MoneyGram 2011 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2011 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249

|

|

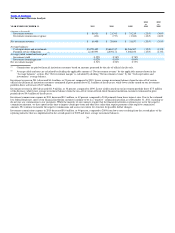

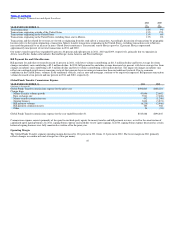

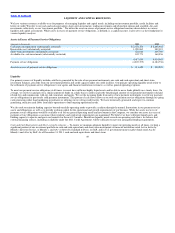

Table of Contents

transfer transaction, higher signing bonus expense and higher marketing and compensation expense, partially offset by money transfer revenue growth net

of related commissions expense. Included in the 2010 operating margin is a $16.4 million benefit from a legal accrual reversal in 2010 related to a Global

Funds Transfer patent, which added a 155 basis point benefit to the 2010 operating margin.

The operating margin for the Global Funds Transfer segment increased to 13.2 percent in 2010 from 8.1 percent in 2009. Included in the 2010 operating

margin is a $16.4 million benefit from a legal accrual reversal in 2010, which added a 155 basis point benefit to the 2010 operating margin. In 2009, the

operating margin included $34.5 million of legal reserves related to a patent lawsuit and a settlement agreement with the Federal Trade Commission, an

incremental $15.0 million provision for loss in 2009 from the closure of an international agent and a $3.2 million goodwill impairment charge related to a

discontinued bill payment product. After considering these items, the 2010 operating margin benefited from money transfer volume growth and lower

signing bonus amortization, partially offset by lower bill payment revenue.

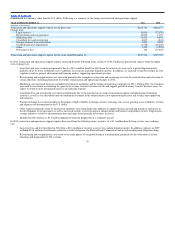

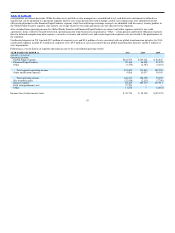

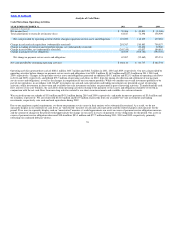

FINANCIAL PAPER PRODUCTS SEGMENT

2011 2010

vs. vs.

YEAR ENDED DECEMBER 31, 2011 2010 2009 2010 2009

(Amounts in thousands)

Money order revenue:

Fee and other revenue $57,350 $ 64,342 $ 69,296 (11)% (7)%

Investment revenue 3,100 3,951 5,584 (22)% (29)%

Total money order revenue 60,450 68,293 74,880 (11)% (9)%

Official check revenue:

Fee and other revenue 21,069 25,696 23,690 (18)% 8%

Investment revenue 11,813 15,526 24,213 (24)% (36)%

Total official check revenue 32,882 41,222 47,903 (20)% (14)%

Total Financial Paper Products revenue:

Fee and other revenue 78,419 90,038 92,986 (13)% (3)%

Investment revenue 14,913 19,477 29,797 (23)% (35)%

Total Financial Paper Products revenue 93,332 109,515 122,783 (15)% (11)%

Commissions expense $ 2,396 $ 3,931 $ 8,295 (39)% (53)%

Operating income $29,168 $ 36,508 $ 27,372 (20)% 33%

Operating margin 31.3% 33.3% 22.3%

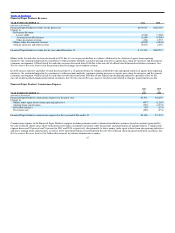

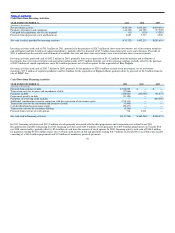

Total revenue in the Financial Paper Products segment consists of per−item fees charged to our financial institution customers and retail agents and

investment revenue. Financial Paper Products revenue decreased $16.2 million and $13.3 million in 2011 and 2010, respectively.

46