MoneyGram 2011 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2011 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

our vendors’ systems or processes, we could suffer financial loss, loss of customers, regulatory sanctions, lawsuits and damage to our reputation. The

measures we have enacted, such as the implementation of disaster recovery plans and redundant computer systems, may not be successful. We may also

experience problems other than system failures, including software defects, development delays and installation difficulties, which would harm our business

and reputation and expose us to potential liability and increased operating expenses. In addition, any work stoppages or other labor actions by employees

who support our systems or perform any of our major functions could adversely affect our business. Certain of our agent contracts, including our contract

with Wal−Mart, contain service level standards pertaining to the operation of our system, and give the agent a right to collect damages and in extreme

situations a right of termination for system downtime exceeding agreed upon service levels. If we experience significant system interruptions or system

failures, our business interruption insurance may not be adequate to compensate us for all losses or damages that we may incur.

If we are unable to effectively operate and adapt our technology to match our business growth, our business, financial condition and results of

operations could be adversely affected.

Our ability to continue to provide our services to a growing number of agents and consumers, as well as to enhance our existing services and offer new

services, is dependent on our information technology systems. If we are unable to effectively manage the technology associated with our business, we could

experience increased costs, reductions in system availability and loss of agents or consumers. Any failure of our systems in scalability, reliability and

functionality could adversely impact our business, financial condition and results of operations.

The operation of retail locations and acquisition or start−up of businesses create risks and may adversely affect our operating results.

We operate Company−owned retail locations for the sale of our products and services. We may be subject to additional laws and regulations that are

triggered by our ownership of retail locations and our employment of individuals who staff our retail locations. There are also certain risks inherent in

operating any retail location, including theft, personal injury and property damage and long−term lease obligations.

We may, from time to time, acquire or start up businesses both inside and outside of the United States. The acquisition and integration of businesses involve

a number of risks. We may not be able to successfully integrate businesses that we acquire or open, including their facilities, personnel, financial systems,

distribution, operations and general operating procedures. If we fail to successfully integrate acquisitions or start−up businesses, we could experience

increased costs and other operating inefficiencies, which could have an adverse effect on our results of operations. The diversion of capital and

management’s attention from our core business that results from acquiring or opening new businesses could adversely affect our business, financial

condition and results of operations.

Concerns regarding the European debt crisis and market perceptions concerning the instability of the euro, the potential re−introduction of individual

currencies within the Eurozone, or the potential dissolution of the euro entirely, could adversely affect our business, results of operations and financing.

As a result of the debt crisis with respect to countries in Europe, in particular most recently in Greece, Italy, Ireland, Portugal and Spain, the European

Commission created the European Financial Stability Facility, or the EFSF, and the European Financial Stability Mechanism, or the EFSM, to provide

funding to countries using the euro as their currency, or the Eurozone, that are in financial difficulty and seek such support. In March 2011, the European

Council agreed on the need for Eurozone countries to establish a permanent financial stability mechanism, the European Stability Mechanism, which will be

activated by mutual agreement, to assume the role of the EFSF and the EFSM in providing external financial assistance to Eurozone countries after June

2013. Despite these measures, concerns persist regarding the debt burden of certain Eurozone countries and their ability to meet future financial obligations,

the overall stability of the euro and the suitability of the euro as a single currency given the diverse economic and political circumstances in individual

Eurozone countries.

These concerns could lead to the re−introduction of individual currencies in one or more Eurozone countries, or, in more extreme circumstances, the

possible dissolution of the euro currency entirely. Should the euro dissolve

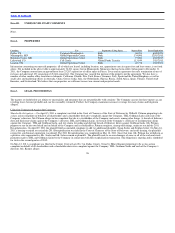

23