MoneyGram 2011 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2011 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

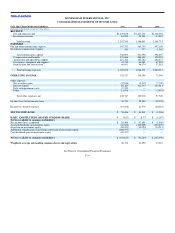

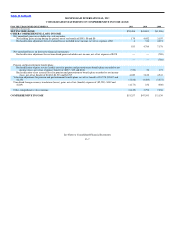

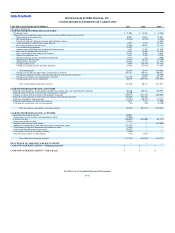

Table of Contents MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Note 1 — Description of the Business

MoneyGram International, Inc. and its wholly owned subsidiaries (“MoneyGram”) offers products and services under its two reporting segments: Global

Funds Transfer and Financial Paper Products. The Global Funds Transfer segment provides global money transfer services and bill payment services to

consumers through a network of agents. The Financial Paper Products segment provides payment processing services, primarily official check outsourcing

services, and money orders through financial institutions and agents. The Company’s headquarters is located in Dallas, Texas, United States of America.

References to “MoneyGram,” the “Company,” “we,” “us” and “our” are to MoneyGram International, Inc. and its subsidiaries and consolidated entities.

2011 Recapitalization — Following shareholder approval on May 18, 2011, the Company completed its recapitalization transaction in accordance with the

Recapitalization Agreement (the “Recapitalization Agreement”), dated as of March 7, 2011, as amended, by and among the Company, affiliates and

co−investors of Thomas H. Lee Partners, L.P. (“THL”) and affiliates of Goldman, Sachs & Co. (“Goldman Sachs,” and collectively with THL, the

“Investors”). Pursuant to the Recapitalization Agreement, (i) THL converted all of its shares of Series B Participating Convertible Preferred Stock, par value

$0.01 per share (the “B Stock”), into 35.8 million shares of common stock and (ii) Goldman Sachs converted all of its shares of Series B−1 Participating

Convertible Preferred Stock, par value $0.01 per share (the “B−1 Stock,” and collectively with the B Stock, the “Series B Stock”), into 157,686 shares of

Series D Participating Convertible Preferred Stock, par value $0.01 per share (the “D Stock”), and (iii) THL received 3.5 million additional shares of

common stock and $140.8 million in cash, and Goldman Sachs received 15,503 additional shares of D Stock and $77.5 million in cash. Collectively, these

transactions are referred to as the “2011 Recapitalization”. Under the 2011 Recapitalization, the Investors received a cash dividend payment for amounts

earned under the terms of the B and B−1 Stock for the period from March 26, 2011 through May 18, 2011. As a result of the 2011 Recapitalization, all

amounts included in mezzanine equity were converted into components of stockholders’ equity. During 2011, the Company recognized $5.4 million for

transaction costs related to the 2011 Recapitalization, which are recorded in the “Other” line in the Consolidated Statements of Income.

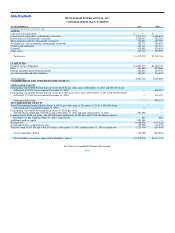

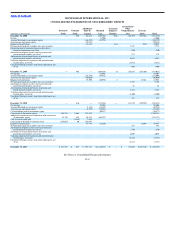

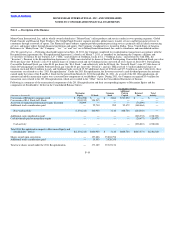

Following is a summary of the transactional components of the 2011 Recapitalization and their corresponding impacts to Mezzanine Equity and the

components of Stockholders’ Deficit in the Consolidated Balance Sheets:

Stockholders' Deficit

(Amounts in thousands) Mezzanine

Equity D Stock Common

Stock

Additional

Paid−in

Capital Retained

Loss Total

Activity

Conversion of B Stock to common stock $ (716,096) $ — $ 2,864 $713,232 $ — $ —

Conversion of B−1 Stock to D Stock (394,215) 394,215 — — — —

Accretion of unamortized mezzanine equity discounts 76,099 — — — (76,099) —

Additional stock consideration paid — 52,710 282 95,472 (148,464) —

Non−cash activity (1,034,212) 446,925 3,146 808,704 (224,563) —

Additional cash consideration paid — — — — (218,333) (218,333)

Cash dividends paid on mezzanine equity — — — — (20,477) (20,477)

Cash activity — — — — (238,810) (238,810)

Total 2011 Recapitalization impact to Mezzanine Equity and

Stockholders’ Deficit $(1,034,212) $446,925 $ 3,146 $808,704 $(463,373) $(238,810)

Shares issued upon conversion — 157,686 35,804,796

Additional stock consideration paid — 15,503 3,520,358

Total new shares issued under the 2011 Recapitalization — 173,189 39,325,154

F−10