MoneyGram 2011 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2011 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents CRITICAL ACCOUNTING POLICIES

The preparation of financial statements in conformity with GAAP requires estimates and assumptions that affect the reported amounts and related

disclosures in the consolidated financial statements. Actual results could differ from those estimates. On a regular basis, management reviews its accounting

policies, assumptions and estimates to ensure that our financial statements are presented fairly and in accordance with GAAP. Our significant accounting

policies are discussed in Note 2 — Summary of Significant Accounting Policies of the Notes to Consolidated Financial Statements.

Critical accounting policies are those policies that management believes are very important to the portrayal of our financial position and results of

operations, and that require management to make estimates that are difficult, subjective or complex. Based on these criteria, management has identified and

discussed with the Audit Committee the following critical accounting policies and estimates, including the methodology and disclosures related to those

estimates.

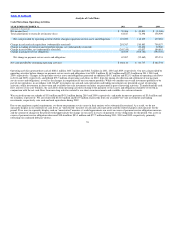

Description Judgments and Uncertainties Effect if Actual Results Differ From

Assumptions

Fair Value of Investment Securities

The Company has available−for−sale investments that

are recorded at their estimated fair value. Our

available−for−sale investments are comprised

primarily of U.S. government agency debenture

securities and residential mortgage−backed securities

collateralized by U.S. government agency debenture

securities. In addition, we hold other asset−backed

securities and have historically held three trading

investments.

We estimate fair value for our investments as an “exit

price,” or the exchange price that would be received

for an asset in an orderly transaction between market

participants. Observable price quotes for our exact

securities are not available. For our government

agency debentures and residential mortgage−backed

securities, similar securities trade with sufficient

regularity to allow observation of market inputs

needed to estimate fair value. For our other

asset−backed securities, the overall liquidity and

trading within the relevant markets is not strong.

Accordingly, observable market inputs are not as

readily available and estimating fair value is more

subjective.

The degree of management judgment involved

in determining the fair value of an investment is

dependent upon the availability of quoted

market prices, observable market inputs and the

extent to which the relevant investment markets

are active.

The use of different market assumptions or

valuation methodologies may have a material

effect on the estimated fair value amounts. Due

to the subjective nature of these assumptions,

the estimates determined may not be indicative

of the actual exit price if the investment was

sold at the measurement date. In the current

market, the most subjective assumptions include

the default rate of collateral securities, loss

severity and risk premiums as it relates to our

other asset−backed securities.

As of December 31, 2011, we hold

investments classified as other asset−backed

securities with a fair value of $24.2 million.

Using the highest and lowest prices received

or internally estimated during the valuation

process, the range of fair value for these

securities was $23.5 million to $28.1 million.

At December 31, 2011, $18.8 million, or less

than one percent, of our total investment

portfolio was valued using internal pricing

information. No third party price was able to

be obtained for these securities.

64