MoneyGram 2011 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2011 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

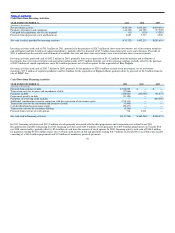

Description Judgments and Uncertainties Effect if Actual Results Differ From

Assumptions

Pension

Through our qualified pension plan and various

supplemental executive retirement plans, collectively

referred to as our “pension” plans, we provide defined

benefit pension plan coverage to certain of our

employees and employees of Viad Corp, our former

parent. Our pension obligations under these plans are

measured as of December 31, or the measurement

date. Pension benefit obligations and the related

expense are based upon actuarial projections using

assumptions regarding mortality, discount rates,

long−term return on assets and other factors.

Our pension plan assets are primarily invested in

interest−bearing cash accounts and commingled trust

funds issued or sponsored by the plan trustee. Our

investments are periodically realigned in accordance

with the investment guidelines.

Our assumptions reflect our historical

experience and management’s best judgment

regarding future expectations. Certain of the

assumptions, particularly the discount rate and

expected return on plan assets, require

significant judgment and could have a material

impact on the measurement of our pension

obligation.

At each measurement date, the discount rate is

based on the then current interest rate yield

curves for long−term corporate debt securities

with maturities rate AA comparable to our

obligations.

The expected return on pension plan assets is

based on our historical market experience, our

pension asset allocations and our expectations

for long−term rates of return. We also consider

peer data and historical returns to assess the

reasonableness and appropriateness of our

assumption. Our pension plan asset allocations

are reviewed annually and are based upon plan

obligations, an evaluation of market conditions,

tolerance for risk and cash requirements for

benefit payments.

The discount rates for the 2011, 2010 and

2009 net periodic benefit cost pension

plans and SERPs were 5.30 percent, 5.80

percent and 6.30 percent, respectively. The

discount rate for the projected benefit

obligation for the pension plan for 2011

and 2010 was 4.90 percent and 5.30

percent, respectively, while the discount

rate for the SERPs was 4.80 percent and

5.30 percent, respectively.

The long−term expected rate of return for

the 2011, 2010 and 2009 net periodic

benefit cost for the pension plan was eight

percent. The actual rate of return on

average plan assets in 2011 and 2010 was

4.14 percent and 4.80 percent.

Lower discount rates increase the plan

obligation and subsequent year pension

expense, while higher discount rates

decrease the plan obligation and

subsequent year pension expense.

Decreasing the discount rate by 50 basis

points would have increased 2011 pension

expense by $0.4 million. If the discount

rate increased by 50 basis points pension

expense would have decreased by $0.3

million. Changing the expected rate of

return by 50 basis points would have

increased/decreased 2011 pension expense

by $0.5 million.

66