MoneyGram 2011 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2011 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

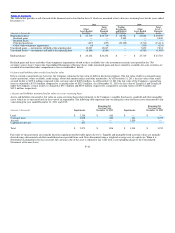

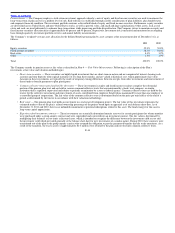

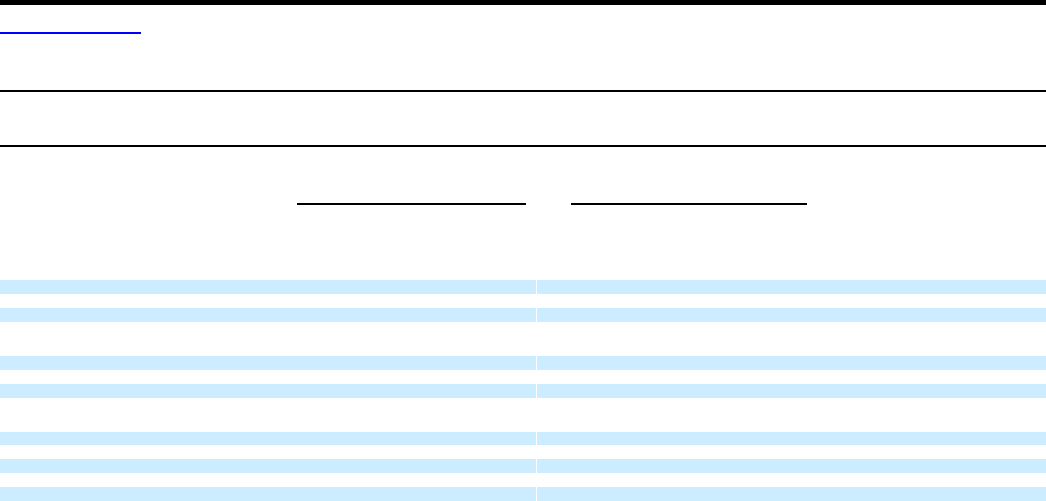

Note 9 — Debt

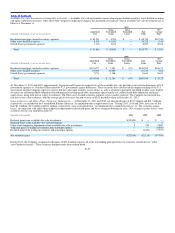

Following is a summary of the outstanding debt at December 31:

2008 Senior Facility 2011 Credit Agreement

(Amounts in thousands)

Senior Tranche

A Loan

due 2013 (1)

Senior Tranche

B Loan

due 2013 (1)

Senior secured

credit facility

due 2017 (1)

Senior secured

incremental term

loan due 2017 (1)

Second Lien

Notes due

2018 (1) Total Debt

Balance at January 1, 2009 $ 100,000 $ 233,881 $ — $ — $ 500,000 $ 833,881

Payments — (41,875) — — — (41,875)

Accretion of discount — 2,934 — — — 2,934

Write−off of discount — 1,851 — — — 1,851

Balance at January 1, 2010 100,000 196,791 — — 500,000 796,791

Payments — (165,000) — — — (165,000)

Accretion of discount — 2,253 — — — 2,253

Write−off of discount — 5,902 — — — 5,902

Balance at January 1, 2011 100,000 39,946 — — 500,000 639,946

Borrowings, gross — — 390,000 150,000 — 540,000

Discount on borrowings — — (975) (3,000) — (3,975)

Payments (100,000) (41,250) (50,000) (375) (175,000) (366,625)

Accretion and write−off of discount — 219 207 31 — 457

Debt extinguishment loss — 1,085 — — — 1,085

Balance at December 31, 2011 $ — $ — $ 339,232 $ 146,656 $ 325,000 $ 810,888

(1) For the year ended December 31, 2011, the weighted average interest rates were 4.52% for the Senior secured credit facility, 4.5% for the Senior secured incremental term loan and

13.25% for the Second Lien Notes. For the year ended December 31, 2010 the weighted average interest rates were 5.75% for the Senior Tranche A Loan, 7.25% for the Senior Tranche B

Loan and 13.25% for the Second Lien Notes.

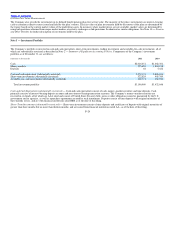

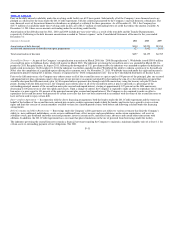

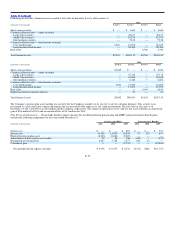

2008 Senior Facility — In connection with the 2011 Recapitalization, the 2008 senior facility was terminated. Prior to the termination, the Company was

able to elect an interest rate for the 2008 senior facility at each reset period based on the JP Morgan prime bank rate or the Eurodollar rate. During 2011,

2010 and 2009, the Company elected the United States prime bank rate as its interest basis.

2011 Credit Agreement — On May 18, 2011, Worldwide entered into the 2011 Credit Agreement of $540.0 million with BOA as Administrative Agent for

a group of lenders. The 2011 Credit Agreement is comprised of a $390.0 million six−and−one−half−year term loan maturing the earlier of November 2017

and 180 days prior to the scheduled maturity of the Second Lien Notes, and a $150.0 million five−year revolving credit facility, maturing May 2016. The

term loan was issued by Worldwide at 99.75% of par. On November 21, 2011, Worldwide entered into an amendment related to the 2011 Credit Agreement

and obtained an incremental term loan in an aggregate principal amount of $150 million. The incremental term loan was issued to Worldwide at 98.0% of

par. The discounts for the term loan and the incremental term loan are recorded as a reduction in the carrying value of the loans and will be amortized over

the life of the debt using the effective interest method. The incremental term loan has quarterly principal payments of $0.4 million beginning September 30,

2011, with the remaining outstanding principal due November 2017.

The Company may elect an interest rate for the 2011 Credit Agreement at each reset period based on the BOA alternate base rate or the Eurodollar rate. The

interest rate election may be made individually for the term loan, incremental term loan and each draw under the revolving credit facility. The interest rate is

either the BOA prime rate plus 225 basis points or the Eurodollar rate plus 325 basis points. Since inception of the 2011 Credit Agreement, the Company

elected the Eurodollar rate as its primary interest basis, with a minimal amount of the term debt at the BOA alternate base rate. Under the terms of the 2011

Credit Agreement, the interest rate determined using the Eurodollar rate has a minimum rate of 1.25 percent.

F−30