MoneyGram 2011 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2011 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

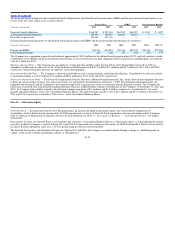

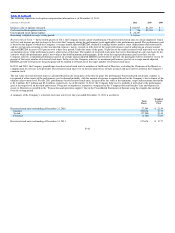

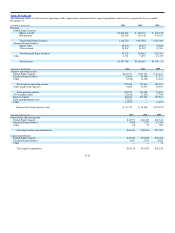

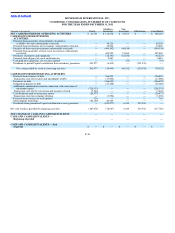

Rent expense under operating leases was $16.6 million, $15.3 million and $13.8 million during 2011, 2010 and 2009, respectively. Minimum future rental

payments for all non−cancelable operating leases with an initial term of more than one year are (amounts in thousands):

2012 $ 12,927

2013 11,714

2014 10,733

2015 8,551

2016. 2,405

Thereafter 7,623

Total $ 53,953

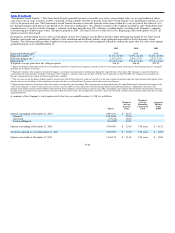

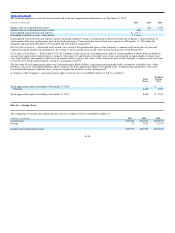

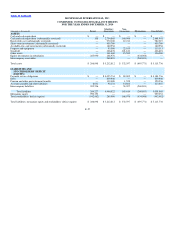

Credit Facilities — At December 31, 2011, the Company has overdraft facilities through its senior facility consisting of $12.7 million of letters of credit to

assist in the management of investments and the clearing of payment service obligations. All of these letters of credit are outstanding as of December 31,

2011. These overdraft facilities reduce amounts available under the senior facility. Fees on the letters of credit are paid in accordance with the terms of the

senior facility described in Note 9 — Debt.

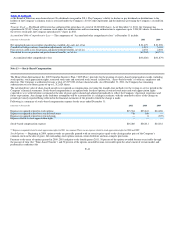

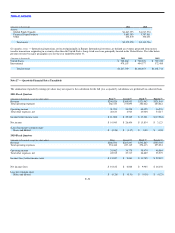

Minimum Commission Guarantees — In limited circumstances as an incentive to new or renewing agents, the Company may grant minimum commission

guarantees for a specified period of time at a contractually specified amount. Under the guarantees, the Company will pay to the agent the difference

between the contractually specified minimum commission and the actual commissions earned by the agent. Expense related to the guarantee is recognized

in the “Fee commissions expense” line in the Consolidated Statements of Income (Loss).

As of December 31, 2011, the liability for minimum commission guarantees is $1.7 million and the maximum amount that could be paid under the

minimum commission guarantees is $7.2 million over a weighted average remaining term of 3.5 years. The maximum payment is calculated as the

contractually guaranteed minimum commission times the remaining term of the contract and, therefore, assumes that the agent generates no money transfer

transactions during the remainder of its contract. However, under the terms of certain agent contracts, the Company may terminate the contract if the

projected or actual volume of transactions falls beneath a contractually specified amount. With respect to minimum commission guarantees expiring in 2011

and 2010, the Company paid $0.4 million and $0.5 million, respectively, or 34 percent and 22 percent, respectively, of the estimated maximum payment for

the year.

Other Commitments — The Company has agreements with certain co−investors to provide funds related to investments in limited partnership interests. As

of December 31, 2011, the total amount of unfunded commitments related to these agreements was $0.3 million. The amortization expense was recognized

as part of “Transaction and operations support” expense in the Consolidated Statements of Income (Loss).

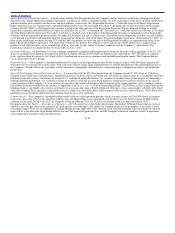

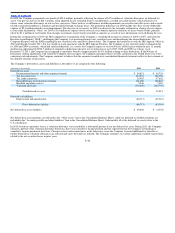

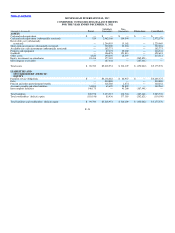

Legal Proceedings — The matters set forth below are subject to uncertainties and outcomes that are not predictable with certainty. The Company accrues

for these matters as any resulting losses become probable and can be reasonably estimated. Further, the Company maintains insurance coverage for many

claims and litigations alleged. In relation to various legal matters, including those described above, the Company had $3.0 million and $2.3 million of

liability recorded in the “Accounts payable and other liabilities” line in the Consolidated Balance Sheets as of December 31, 2011 and 2010, respectively. A

charge of $1.9 million, a net gain of $12.7 million and charges totaling $54.9 million, net of insurance recoveries, were recorded in the “Transaction and

operations support” line in the Consolidated Statements of Income (Loss) during 2011, 2010 and 2009, respectively.

Litigation Commenced Against the Company:

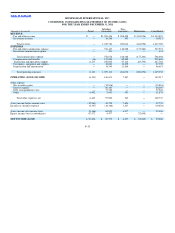

Shareholder Litigation — On April 15, 2011 a complaint was filed in the Court of Chancery of the State of Delaware by Willie R. Pittman purporting

to be a class action complaint on behalf of all shareholders and a shareholder derivative complaint against the Company, THL, Goldman Sachs and

each of the Company’s directors. Ms. Pittman alleges in her complaint that she is a stockholder of the Company and asserts, among

F−48