MoneyGram 2011 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2011 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

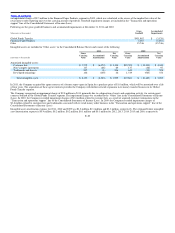

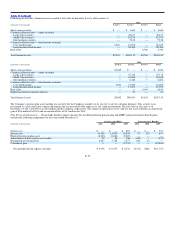

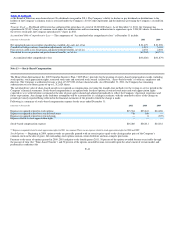

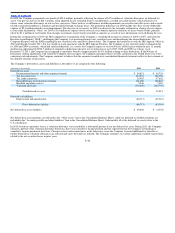

The projected benefit obligation and accumulated benefit obligation for the defined benefit pension plan, SERPs and the postretirement benefit plans are in

excess of the fair value of plan assets as shown below:

Pension Plan SERPs Postretirement Benefits

(Amounts in thousands) 2011 2010 2011 2010 2011 2010

Projected benefit obligation $160,787 $152,904 $62,812 $68,587 $ 2,035 $ 1,027

Accumulated benefit obligation 160,787 152,904 62,812 68,587 — —

Fair value of plan assets 110,142 107,136 — — — —

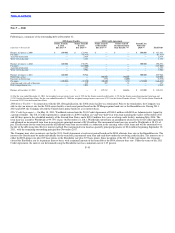

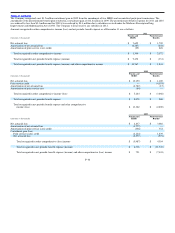

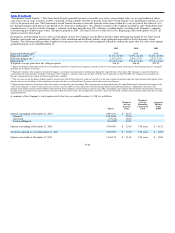

Estimated future benefit payments for the defined benefit pension plan and SERPs and the postretirement benefit plans are as follows:

(Amounts in thousands) 2012 2013 2014 2015 2016 2017−21

Pension and SERPs $14,018 $14,094 $14,166 $20,034 $14,336 $72,804

Postretirement benefits 153 166 172 161 154 577

The Company has a minimum required contribution of approximately $10.2 million for the defined benefit pension plan in 2012, and will continue to make

contributions to the SERPs and the postretirement benefit plans to the extent benefits are paid. Aggregate benefits paid for the unfunded plans are expected

to be $4.1 million in 2012.

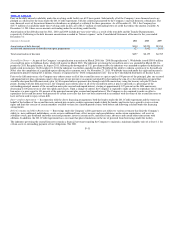

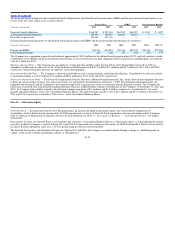

Employee Savings Plan — The Company has an employee savings plan that qualifies under Section 401(k) of the Internal Revenue Code of 1986, as

amended. Contributions to, and costs of, the 401(k) defined contribution plan totaled $3.5 million, $3.4 million and $3.7 million in 2011, 2010 and 2009,

respectively. MoneyGram does not have an employee stock ownership plan.

International Benefit Plans — The Company’s international subsidiaries have certain defined contribution benefit plans. Contributions to and costs related

to international plans were $1.2 million, $1.0 million and $0.8 million for 2011, 2010 and 2009, respectively.

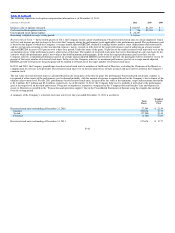

Deferred Compensation Plans — The Deferred Compensation Plan for Directors of MoneyGram International, Inc., which allowed non−employee directors

to defer all or part of their retainers, fees and stock awards, was permanently discontinued as of January 1, 2009. The deferred compensation plans are

unfunded and unsecured, and the Company is not required to physically segregate any assets in connection with the deferred accounts. The Company has

rabbi trusts associated with each deferred compensation plan which are funded through voluntary contributions by the Company. At December 31, 2011 and

2010, the Company had a liability related to the deferred compensation plans of $3.4 million and $3.8 million, respectively, recorded in the “Accounts

payable and other liabilities” line in the Consolidated Balance Sheets. The rabbi trust had a market value of $8.1 million and $10.7 million at December 31,

2011 and 2010, respectively, recorded in “Other assets” in the Consolidated Balance Sheets.

Note 11 — Mezzanine Equity

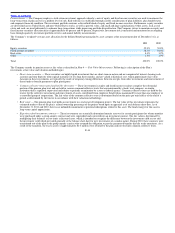

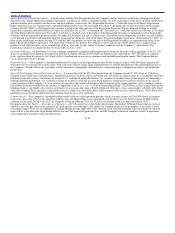

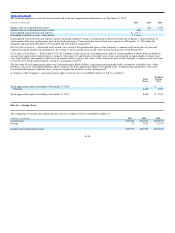

Preferred Stock — In connection with the 2011 Recapitalization, all amounts included in mezzanine equity were converted into components of

stockholders’ deficit. Following the closing of the 2011 Recapitalization, no shares of Series B Stock remained issued and outstanding and the Company

filed a Certificate of Elimination to eliminate all shares of Series B Stock. See Note 1— Description of Business — “2011 Recapitalization” for further

information.

Prior to May 18, 2011, the Series B Stock was recorded in the Company’s Consolidated Balance Sheets as “Mezzanine equity” as it had redemption features

not solely within the Company’s control. During 2011 and 2010 the transaction costs relating to the issuance of the B Stock and B−1 Stock were accreted to

the Series B Stock redemption value over a 10−year period using the effective interest method.

The Series B Stock paid a cash dividend of 10 percent. During 2011 and 2010, the Company accrued dividends through a charge to “Additional paid−in

capital” to the extent available and through a charge to “Retained loss”

F−38