MoneyGram 2011 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2011 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249

|

|

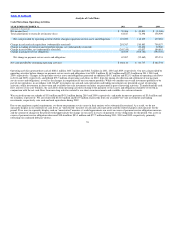

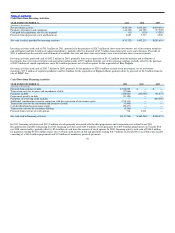

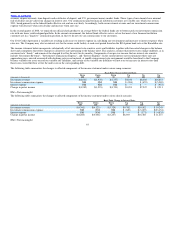

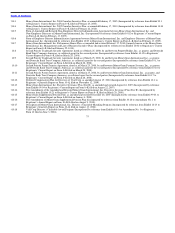

Table of Contents

Description Judgments and Uncertainties Effect if Actual Results Differ From

Assumptions

Goodwill

We perform impairment testing of our goodwill

balances annually as of November 30 and whenever

events or changes in circumstances indicate the

carrying value of our goodwill may not be

recoverable.

Goodwill impairment is determined using a two−step

process. The first step identifies if a potential

impairment exists by comparing the fair value of each

reporting unit to its carrying amount. If the fair value

exceeds the carrying amount, goodwill is not

considered to have a potential impairment and the

second step of the test is not necessary. However, if

the carrying amount exceeds the fair value, the second

step is performed to determine the implied fair value

of a reporting unit’s goodwill by comparing the

reporting unit’s fair value to the allocated fair values

of all assets and liabilities as if the reporting unit had

been acquired in a business combination. If the

carrying amount of goodwill exceeds its implied fair

value, an impairment is recognized in an amount equal

to that excess.

Fair value of a reporting unit and goodwill is

estimated using a discounted cash flow model.

The estimates and assumptions used in this

model regarding expected cash flows, growth

rates, terminal values and the discount rate

require considerable judgment and are based on

historical experience, financial forecasts and

industry trends and conditions.

Our discount rate is based on our debt and

equity balances, adjusted for current market

conditions and investor expectations of return

on our equity. In addition, an assumed terminal

value is used to project future cash flows

beyond base years. Assumptions used in our

impairment testing are consistent with our

internal forecasts and operating plans.

The carrying value of goodwill assigned to the

Global Funds Transfer reporting unit at

December 31, 2011 was $428.7 million. No

goodwill is assigned to the other reporting

units. The annual impairment test indicated a

fair value for the Global Funds Transfer

reporting unit that was substantially in excess

of the reporting unit’s carrying value.

If the discount rate for the Global Funds

Transfer reporting unit increases by 50 basis

points from the rate used in our fair value

estimate, fair value would be reduced by

approximately $177.9 million, assuming all

other components of the fair value estimate

remain unchanged. If the growth rate for the

Global Funds Transfer reporting unit

decreases by 50 basis points from the rate used

in our fair value estimate, fair value would be

reduced by approximately $35.1 million,

assuming all other components of the fair

value estimate remain unchanged.

Our estimated fair value for the Global Funds

Transfer reporting unit would continue to be

substantially in excess under either scenario.

65