MoneyGram 2011 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2011 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

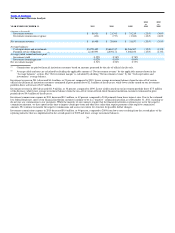

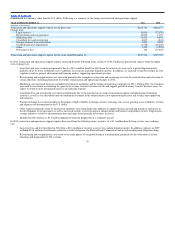

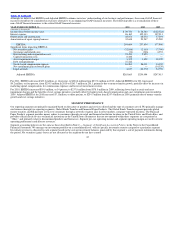

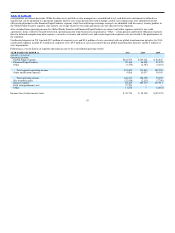

Following is a summary of our operating results in 2011:

• Total fee and other revenue increased in 2011 due to an increase in money transfer fee and other revenue, partially offset by lower revenue from bill

payment products and the Financial Paper Products segment and the impact of certain businesses and products that were discontinued in 2010.

Volume growth of 14 percent and the higher euro exchange rate drove the increase in money transfer fee and other revenue, partially offset by lower

average money transfer fees per transaction, corridor mix and the $50 price band. See further discussion under Fee and Other Revenue and

Commissions Expense.

• Investment revenue decreased in 2011 due to a decline in average investment balances and lower yields earned on our investment portfolio.

• Total commissions expense increased in 2011 due to money transfer volume growth, the higher euro exchange rate and signing bonus amortization,

partially offset by lower volumes from bill payment products.

• Total operating expenses increased in 2011 due to higher commissions expense, $15.2 million of incremental restructuring and reorganization costs,

investments in marketing and higher legal and compensation costs. Legal costs in 2010 benefited from a $16.4 million reversal of a patent litigation

settlement.

• During 2011, the Company recognized $32.8 million of settlements equal to all outstanding principal from two securities. These securities had

previously been written down to a nominal fair value.

• Interest expense decreased 16 percent to $86.2 million in 2011 from $102.1 million in 2010, reflecting lower interest rates from refinancing activity,

partially offset by higher outstanding debt balances.

• We had an income tax benefit of $19.6 million on pre−tax income of $39.8 million in 2011, primarily reflecting the release of $34.0 million of

valuation allowances on U.S. deferred tax assets related to historical net securities losses and a $9.7 million benefit from the disposition of a business.

• The increase in the euro exchange rate increased total revenue by $16.5 million and total expenses by $12.7 million, for a net increase to our income

before income taxes of $3.8 million.

Following is a summary of significant actions taken by the Company and economic conditions during the year that impacted our operating results, liquidity

and capital structure in 2011:

Capital Transactions — Following shareholder approval on May 18, 2011, the Company completed the 2011 Recapitalization with THL and Goldman

Sachs. As a result of the recapitalization, (i) THL converted all of its shares of the B Stock into 35.8 million shares of common stock and (ii) Goldman

Sachs converted all of its shares of the B−1 Stock into 157,686 shares of D Stock, and (iii) THL received 3.5 million additional shares of common stock and

$140.8 million in cash, and Goldman Sachs received 15,503 additional shares of D Stock and $77.5 million in cash. Under the 2011 Recapitalization, the

Investors received a cash dividend payment for amounts earned under the terms of the B and B−1 Stock for the period from March 26, 2011 through

May 18, 2011. During the year ended December 31, 2011, the Company recognized expense of $5.4 million for transaction costs related to the 2011

Recapitalization, which are recorded in the “Other” line in the Consolidated Statements of Income.

On November 14, 2011, the Company effected a reverse stock split of the Company’s common stock at a ratio of 1−for−8 and decreased the number of

authorized shares of common stock from 1,300,000,000 to 162,500,000. All share and per share amounts have been retroactively adjusted to reflect the

stock split with the exception of the Company’s treasury stock, which was not a part of the reverse stock split.

In November and December 2011, the Company completed a secondary offering pursuant to which the Investors sold an aggregate of 10,237,524 shares in

an underwritten offering. In connection with the secondary offering, 63,950 shares of D Stock were converted to 7,993,762 shares of common stock. The

Company did not receive proceeds from the offering and incurred transaction costs totaling $1.0 million for the year ended December 31, 2011, which are

recorded in the “Other” line in the Consolidated Statement of Income.

33