligations as disclosed in the

Consolidated Balance Sheets as we are not regulated by state agencies for payment service obligations resulting from outstanding cashier’s checks or for

amounts payable to agents and brokers. All states require MPSI to maintain positive net worth, with one state also requiring MPSI to maintain positive

tangible net worth of $100.0 million.

We are also subject to regulatory requirements in various countries outside of the United States, which typically result in needing to either prefund agent

settlements or hold minimum required levels of cash within the applicable country. The most material of these requirements is in the United Kingdom,

where our licensed entity, MoneyGram International Limited, is required to maintain a cash and cash equivalent balance equal to outstanding payment

instruments issued in the European community. This amount will fluctuate based on our level of activity within the European Community, and is likely to

increase over time as our business expands in that region. Assets used to meet these regulatory requirements support our payment service obligations, but

are not available to satisfy other liquidity needs. As of December 31, 2011, we had approximately $79.5 million of cash deployed outside of the United

States to meet regulatory requirements.

We were in compliance with all financial regulatory requirements as of December 31, 2011. We believe that our liquidity and capital resources will remain

sufficient to ensure on−going compliance with all financial regulatory requirements.

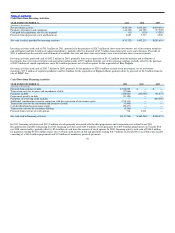

Available−for−sale Investments — Our investment portfolio includes $102.8 million of available−for−sale investments as of December 31, 2011. U.S.

government agency residential mortgage−backed securities and U.S. government agency debentures compose $78.5 million of our available−for−sale

investments, while other asset−backed securities compose the remaining $24.2 million. In completing our 2008 Recapitalization in 2008, we contemplated

that our other asset−backed securities might decline further in value. Accordingly, the capital raised assumed a zero value for these securities and any

further unrealized losses and impairments on these securities are already funded and would not cause us to seek additional capital or financing.

Other Funding Sources and Requirements

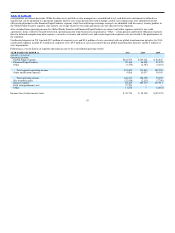

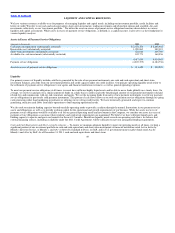

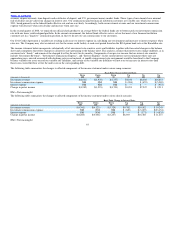

Contractual Obligations — The following table includes aggregated information about the Company’s contractual obligations that impact our liquidity and

capital needs. The table includes information about payments due under specified contractual obligations, aggregated by type of contractual obligation.

Contractual Obligations

Payments due by period

Less than More

than

(Amounts in thousands) Total 1 year 1−3 years 4−5 years 5 years

Debt, including interest payments $1,219,547 $68,513 $136,120 $135,103 $879,811

Operating leases 53,952 12,927 22,446 10,956 7,623

Signing bonuses 11,337 4,700 6,105 532 —

Signage 1,920 1,920 — — —

Marketing 8,338 8,338 — — —

Other obligations 291 291 — — —

Total contractual cash obligations $1,295,385 $96,689 $164,671 $146,591 $887,434

53