MoneyGram 2011 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2011 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

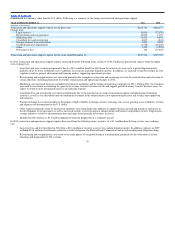

Debt Refinancings — On May 18, 2011, the Company entered into a credit agreement in connection with the New Credit Facility, referred to herein as the

2011 Credit Agreement, consisting of a $150.0 million, five−year revolving credit facility and a $390.0 million, six−and−one−half−year term loan. On

November 21, 2011, the Company entered into an amendment to the 2011 Credit Agreement and obtained in incremental term loan in an aggregate principal

amount of $150 million. The net proceeds from the term loan under the 2011 Credit Agreement were used to consummate the 2011 Recapitalization and to

refinance the Company’s existing 2008 senior facility. In connection with this refinancing, the Company incurred a $5.2 million debt extinguishment loss

from the pro−rata write−off of unamortized deferred financing costs.

In connection with the secondary offering, the Company exercised an option to redeem a portion of its Second Lien Notes in November 2011. The

redemption was completed through the issuance of the $150.0 million incremental term loan under the 2011 Credit Agreement, with the remaining balance

paid from cash and cash equivalents. In connection with the redemption, the Company incurred a prepayment penalty of $23.2 million and wrote−off $9.1

million of unamortized deferred financing costs, for a total debt extinguishment loss of $32.3 million.

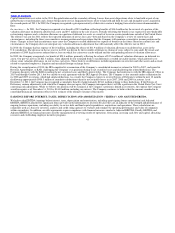

Global Economic Conditions — Throughout 2011, worldwide economic conditions continued to remain weak, as evidenced by high unemployment rates,

government assistance to citizens and businesses on a global basis, continued declines in asset values, restricted lending activity and low consumer

confidence, among other factors. Historically, the money remittance industry has generally been resilient during times of economic softness as money

transfers are deemed essential to many, with the funds used by the receiving party for food, housing and other basic needs. However, given the global reach

and extent of the current economic recession, the growth of money transfer volumes and the average principal of money transfers continued to fluctuate by

corridor and country in 2011, particularly in Europe.

The Company experienced transaction growth in Northern Europe, which was somewhat offset by weakness in Spain, Italy and Greece from economic and

regulatory factors. New regulations in Italy, which include a tax on non−European Union residents and send limits at non−bank locations, limited our

consumers’ ability to send money and slowed growth in the country. The impact of the new legislation was partially offset as a large Italian agent has a

higher send limit than non−bank locations.

In addition, bill payment products available in the United States are not as resilient as money transfers given the consumer credit markets and the more

discretionary nature of some items paid for by consumers using these products. Accordingly, the volume of bill payment transactions continued to be

adversely impacted in 2011, particularly in the auto, housing and credit card sectors. The Company continues to actively pursue strategic initiatives to

mitigate the economic impact on bill payment products, including the addition of 1,500 billers to the MoneyGram network and expansion of the products

into Canada during 2011. While there have been some indicators of moderation and improvement during the fourth quarter of 2011, particularly in the

United States, we continue to have limited visibility into the future and believe growth rates will continue to be hampered in 2012.

Money Transfer Pricing — In the first half of 2010, we introduced a $50 price band that allows consumers to send $50 of principal for a $5 fee at most

locations, or a $4.75 fee at a Wal−Mart location. As discussed further in Global Funds Transfer Segment, the $50 price band impacted revenue growth, as

2011 was the first full year of the pricing change.

Global Transformation Initiative — In the second quarter of 2010, we announced the implementation of a global transformation initiative to realign our

management and operations with the changing global market and streamline operations to promote a more efficient and scalable cost structure. The

initiative includes organizational changes, relocation of certain operations and investment in technology, among other items. The Company has incurred

$20.7 million and $5.4 million of cash outlays in 2011 and 2010, respectively, and recorded $23.5 million and $5.9 million of expenses during 2011 and

2010, respectively. We anticipate this initiative to generate annual pre−tax cost savings of $25.0 million to $30.0 million when fully implemented in 2012.

34