MoneyGram 2011 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2011 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

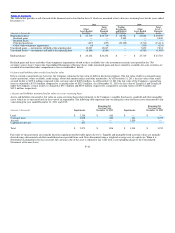

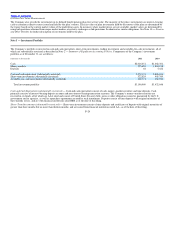

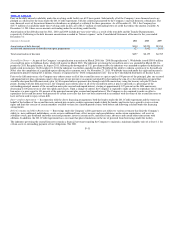

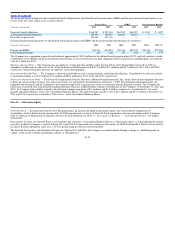

Depreciation expense for the year ended December 31 is as follows:

(Amounts in thousands) 2011 2010 2009

Computer hardware and software $21,064 $20,314 $23,351

Signage 9,616 8,688 10,891

Agent equipment 6,469 8,989 11,449

Office furniture and equipment 3,962 3,772 4,600

Leasehold improvements 3,744 3,885 3,526

Total depreciation expense $44,855 $45,648 $53,817

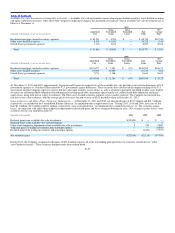

At December 31, 2011 and 2010, there was $9.9 million and $3.9 million, respectively, of property and equipment that had been received by the Company

and included in “Accounts payable and other liabilities” in the Consolidated Balance Sheets.

Following its decision to sell land in 2011, the Company recognized a $2.4 million impairment charge. During 2011, the Company also recognized a $0.7

million capitalized software impairment charge, primarily in connection with the disposition of assets in the Global Funds Transfer segment. The

impairment charges recorded in 2011 were included in the “Other” line in the Consolidated Statements of Income (Loss).

In connection with its decision to sell its corporate airplane, the Company recognized a $7.0 million impairment charge in 2009 and a $1.5 million

impairment charge in 2010. The sale was completed in the third quarter of 2010. In 2009, the Company fully impaired $1.4 million of software related to its

ACH Commerce business based on changes in its exit plan. The impairment charges recorded in 2010 and 2009 were included in the “Transaction and

operations support” line in the Consolidated Statements of Income (Loss).

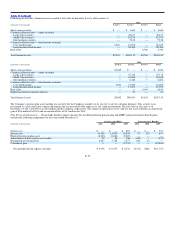

Note 8 — Goodwill and Intangible Assets

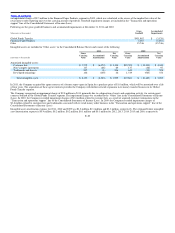

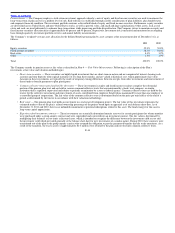

Following is a roll−forward of goodwill by reporting segment:

(Amounts in thousands) Global Funds

Transfer Financial

Paper Products Other Total

Balance as of January 1, 2009 $ 426,794 $ 2,487 $ 5,056 $434,337

Acquisitions 2,012 — — 2,012

Impairment charge (3,176) (2,487) (582) (6,245)

Divestitures — — (4,474) (4,474)

Balance as of December 31, 2009 $ 425,630 $ — $ — $425,630

Acquisitions 3,061 — — 3,061

Balance as of December 31, 2010 $ 428,691 $ — $ — $428,691

Balance as of December 31, 2011 $ 428,691 $ — $ — $428,691

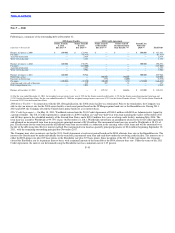

Goodwill acquired in 2010 relates to the acquisition of Blue Dolphin which is a component of the Global Funds Transfer segment and is not deductible for

tax purposes.

The Company impaired $3.2 million of goodwill in 2009 allocated to the Global Funds Transfer segment associated with a decision to discontinue certain

bill payment product offerings. In connection with the sale of FSMC in 2009, the Company recorded a charge of $0.6 million to impair goodwill that was in

excess of the final sale price. In addition, goodwill was reduced by $4.5 million from the sale of FSMC. The FSMC reporting unit was not a component of

the Global Funds Transfer or Financial Paper Products segments.

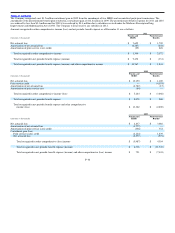

The Company performed an annual assessment of goodwill during the fourth quarters of 2011, 2010 and 2009. As a result of the 2009 annual assessment, it

was determined that the fair value of the retail money order reporting unit, a component of the Financial Paper Products segment, was fully impaired. The

Company recorded

F−28