MoneyGram 2011 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2011 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249

|

|

Table of Contents

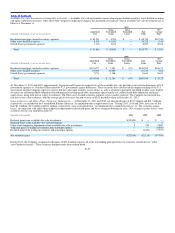

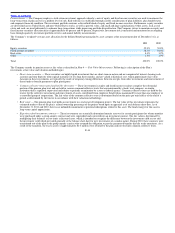

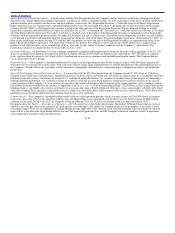

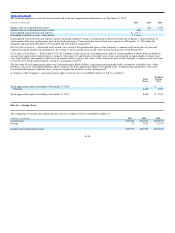

Following are the Plan’s financial assets recorded at fair value by hierarchy level as of December 31:

2011

(Amounts in thousands) Level 1 Level 2 Level 3 Total

Short−term securities $ — $ 1,644 $ — $ 1,644

Common collective trust — equity securities

Large Cap securities — 46,133 — 46,133

Small Cap securities — 10,274 — 10,274

International securities — 5,126 — 5,126

Common collective trust — fixed income securities

Core fixed income 5,267 16,558 — 21,825

Long duration fixed income — 20,380 — 20,380

Real estate — — 4,760 4,760

Total financial assets $5,267 $100,115 $4,760 $110,142

2010

(Amounts in thousands) Level 1 Level 2 Level 3 Total

Short−term securities $1,949 $ — $ — $ 1,949

Common collective trust — equity securities

Large Cap securities — 47,178 — 47,178

Small Cap securities — 10,641 — 10,641

International securities — 6,282 — 6,282

Common collective trust — fixed income securities

Core fixed income 4,943 13,949 — 18,892

Long duration fixed income — 17,973 — 17,973

Real estate — — 4,194 4,194

Experience fund investment contracts — 27 — 27

Total financial assets $6,892 $96,050 $4,194 $107,136

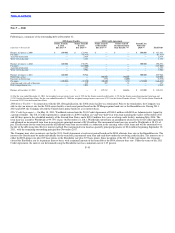

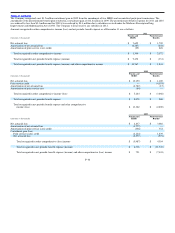

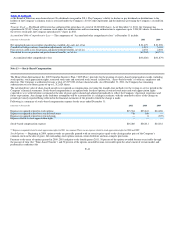

The Company’s pension plan assets include one security that the Company considers to be a Level 3 asset for valuation purposes. This security is an

investment in a real estate joint venture and requires the use of unobservable inputs in its fair value measurement. The fair value of this asset as of

December 31, 2011 and 2010 was $4.8 million and $4.2 million, respectively. The change in reported net asset value for this asset resulted in an unrealized

gain of $0.6 million for 2011 and an unrealized loss of $1.5 million for 2010.

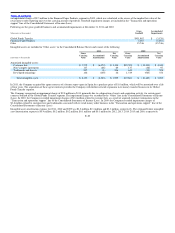

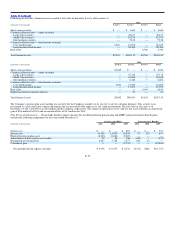

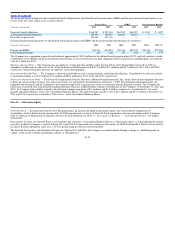

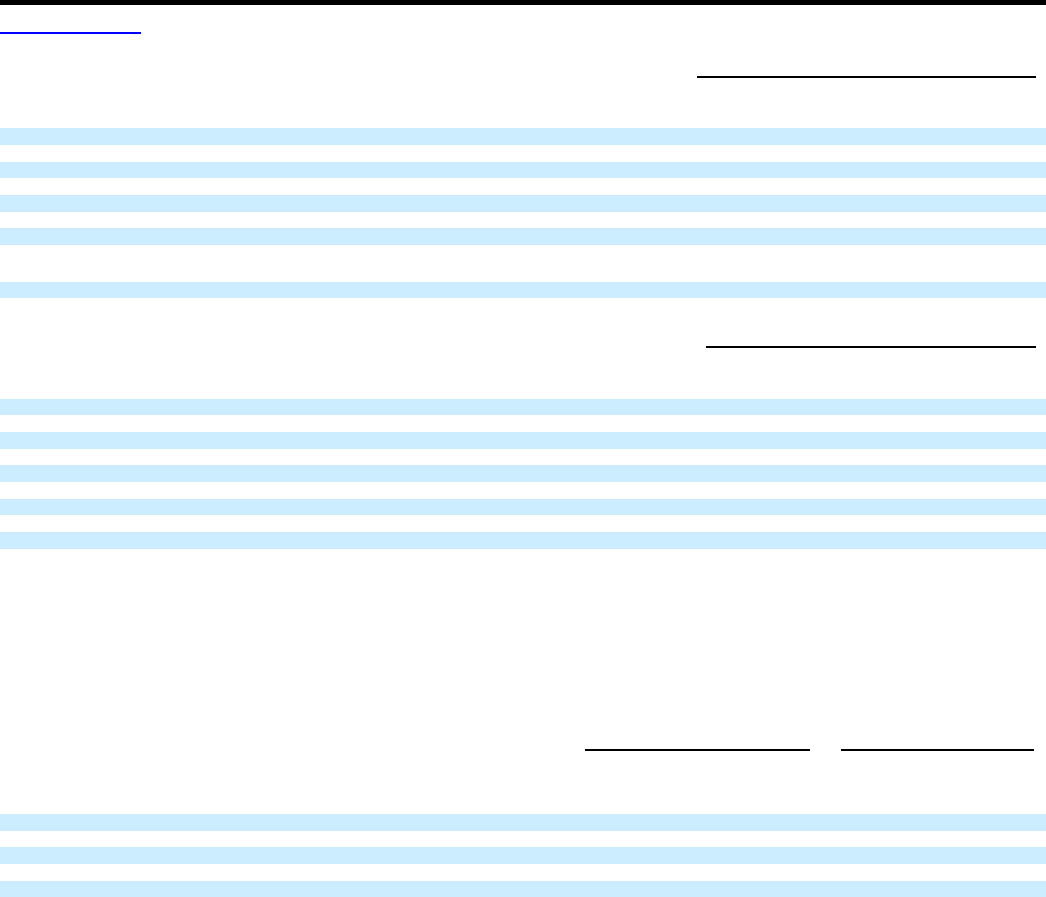

Plan Financial Information — Net periodic benefit expense (income) for the defined benefit pension plan and SERPs and postretirement benefit plans

includes the following components for the years ended December 31:

Pension and SERPs Postretirement Benefits

(Amounts in thousands) 2011 2010 2009 2011 2010 2009

Service cost $ — $ — $ 894 $ — $ — $ 572

Interest cost 11,365 11,876 12,659 51 253 837

Expected return on plan assets (8,223) (8,664) (9,403) — — —

Amortization of prior service cost (credit) 29 84 346 (626) — (352)

Recognized net actuarial loss 6,287 4,782 3,777 244 15 —

Curtailment gain — — (1,535) — — (12,804)

Net periodic benefit expense (income) $ 9,458 $ 8,078 $ 6,738 $(331) $268 $(11,747)

F−35