MoneyGram 2011 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2011 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

as the Board of Directors may deem relevant. No dividends were paid in 2011. The Company’s ability to declare or pay dividends or distributions to the

holders of the Company’s common stock is restricted under the Company’s 2011 Credit Agreement and the indenture governing the Company’s second lien

notes.

Treasury Stock — The Board of Directors has authorized the repurchase of a total of 12,000,000 shares. As of December 31, 2011, the Company has

repurchased 6,795,017 shares of common stock under this authorization and has remaining authorization to repurchase up to 5,204,983 shares. In relation to

the reverse stock split, the Company repurchased 17 shares in 2011.

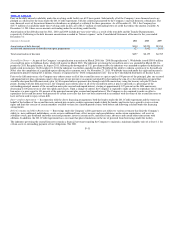

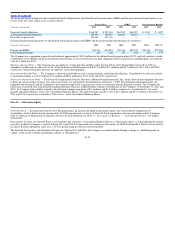

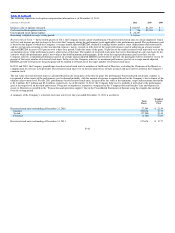

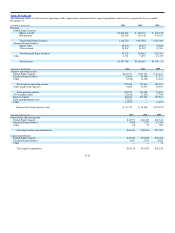

Accumulated Other Comprehensive Loss — The components of “Accumulated other comprehensive loss” at December 31 include:

(Amounts in thousands) 2011 2010

Net unrealized gains on securities classified as available−for−sale, net of tax $ 21,479 $ 21,296

Cumulative foreign currency translation adjustments, net of tax 1,021 5,194

Prior service credit (cost) for pension and postretirement benefits, net of tax 2,034 2,404

Unrealized losses on pension and postretirement benefits, net of tax (62,562) (60,773)

Accumulated other comprehensive loss $(38,028) $(31,879)

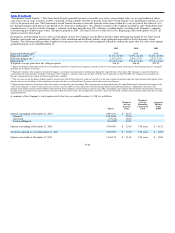

Note 13 — Stock−Based Compensation

The MoneyGram International, Inc. 2005 Omnibus Incentive Plan (“2005 Plan”) provides for the granting of equity−based compensation awards, including

stock options, stock appreciation rights, restricted stock units and restricted stock awards (collectively, “share−based awards”) to officers, employees and

directors. The Company is authorized to issue a total of 5,875,000 of share−based awards. As of December 31, 2011, the Company has remaining

authorization to issue future grants of up to 1,312,624 shares.

The calculated fair value of share−based awards is recognized as compensation cost using the straight−line method over the vesting or service period in the

Company’s financial statements. Stock−based compensation is recognized only for those options, restricted stock units and stock appreciation rights

expected to vest, with forfeitures estimated at the date of grant and evaluated and adjusted periodically to reflect the Company’s historical experience and

future expectations. Any change in the forfeiture assumption will be accounted for as a change in estimate, with the cumulative effect of the change on

periods previously reported being reflected in the financial statements of the period in which the change is made.

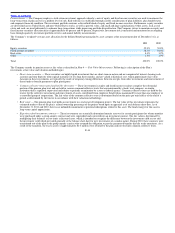

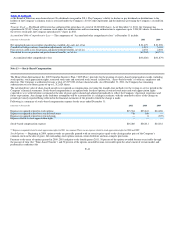

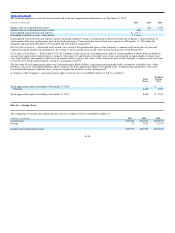

Following is a summary of stock−based compensation expense for the years ended December 31:

(Amounts in thousands) 2011 2010 2009

Expense recognized related to stock options $15,564 $25,643 $14,488

Expense recognized related to restricted stock units 716 360 —

Expense recognized related to restricted stock — 8 (307)

Expense related to stock appreciation rights (1) ———

Stock−based compensation expense $16,280 $26,011 $14,181

(1) Expense recognized related to stock appreciation rights for 2011 was nominal. There was no expense related to stock appreciation rights for 2010 and 2009.

Stock Options — Beginning in 2009, option awards are generally granted with an exercise price equal to the closing market price of the Company’s

common stock on the date of grant. All outstanding stock options contain certain forfeiture and non−compete provisions.

Pursuant to the terms of options granted in 2009, 2010 and prior to the fourth quarter 2011, 50 percent of the options awarded become exercisable through

the passage of time (the “Time−based Tranche”) and 50 percent of the options awarded become exercisable upon the achievement of certain market and

performance conditions (the

F−41