MoneyGram 2011 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2011 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

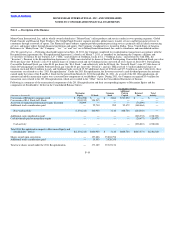

Reverse Stock Split — On November 14, 2011, the Company filed a certificate of amendment to its Amended and Restated Certificate of Incorporation to

effect a reverse stock split of the Company’s common stock at a reverse stock split ratio of 1−for−8 and to decrease the number of authorized shares of

common stock from 1,300,000,000 to 162,500,000. All share and per share amounts have been retroactively adjusted to reflect the stock split with the

exception of the Company’s treasury stock, which was not a part of the reverse stock split.

Secondary Offering — In November and December 2011, the Company completed a secondary offering (the “Secondary Offering”) pursuant to which the

Investors sold an aggregate of 10,237,524 shares in an underwritten offering. In connection with the Secondary Offering, 63,950 shares of D Stock were

converted to 7,993,762 shares of common stock. The Company did not receive proceeds from the offering and incurred transaction costs totaling $1.0

million for the year ended December 31, 2011, which are recorded in the “Other” line in the Consolidated Statement of Income.

Participation Agreement between the Investors and Wal−Mart Stores, Inc. — As previously disclosed, the Investors have a Participation Agreement with

Wal−Mart Stores, Inc. (“Wal−Mart”), under which the Investors are obligated to pay Wal−Mart certain percentages of any accumulated cash payments

received by the Investors in excess of the Investors’ original investment in the Company. While the Company is not a party to, and has no obligations to

Wal−Mart or additional obligations to the Investors under, the Participation Agreement, the Company must recognize the Participation Agreement in its

consolidated financial statements as the Company indirectly benefits from the agreement. A liability and the related expense associated with the

Participation Agreement would be recognized by the Company in the period in which it becomes probable that a liquidity event will occur that would

require the Investors to make a payment to Wal−Mart (a “liquidity event”). Upon payment by the Investors to Wal−Mart, the liability would be released

through a credit to the Company’s additional paid−in capital. The amount of the non−operating expense could be material to the Company’s financial

position or results of operations, but would have no impact on the Company’s cash flows. As liquidity events are dependent on many external factors and

uncertainties, the Company does not consider a liquidity event to be probable at this time, and has not recognized a liability or expense related to the

Participation Agreement. The additional consideration paid to the Investors in connection with the 2011 Recapitalization did not result in a liquidity event as

the amounts received by the Investors are less than their original investment in the Company.

Note 2 — Summary of Significant Accounting Policies

Basis of Presentation — The consolidated financial statements of MoneyGram are prepared in conformity with accounting principles generally accepted in

the United States of America (“GAAP”). The Consolidated Balance Sheets are unclassified due to the short−term nature of the settlement obligations,

contrasted with the ability to invest cash awaiting settlement in long−term investment securities.

Principles of Consolidation — The consolidated financial statements include the accounts of MoneyGram International, Inc. and its subsidiaries.

Intercompany profits, transactions and account balances have been eliminated in consolidation. The Company participates in various trust arrangements

(special purpose entities or “SPEs”) related to official check processing agreements with financial institutions and structured investments within the

investment portfolio.

Working in cooperation with certain financial institutions, the Company historically established separate consolidated SPEs that provided these financial

institutions with additional assurance of its ability to clear their official checks. The Company maintains control of the assets of the SPEs and receives all

investment revenue generated by the assets. The Company remains liable to satisfy the obligations of the SPEs, both contractually and by operation of the

Uniform Commercial Code, as issuer and drawer of the official checks. As the Company is the primary beneficiary and bears the primary burden of any

losses, the SPEs are consolidated in the consolidated financial statements. The assets of the SPEs are recorded in the Consolidated Balance Sheets in a

manner consistent with the assets of the Company based on the nature of the asset. Accordingly, the obligations have been recorded in the Consolidated

Balance Sheets under “Payment service obligations.” The investment revenue generated by the assets of the SPEs is allocated to the Financial Paper

Products segment in the Consolidated Statements of Income (Loss). For the years ending December 31, 2011 and 2010, the Company’s

F−11