MoneyGram 2011 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2011 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

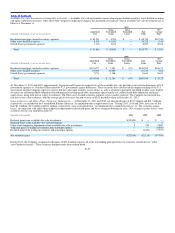

Table of Contents

Fees on the daily unused availability under the revolving credit facility are 62.5 basis points. Substantially all of the Company’s non−financial assets are

pledged as collateral for the loans under the 2011 Credit Agreement, with the collateral guaranteed by the Company’s material domestic subsidiaries. The

non−financial assets of the material domestic subsidiaries are pledged as collateral for these guarantees. As of December 31, 2011, the Company has

$137.3 million of availability under the revolving credit facility, net of $12.7 million of outstanding letters of credit that reduce the amount available. At

December 31, 2011 there are no amounts outstanding under the revolving credit facility.

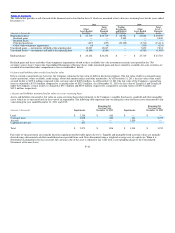

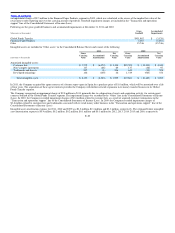

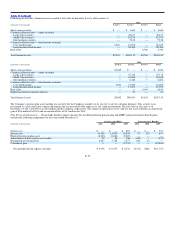

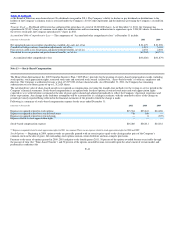

Amortization of the debt discount for 2011, 2010 and 2009 include pro−rata write−offs as a result of the term debt and the Tranche B prepayments,

respectively. Following is the debt discount amortization recorded in “Interest expense” in the Consolidated Statements of Income for the years ended

December 31:

(Amounts in thousands) 2011 2010 2009

Amortization of debt discount $330 $2,253 $2,934

Accelerated amortization of debt discount upon prepayments 127 5,902 1,851

Total amortization of discount $457 $8,155 $4,785

Second Lien Notes — As part of the Company’s recapitalization transaction in March 2008 (the “2008 Recapitalization”), Worldwide issued $500.0 million

of second lien notes to Goldman Sachs, which will mature in March 2018. The indenture governing the second lien notes was amended in March 2011 to

permit the 2011 Recapitalization. In August 2011, following the downgrade of U.S. government debt, the indenture was amended to update the definition of

highly rated investments. On November 21, 2011 the indenture was further amended to allow Worldwide the ability to redeem a portion of its Second Lien

Notes after the completion of a qualified equity offering of its common stock. On November 23, 2011, Worldwide exercised under this right and incurred a

prepayment penalty totaling $23.2 million, which is recognized in the “Debt extinguishment costs” line in the Consolidated Statements of Income (Loss).

Prior to the fifth anniversary, the Company may redeem some or all of the second lien notes at a price equal to 100 percent of the principal, plus any accrued

and unpaid interest plus a premium equal to the greater of one percent or an amount calculated by discounting the sum of (a) the redemption payment that

would be due upon the fifth anniversary plus (b) all required interest payments due through such fifth anniversary using the treasury rate plus 50 basis

points. Starting with the fifth anniversary, the Company may redeem some or all of the second lien notes at prices expressed as a percentage of the

outstanding principal amount of the second lien notes plus accrued and unpaid interest, starting at approximately 107 percent on the fifth anniversary,

decreasing to 100 percent on or after the eighth anniversary. Upon a change of control, the Company is required to make an offer to repurchase the second

lien notes at a price equal to 101 percent of the principal amount plus accrued and unpaid interest. The Company is also required to make an offer to

repurchase the second lien notes with proceeds of certain asset sales that have not been reinvested in accordance with the terms of the second lien notes or

have not been used to repay certain debt.

Inter−creditor Agreement — In connection with the above financing arrangements, both the lenders under the 2011 Credit Agreement and the trustee on

behalf of the holders of the second lien notes entered into an inter−creditor agreement under which the lenders and trustee have agreed to waive certain

rights and limit the exercise of certain remedies available to them for a limited period of time, both before and following a default under the financing

arrangements.

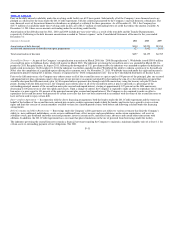

Debt Covenants and Other Restrictions — Borrowings under the Company’s debt agreements are subject to various covenants that limit the Company’s

ability to: incur additional indebtedness; create or incur additional liens; effect mergers and consolidations; make certain acquisitions; sell assets or

subsidiary stock; pay dividends and other restricted payments; invest in certain assets; and effect loans, advances and certain other transactions with

affiliates. In addition, the 2011 Credit Agreement has a covenant that places limitations on the use of proceeds from borrowings under the facility.

The indenture governing the second lien notes contains a financial covenant requiring the Company to maintain a minimum liquidity ratio of at least 1:1 for

certain assets to outstanding payment service obligations. The 2011

F−31