MoneyGram 2011 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2011 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

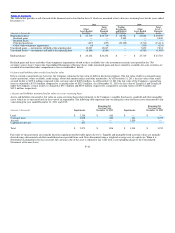

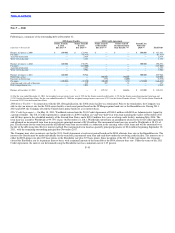

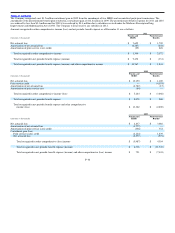

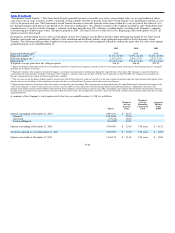

Credit Agreement also has quarterly financial covenants to maintain the following interest coverage and total leverage ratios:

Interest

Coverage

minimum

ratio

Total

Leverage

not to

exceed

Present through September 30, 2012 2.00:1 4.75:1

December 31, 2012 through September 30, 2013 2.15:1 4.625:1

December 31, 2013 through September 30, 2014 2.15:1 4.375:1

December 31, 2014 through September 30, 2015 2.25:1 4.00:1

December 31, 2015 through September 30, 2016 2.25:1 3.75:1

December 31, 2016 through maturity 2.25:1 3.50:1

At December 31, 2011, the Company is in compliance with its financial covenants by a substantial margin.

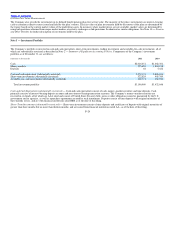

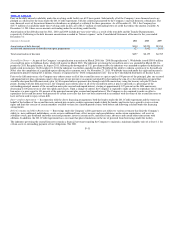

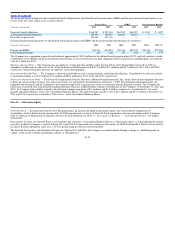

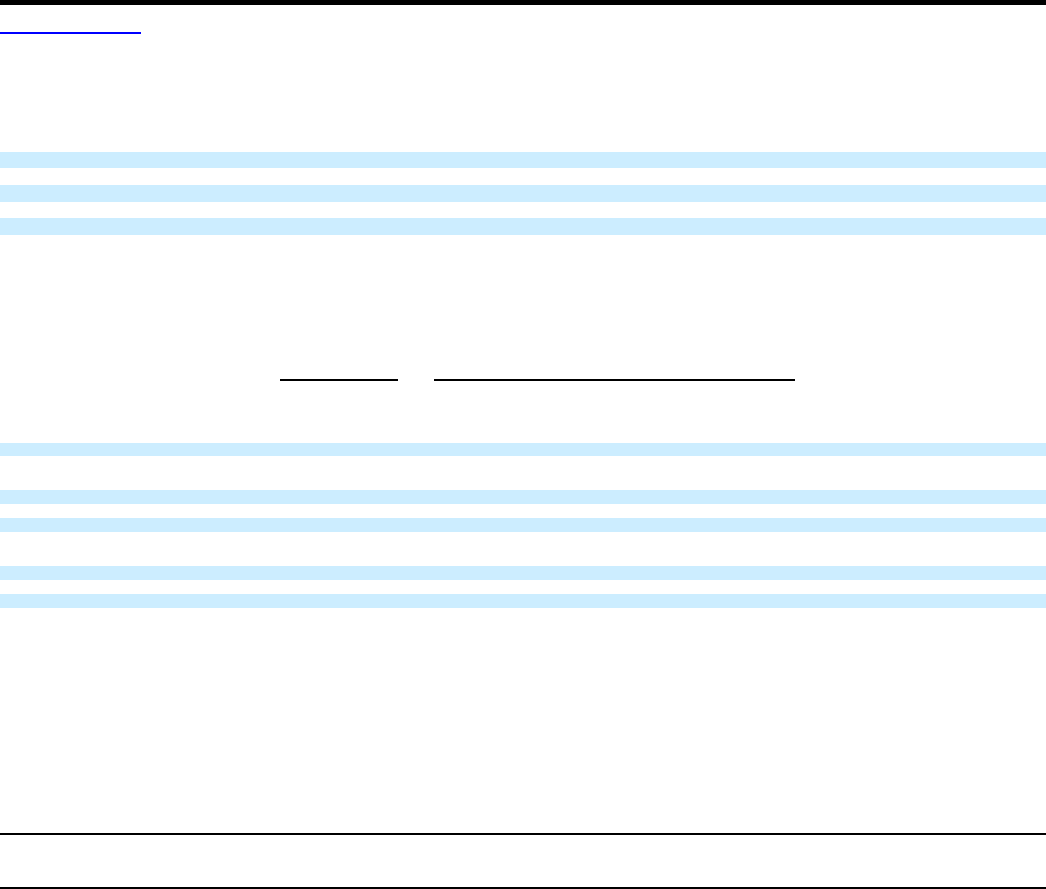

Deferred Financing Costs —The Company capitalized financing costs in “Other assets” in the Consolidated Balance Sheets and amortized them over the

term of the related debt using the effective interest method. Amortization of the deferred financing costs during 2011, 2010 and 2009 include the write−off

of a pro−rata portion of deferred financing costs in connection with the payments on the Second Lien Notes, the incremental term loan, the term debt and

the Senior Tranche B. Amortization is recorded in “Interest expense” in the Consolidated Statements of Income. Following is a summary of the deferred

financing costs at December 31:

2008 Senior Facility 2011 Credit Agreement

(Amounts in thousands) Senior Tranche

B Loan Senior secured

credit facility Senior secured

incremental term Senior revolving

credit facility Second Lien

Notes Total Deferred

Financing Costs

Balance at January 1, 2009 $ 16,586 $ — $ — $ — $ 30,872 $ 47,458

Amortization of deferred financing costs (3,875) — — — (3,251) (7,126)

Write−off of deferred financing costs (854) — — — — (854)

Balance at January 1, 2010 11,857 — — — 27,621 39,478

Amortization of deferred financing costs (3,330) — — — (3,274) (6,604)

Write−off of deferred financing costs (2,734) — — — — (2,734)

Balance at January 1, 2011 5,793 — — — 24,347 30,140

Capitalized deferred financing costs — 8,732 3,151 4,024 5,000 20,907

Amortization of deferred financing costs (968) (750) (51) (501) (3,583) (5,853)

Write−off of deferred financing costs (4,825) (1,100) (8) — (9,115) (15,048)

Balance at December 31, 2011 $ — $ 6,882 $ 3,092 $ 3,523 $ 16,649 $ 30,146

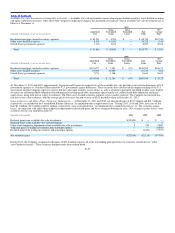

Debt Extinguishment Losses — The Company recognized total debt extinguishment losses of $37.5 million in 2011. In connection with the refinancing of

our 2008 senior debt facility in May 2011, we recorded $5.2 million of debt extinguishment costs, primarily from the write−off of unamortized deferred

financing costs. In connection with the partial redemption of the Second Lien Notes in November 2011, the Company incurred a prepayment penalty of

$23.2 million and wrote−off $9.1 million of unamortized deferred financing costs.

Interest Paid in Cash — The Company paid $78.5 million, $83.5 million and $94.4 million of interest in 2011, 2010 and 2009, respectively.

Maturities — At December 31, 2011, debt totaling $481.0 million will mature in 2017 and $325.0 million will mature in 2018, while debt principal totaling

$8.6 million will be paid in increments of $0.4 million quarterly through 2017.

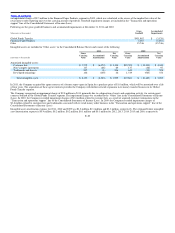

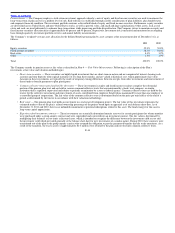

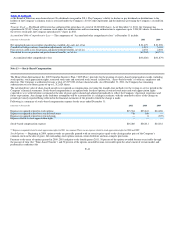

Note 10 — Pensions and Other Benefits

Pension Benefits — The Pension Plan is a frozen non−contributory funded defined benefit pension plan under which no new service or compensation

credits are accrued by the plan participants. Cash accumulation accounts continue to be credited with interest credits until participants withdraw their money

from the Pension Plan. It is the Company’s policy to fund the minimum required contribution each year.

F−32