MoneyGram 2011 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2011 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

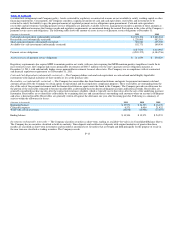

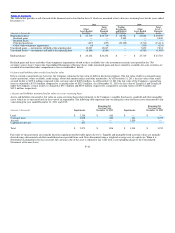

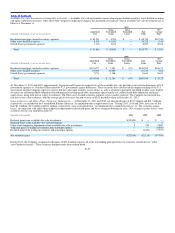

The table below provides a roll−forward of the financial assets classified in Level 3 which are measured at fair value on a recurring basis for the years ended

December 31:

2011 2010

Total Trading Total

Other Level 3 Investments Other Level 3

Asset−Backed Financial and Related Asset−Backed Financial

(Amounts in thousands) Securities Assets Put Options Securities Assets

Beginning balance $ 23,710 $23,710 $ 26,951 $ 22,088 $ 49,039

Realized gains — — 2,449 — 2,449

Realized losses — — — — —

Principal paydowns (657) (657) (29,400) (3,711) (33,111)

Other−than−temporary impairments (4) (4) — (334) (334)

Unrealized gains — instruments still held at the reporting date 10,047 10,047 — 7,632 7,632

Unrealized losses — instruments still held at the reporting date (8,864) (8,864) — (1,965) (1,965)

Ending balance $ 24,232 $24,232 $ — $ 23,710 $ 23,710

Realized gains and losses and other−than−temporary impairments related to these available−for−sale investment securities are reported in the “Net

securities (gains) losses” line in the Consolidated Statements of Income (Loss) while unrealized gains and losses related to available−for−sale securities are

recorded in accumulated other comprehensive loss in stockholders’ deficit.

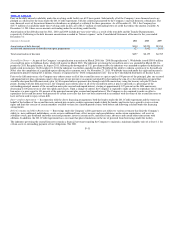

b) Assets and liabilities that are disclosed at fair value

Debt is carried at amortized cost; however, the Company estimates the fair value of debt for disclosure purposes. The fair value of debt is estimated using

market quotations, where available, credit ratings, observable market indices and other market data. As of December 31, 2011, the fair value of the senior

secured facility is $479.8 million compared to the carrying value of $489.6 million. As of December 31, 2011 the fair value of the Company’s second lien

notes is estimated at $335.6 million compared to a carrying value of $325.0 million. As of December 31, 2010, the fair value of Tranche A and Tranche B

under the Company’s senior facility is estimated at $95.3 million and $40.0 million, respectively, compared to carrying values of $100.0 million and

$39.9 million, respectively.

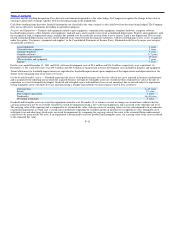

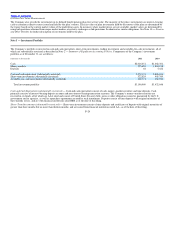

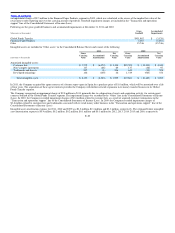

c) Assets and liabilities measured at fair value on a non−recurring basis

Assets and liabilities measured at fair value on a non−recurring basis relate primarily to the Company’s tangible fixed assets, goodwill and other intangible

assets which are re−measured only in the event of an impairment. The following table represents non−recurring fair value for those assets remeasured to fair

value during the year ended December 31, 2011 and 2010:

(Amounts in thousands) Impairments

Remaining Net

Carrying Value

December 31, 2011 Impairments

Remaining Net

Carrying Value

December 31, 2010

Land $ 2,356 $ 410 $ — $ —

Customer Lists 2,038 486 414 3,235

Aircraft — — 1,500 —

Capitalized software 677 — — —

Total $ 5,071 $ 896 $ 1,914 $ 3,235

Fair value re−measurements are normally based on significant unobservable inputs (Level 3). Tangible and intangible fixed asset fair values are normally

derived using a discounted cash flow model based on expected future cash flows discounted using a weighted−average cost of capital rate. When it is

determined an impairment loss has occurred, the carrying value of the asset is reduced to fair value with a corresponding charge to the Consolidated

Statements of Income (Loss).

F−23