MoneyGram 2011 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2011 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

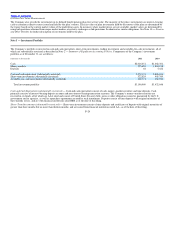

Table of Contents

measurement principles, clarifies the application of existing fair value measurement and expands the ASC 820 disclosure requirements, particularly for

Level 3 fair value measurements. ASU 2011−04 will be effective for the Company’s interim and annual periods beginning after December 15, 2011, with

early adoption prohibited. The Company is currently evaluating the adoption of ASU 2011−04, but does not expect it to have a material effect on the

Company’s Consolidated Financial Statements, although additional disclosures may be required.

In June 2011, the FASB issued ASU No. 2011−05, Comprehensive Income (ASC Topic 220): Presentation of Comprehensive Income, (“ASU 2011−05”) to

amend financial statement presentation guidance for other comprehensive income (“OCI”). Under ASU 2011−05, the statement of income and OCI can be

presented either as a continuous statement or in two separate consecutive statements. As such, the option to present the components of other comprehensive

income as part of the statement of stockholders’ equity is eliminated. The amendments in ASU 2011−05 do not change the items that must be reported in

other comprehensive income or when an item of other comprehensive income must be reclassified to net income. ASU 2011−05 will be effective for the

Company as of January 1, 2012. The Company is currently evaluating the impact of this standard on the presentation of its Consolidated Financial

Statements.

In September 2011, the FASB issued ASU No. 2011−08, Testing Goodwill for Impairment (“ASU 2011−08”). ASU 2011−08 provides entities an option of

assessing qualitative factors when testing goodwill for impairment before calculating the fair value of a reporting unit in step 1 of the goodwill impairment

test. If an entity determines that the fair value of a reporting unit is more likely than not less than its carrying value, then performing the two step

impairment test is required after performing a qualitative assessment. Otherwise, the two step impairment test is not necessary. ASU 2011−08 is effective

for the Company as of January 1, 2012, with early adoption permitted. The Company is currently evaluating the impact of this standard on its annual

goodwill impairment test, but does not expect any impact to the Company’s Consolidated Financial Statements.

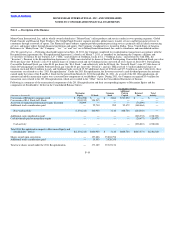

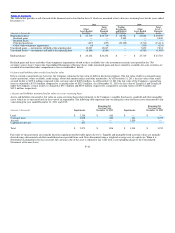

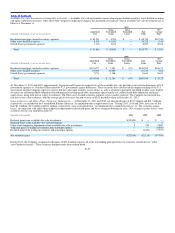

Note 3 — Acquisitions and Disposals

PropertyBridge — After evaluating the Company’s market opportunity for certain of its electronic payment services, the Company received approval from

its Board of Directors and began to actively pursue the sale of certain assets of PropertyBridge, Inc. (“PropertyBridge”) in 2011. In connection with this

decision, the Company recorded an impairment charge of $2.3 million. In October 2011, certain assets and liabilities associated with PropertyBridge were

sold, resulting in a loss on disposal of $0.3 million. The impairment charge and loss on disposal are recorded in the “Other” line in the Consolidated

Statements of Income (Loss). A tax benefit of $9.7 million was recorded in the income tax (benefit) expense line of the Consolidated Statements of Income

(loss) upon disposition of the remaining assets.

The assets, liabilities and loss on disposal related to the PropertyBridge transaction are immaterial to the Consolidated Balance Sheets as of December 31,

2011 and the Consolidated Statements of Income (Loss) for the year ended December 31, 2011.

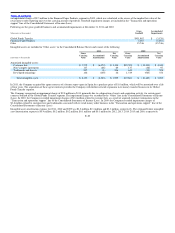

Blue Dolphin Financial Services N.V. — On February 5, 2010, the Company acquired Blue Dolphin Financial Services N.V. (“Blue Dolphin”), a former

super−agent in Belgium and the Netherlands, for a purchase price of $1.4 million, including cash acquired of $1.1 million, and an earn−out potential of up

to $1.4 million. The acquisition of Blue Dolphin provided the Company with the opportunity for further network expansion in the Netherlands and Belgium

under the European Union Payment Services Directive and additional control over sales and marketing activities.

The Company finalized its purchase price allocation in 2010, resulting in $3.1 million of goodwill assigned to the Company’s Global Funds Transfer

segment, and the forgiveness of $2.7 million of liabilities. The final earn−out was calculated as of December 31, 2010 in the amount of $0.8 million. As a

result, the Company recorded a gain of $0.2 million in the “Transaction and operations support” line in the Consolidated Statements of Income (Loss). The

Company also incurred $0.1 million of transaction costs related to the acquisition in 2010, which are included in the “Transaction and operations support”

line in the Consolidated Statements of Income (Loss).

F−19