MoneyGram 2011 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2011 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249

|

|

Table of Contents

respectively, of the fee and investment revenue of our Global Funds Transfer segment. Wal−Mart Stores, Inc. is our only agent that accounts for more than

10 percent of our total company fee and investment revenue. In 2011,

2010 and 2009, Wal−Mart accounted for 29 percent, 30 percent and 29 percent, respectively, of our total company fee and investment revenue, and 31

percent, 32 percent and 32 percent, respectively, of the fee and investment revenue of our Global Funds Transfer segment. Our contract with Wal−Mart in

the United States, which runs through January 2013, provides for Wal−Mart’s sale of our money order and money transfer services and real−time, urgent

bill payment services at its retail locations on an exclusive basis.

Our Segments

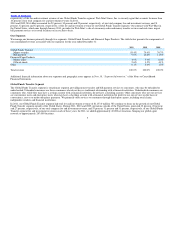

We manage our business primarily through two segments: Global Funds Transfer and Financial Paper Products. The table below presents the components of

our consolidated revenue associated with our segments for the year ended December 31:

2011 2010 2009

Global Funds Transfer

Money transfer 83.4% 79.4% 76.7%

Bill payment 9.0% 10.8% 11.6%

Financial Paper Products

Money order 4.9% 5.9% 6.4%

Official check 2.6% 3.5% 4.1%

Other 0.1% 0.4% 1.2%

Total revenue 100.0% 100.0% 100.0%

Additional financial information about our segments and geographic areas appears in Note 16, “Segment Information,” of the Notes to Consolidated

Financial Statements.

Global Funds Transfer Segment

The Global Funds Transfer segment is our primary segment, providing money transfer and bill payment services to consumers, who may be unbanked or

underbanked. Unbanked consumers are those consumers who do not have a traditional relationship with a financial institution. Underbanked consumers are

consumers who, while they may have a savings account with a financial institution, do not have a checking account. Other consumers who use our services

are convenience users and emergency users who may have a checking account with a financial institution but prefer to use our services on the basis of

convenience, cost or to make emergency payments. We primarily offer services to consumers through third−party agents, including retail chains,

independent retailers and financial institutions.

In 2011, our Global Funds Transfer segment had total fee and investment revenue of $1,153.0 million. We continue to focus on the growth of our Global

Funds Transfer segment outside of the United States. During 2011, 2010 and 2009, operations outside of the United States generated 32 percent, 28 percent

and 27 percent, respectively, of our total company fee and investment revenue, and 35 percent, 31 percent and 31 percent, respectively, of our Global Funds

Transfer segment fee and investment revenue in each of these years. In 2011, we added approximately 40,000 net locations, bringing our global agent

network to approximately 267,000 locations.

5