MoneyGram 2011 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2011 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

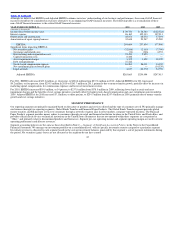

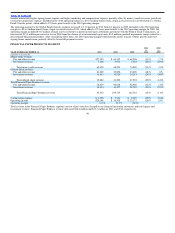

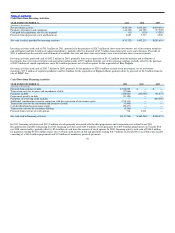

Credit Facilities — Our credit facilities consist of the 2011 Credit Agreement and Second Lien Notes. See Note 9 — Debt of the Notes to the Consolidated

Financial Statements for further information. Following is a summary of principal payments and debt issuance from January 1, 2009 to December 31, 2011:

2008 Senior Facility 2011 Credit Agreement

(Amounts in thousands) Tranche A Tranche B Revolving facility Term loan Incremental term loan Second Lien Notes Total Debt

Balance at January 1, 2009 $ 100,000 $ 248,125 $ 145,000 $ — $ — $ 500,000 $ 993,125

2009 payments — (41,875) (145,000) — — — (186,875)

2010 payments — (165,000) — — — — (165,000)

2011 new debt issued — — — 390,000 150,000 — 540,000

2011 payments (100,000) (41,250) — (50,000) (375) (175,000) (366,625)

Balance at December 31, 2011 $ — $ — $ — $340,000 $ 149,625 $ 325,000 $ 814,625

Outside of payments relating to refinance debt, we have paid down $427.3 million of our outstanding debt since January 1, 2009. We continue to evaluate

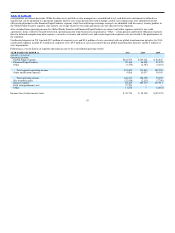

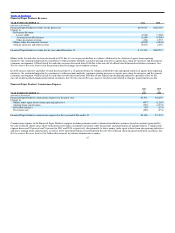

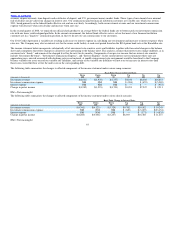

further reductions of our outstanding debt ahead of scheduled maturities. Following is a summary of our outstanding debt at December 31:

Original

Interest Rate Facility Outstanding 2012

(Amounts in thousands) for 2011 Size 2011 2010 Interest (1)

Senior Tranche A Loan, due 2013 5.75% $ — $ — $100,000 $ —

Senior Tranche B, net of discount, due 2013 7.25% — — 39,946 —

Senior revolving credit facility, due 2013 5.75% — — — —

2008 Credit Agreement — — 139,946 —

Senior secured credit facility, net of discount, due 2017 4.52% 390,000 339,232 — 15,555

Senior secured incremental term loan, net of discount, due 2017 4.50% 150,000 146,656 — 6,820

Senior revolving credit facility, due 2016 — 150,000 — — —

2011 Credit Agreement 690,000 485,888 — 22,375

Second lien notes, due 2018 13.25% 500,000 325,000 500,000 43,063

Total debt $1,190,000 $810,888 $639,946 $ 65,438

(1) Reflects interest expected to be paid in 2012 using the rates in effect on December 31, 2011, assuming no prepayments of principal.

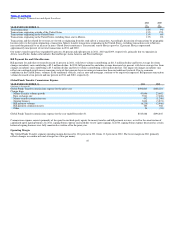

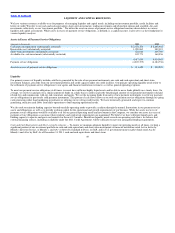

Our revolving credit facility has $137.3 million of borrowing capacity as of December 31, 2011, net of $12.7 million of outstanding letters of credit. The

incremental term loan has quarterly principal payments of $0.4 million beginning September 30, 2011, with the remaining outstanding principal due

November 2017. At each reset period, we may elect an interest rate for the 2011 Credit Agreement, based on the BOA prime rate plus 225 basis points or

the Eurodollar rate plus 325 basis points. If the Eurodollar rate is elected, there is a minimum rate of 1.25 percent. Fees on the daily unused availability

under the revolving credit facility are 62.5 basis points. Since inception of the 2011 Credit Agreement and through the date of this filing, the Company

elected the Eurodollar rate as its primary interest basis, with a minimal amount of the term debt at the BOA prime rate. Our 2011 Credit Agreement has a

provision to step down our applicable borrowing margin by .25 percent if our leverage ratio falls below 3.0.

Our 2011 Credit Agreement contains various financial and non−financial covenants. A violation of these covenants could negatively impact our liquidity by

restricting our ability to borrow under the revolving credit

51