MoneyGram 2011 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2011 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

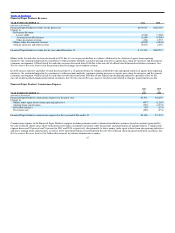

Mezzanine Equity and Stockholders’ Deficit

Mezzanine Equity — See Note 11 — Mezzanine Equity of the Notes to the Consolidated Financial Statements for information regarding the mezzanine

equity.

Stockholders’ Deficit — The Company is authorized to repurchase up to 12,000,000 shares. As of December 31, 2011, we had repurchased a total of

6,795,017 shares of our common stock under this authorization and have remaining authorization to purchase up to 5,204,983 shares.

Under the terms of our outstanding credit facilities, we are limited in our ability to pay dividends on our common stock. No dividends were paid on our

common stock in 2011 and we do not anticipate declaring any dividends on our common stock during 2012.

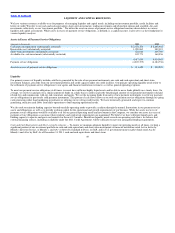

Off−Balance Sheet Arrangements

None.

Enterprise Risk Management

Risk is an inherent part of any business. Our most prominent risk exposures are credit, interest rate, foreign currency exchange and operational risk. See

Part 1, Item 1A “Risk Factors” for a description of the principal risks to our business. Appropriately managing risk is important to the success of our

business, and the extent to which we effectively manage each of the various types of risk is critical to our financial condition and profitability. Our risk

management objective is to monitor and control risk exposures to produce steady earnings growth and long−term economic value.

Management implements policies approved by our Board of Directors that cover our investment, capital, credit and foreign currency practices and

strategies. The Board receives periodic reports regarding each of these areas and approves significant changes to policy and strategy. An Asset/Liability

Committee, composed of senior management, routinely reviews investment and risk management strategies and results. A Credit Committee, composed of

senior management, routinely reviews credit exposure to our agents.

Following is a discussion of the risks we have deemed most critical to our business and the strategies we use to manage and mitigate such risks. While

containing forward−looking statements related to risks and uncertainties, this discussion and related analyses are not predictions of future events.

MoneyGram’s actual results could differ materially from those anticipated due to various factors discussed under “Cautionary Statements Regarding

Forward−Looking Statements” and under “Risk Factors” in Part 1, Item 1A of this Annual Report on Form 10−K.

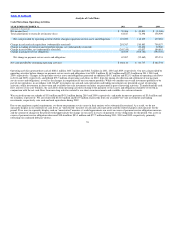

Credit Risk

Credit risk, or the potential risk that we may not collect amounts owed to us, affects our business primarily through receivables, investments and derivative

financial instruments. In addition, the concentration of our cash, cash equivalents and investments at large financial institutions exposes us to credit risk.

Investment Portfolio — Credit risk from our investment portfolio relates to the risk that we may be unable to collect the interest or principal owed to us

under the legal terms of the various securities. Our primary exposure to credit risk arises through the concentration of a large amount of our investment

portfolio at a few large financial institutions, also referred to as financial institution risk, as well as a concentration in securities issued by, or collateralized

by, U.S. government agencies.

At December 31, 2011, the Company’s investment portfolio of $3.2 billion was primarily comprised of cash, U.S. government money market funds, bank

deposits and bank time deposits. Based on investment policy restrictions in the Company’s second lien note indenture, investments are limited to U.S.

Government Securities and securities of agencies of the U.S. Government, certificates of deposit and time deposits with banks with

57