MoneyGram 2011 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2011 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

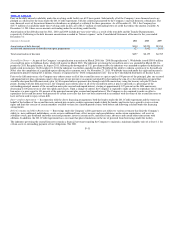

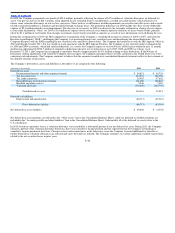

Equity Registration Rights Agreement — In connection with the 2008 Recapitalization, the Company and the Investors entered into a Registration Rights

Agreement (the “Equity Registration Rights Agreement”) on March 25, 2008, as amended on May 18, 2011, with respect to the Series B Stock and D Stock,

and the common stock owned by the Investors and their affiliates (collectively, the “Registrable Securities”). Under the terms of the Equity Registration

Rights Agreement, we are required, after a specified holding period, to use our reasonable best efforts to promptly file with the Securities and Exchange

Commission (the “SEC”) a shelf registration statement relating to the offer and sale of the Registrable Securities. We are obligated to keep such shelf

registration statement continuously effective under the Securities Act of 1933, as amended (the “Securities Act”), until the earlier of (1) the date as of which

all of the Registrable Securities have been sold, (2) the date as of which each of the holders of the Registrable Securities is permitted to sell its Registrable

Securities without registration pursuant to Rule 144 under the Securities Act and (3) fifteen years. The holders of the Registrable Securities are also entitled

to six demand registrations and unlimited piggyback registrations during the term of the Equity Registration Rights Agreement. On December 14, 2010, we

filed a shelf registration statement on Form S−3 with the SEC that permits the offer and sale of the Registrable Securities, as required by the terms of the

Equity Registration Rights Agreement. The registration statement also permits the Company to offer and sell up to $500 million of its common stock,

preferred stock, debt securities or any combination of these, from time to time, subject to market conditions and the Company’s capital needs. The

registration statement was declared effective by the SEC on July 7, 2011.

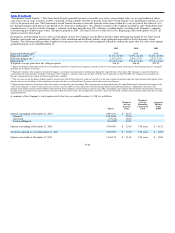

Secondary Offering — In November 2011, the Company completed a secondary offering pursuant to which the Investors sold an aggregate of 10,237,524

shares in an underwritten offering. In connection with the secondary offering, 63,950 shares of D Stock were converted to 7,993,762 shares of common

stock, which resulted in a decrease to D Stock of $165.0 million and an increase to common stock and additional paid in capital. The Company did not

receive proceeds from the offering.

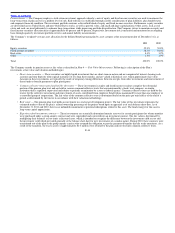

Preferred Stock — The Company’s Amended and Restated Certificate of Incorporation provides for the issuance of up to 7,000,000 shares of preferred

stock that may be issued in one or more series, with each series to have certain rights and preferences as shall be determined in the unlimited discretion of

the Company’s Board of Directors, including, without limitation, voting rights, dividend rights, conversion rights, redemption privileges and liquidation

preferences.

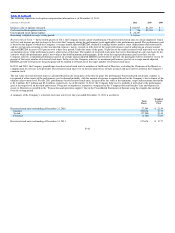

Series D Participating Convertible Preferred Stock — In connection with the 2011 Recapitalization, the Company issued 173,189 shares of D Stock to

Goldman Sachs. Each share of D Stock has a liquidation preference of $0.01 and is convertible into 125 shares of common stock by a stockholder other than

Goldman Sachs who receives such shares by means of (i) a widespread public distribution, (ii) a transfer to an underwriter for the purpose of conducting a

widespread public distribution, (iii) a transfer in which no transferee (or group of associated transferees) would receive 2 percent or more of any class of

voting securities of the Company, or (iv) a transfer to a transferee that would control more than 50 percent of the voting securities of the Company without

any transfer from such transferor or its affiliates as applicable (each of (i) — (iv), a “Widely Dispersed Offering”). The D Stock is non−voting while held by

Goldman Sachs or any holder who receives such shares by any means other than a Widely Dispersed Offering (a “non−voting holder”). Holders of D Stock

other than Goldman Sachs and non−voting holders vote as a single class with the holders of the common stock on an as−converted basis. The D Stock also

participates in any dividends declared on the common stock on an as−converted basis.

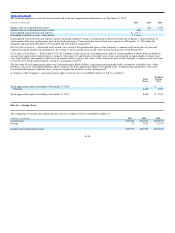

Common Stock — The Company’s Amended and Restated Certificate of Incorporation provides for the issuance of up to 162,500,000 shares of common

stock with a par value of $0.01. In connection with the spin−off, MoneyGram was recapitalized such that there were 15,388,120 shares of MoneyGram

common stock issued. On May 18, 2011, the Company issued an additional 39,325,154 shares of common stock in connection with the 2011

Recapitalization. See Note 1 — Description of Business — 2011 Recapitalization for further information. The holders of MoneyGram common stock are

entitled to one vote per share on all matters to be voted upon by its stockholders. The holders of common stock have no preemptive, conversion or other

subscription rights. There are no redemption or sinking fund provisions applicable to the common stock. The determination to pay dividends on common

stock will be at the discretion of the Board of Directors and will depend on applicable laws and the Company’s financial condition, results of operations,

cash requirements, prospects and such other factors

F−40