MoneyGram 2011 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2011 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

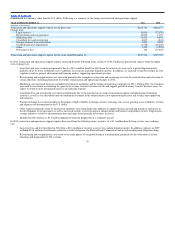

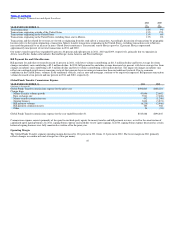

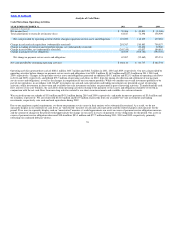

Operating Margin

The operating margin for the Financial Paper Products segment decreased to 31.3 percent in 2011 from 33.3 percent in 2010 due to volume and investment

revenue declines. The operating margin for the Financial Paper Products segment increased to 33.3 percent in 2010 from 22.3 percent in 2009, reflecting

$6.1 million of goodwill and asset impairment charges in 2009 related to our money order business and lower commissions, partially offset by lower

investment revenue in 2010.

TRENDS EXPECTED TO IMPACT 2012

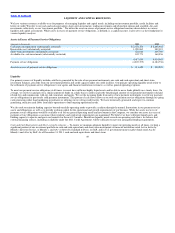

The discussion of trends expected to impact our business in 2012 is based on information presently available and contains certain assumptions regarding

future economic conditions. Differences in actual economic conditions during 2012 compared with our assumptions could have a material impact on our

results. See “Cautionary Statements Regarding Forward−Looking Statements” and Part I, Item 1A, “Risk Factors” of this Annual Report on Form 10−K for

additional factors that could cause results to differ materially from those contemplated by the following forward−looking statements.

Throughout 2011, global economic conditions remained weak. We cannot predict the duration or extent of the severity of these economic conditions, nor the

extent to which these conditions could negatively affect our business, operating results or financial condition. While the money remittance industry has

generally been resilient during times of economic softness, the current global economic conditions have continued to adversely impact the demand for

money remittances. Given the global economic uncertainty, we have less visibility to the future and believe growth rates could continue to be impacted by

slow economic conditions. In addition, bill payment products available in the United States have not been as resilient as money transfers.

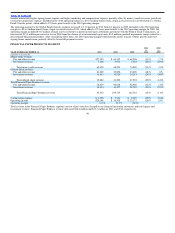

While there is uncertainty around the global economy and the remittance industry, the World Bank, a key source of industry analysis for developing

countries, is projecting seven percent remittance growth in 2012. Our growth has historically exceeded the World Bank projections. Our expansion in key

global growth markets and strong partnership focus with our agents will continue to fuel this growth. Additionally, agent expansion and increasing

productivity in our existing agent locations through marketing support, customer acquisition and new product innovation will drive growth. We believe all

of these efforts will not only help to mitigate the effects of the current global economic conditions, but position us for enhanced market share and growth

when the economy begins to recover.

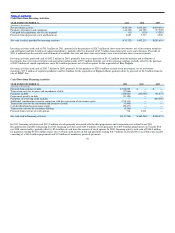

For our Financial Paper Products segment, we expect the decline in overall paper−based transactions to continue in 2012. As a result of the pricing

initiatives undertaken in prior years, we have reduced the commission rates paid to our official check financial institution customers and instituted certain

per item and other fees for both the official check and money order services. In addition, the historically low interest rate environment has resulted in low or

no commissions being paid to our official check financial institution customers. As a result, we anticipate that the Financial Paper Products segment will

continue to experience financial institution and agent attrition in 2012.

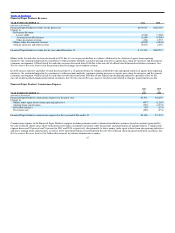

We continue to see a trend among state, federal and international regulators toward enhanced scrutiny of anti−money laundering compliance, as well as

consumer fraud prevention and education. As we continue to revise our processes and enhance our technology systems to meet regulatory trends, our

operating expenses for compliance may increase.

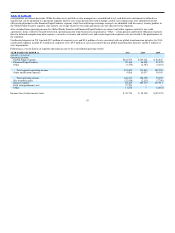

Acquisition and Disposal Activity

Acquisition and disposal activity is set forth in Note 3 — Acquisitions and Disposals of the Notes to Consolidated Financial Statements.

48