MoneyGram 2011 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2011 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249

|

|

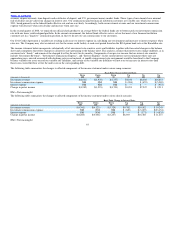

Table of Contents

minimum debt ratings of A3 (Moody’s) and A− (S&P), commercial paper with minimum ratings of A−1 (Moody’s) and P−1 (S&P) and U.S. dollar

denominated SEC registered senior notes of corporations with minimum ratings of A3 and A−. No maturity in the portfolio can exceed 24 months from the

date of purchase.

The financial institutions holding significant portions of our investment portfolio act as custodians for our asset accounts, serve as counterparties to our

foreign currency transactions and conduct cash transfers on our behalf for the purpose of clearing our payment instruments and related agent receivables and

agent payables. Through certain check clearing agreements and other contracts, we are required to utilize several of these financial institutions. As a result

of the credit market crisis, several financial institutions have faced capital and liquidity issues that led them to restrict credit exposure. This has led certain

financial institutions to require that we maintain pre−defined levels of cash, cash equivalents and investments at these financial institutions overnight, with

no restrictions to our usage of the assets during the day. While the credit market crisis and recession affected all financial institutions, those institutions

holding our assets are well capitalized, and there have been no significant concerns as to their ability to honor all obligations related to our holdings.

With respect to our credit union customers, our credit exposure is partially mitigated by National Credit Union Administration insurance. However, as our

credit union customers were not insured by a Temporary Liquidity Guarantee Program (“TLGP”) − equivalent program, we have required certain credit

union customers to provide us with larger balances on deposit and/or to issue cashier’s checks only. While the value of these assets are not at risk in a

disruption or collapse of a counterparty financial institution, the delay in accessing our assets could adversely affect our liquidity and potentially our

earnings depending upon the severity of the delay and corrective actions we may need to take. Corrective actions could include draws upon our 2011 Credit

Agreement to provide short−term liquidity until our assets are released, reimbursements of costs or payment of penalties to our agents and higher banking

fees to transition banking relationships in a short timeframe.

The concentration in U.S. government agencies includes agencies placed under conservatorship by the U.S. government in 2008 and extended unlimited

lines of credit from the U.S. Treasury. The implicit guarantee of the U.S. government and its actions to date support our belief that the U.S. government will

honor the obligations of its agencies if the agencies are unable to do so themselves.

58