MoneyGram 2011 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2011 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

PART II

Item 5. MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES

OF EQUITY SECURITIES

Our common stock is traded on the New York Stock Exchange under the symbol “MGI”. No dividends on our common stock were declared by our Board of

Directors in 2011 or 2010. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Mezzanine Equity and

Stockholders’ Deficit” and Note 12 — Stockholders’ Deficit of the Notes to Consolidated Financial Statements. As of February 28, 2012, there were 10,482

stockholders of record of our common stock. On November 14, 2011, we effected a one−for−eight reverse stock split of our issued and outstanding common

stock. All share and per share amounts have been retroactively adjusted to reflect the stock split with the exception of the Company’s treasury stock, which

was not a part of the reverse stock split.

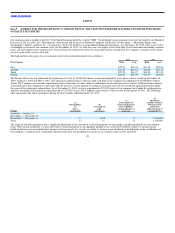

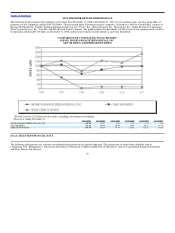

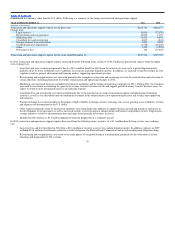

The high and low sales prices for our common stock for the periods presented were as follows:

2011 2010

Fiscal Quarter High Low High Low

First $27.44 $19.44 $31.28 $20.24

Second $33.12 $25.12 $32.08 $18.72

Third $29.28 $16.72 $23.20 $15.92

Fourth $23.04 $15.90 $23.52 $18.00

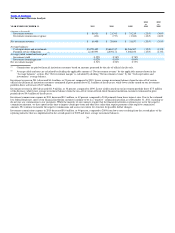

The Board of Directors has authorized the repurchase of a total of 12,000,000 shares, as announced publicly in our press releases issued on November 18,

2004, August 18, 2005 and May 9, 2007. The repurchase authorization is effective until such time as the Company has repurchased 12,000,000 common

shares. The Company may consider repurchasing shares from time−to−time, subject to limitations in our debt agreements. Shares of MoneyGram common

stock tendered to the Company in connection with the exercise of stock options or vesting of restricted stock are not considered repurchased shares under

the terms of the repurchase authorization. As of December 31, 2011, we have repurchased 6,795,017 shares of our common stock under this authorization

and have remaining authorization to repurchase up to 5,204,983 shares. The Company repurchased 17 shares in the fourth quarter of 2011. The following

table summarizes the share repurchases during the three months ended December 31, 2011:

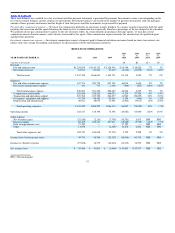

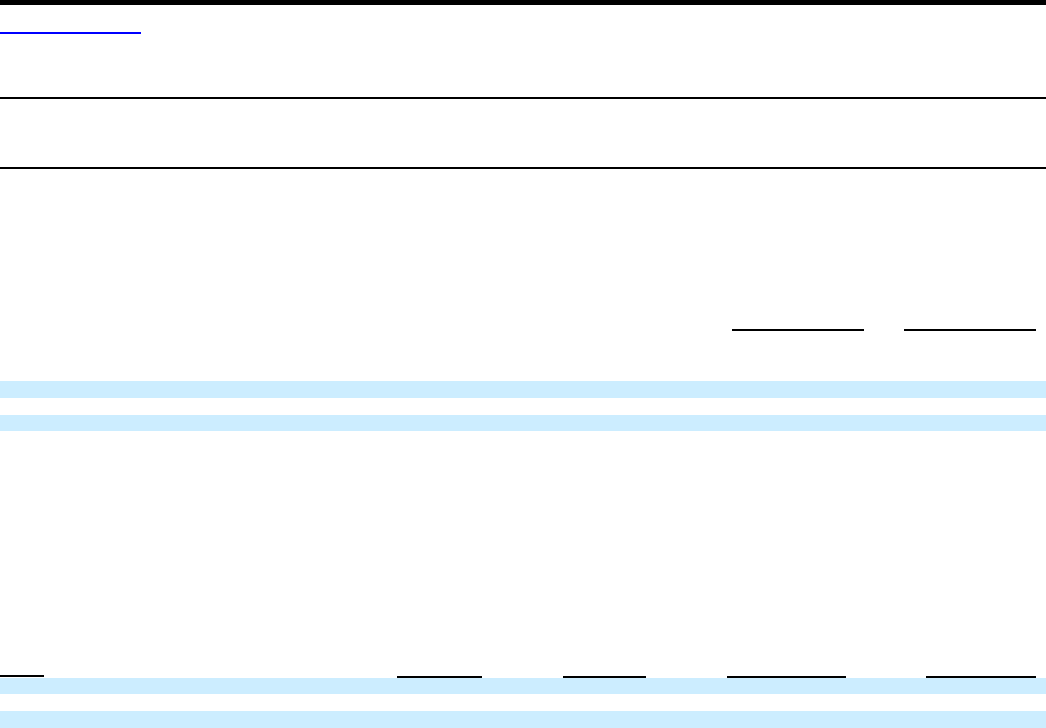

Period

(a)

Total number

of

shares

purchased

(b)

Average price

paid

per share

(c)

Total number of

shares purchased as

part of publicly

announced plans or

programs

(d)

Maximum

number of shares

that may yet be

purchased

under the plans or

programs (1)

October 1 – October 31

November 1 – November 30

December 1 – December 31 17 16.28 17 5,204,983

Total 17 — 17 5,204,983

The terms of our debt agreements place significant limitations on the amount of restricted payments we may make, including dividends on our common

stock. With certain exceptions, we may only make restricted payments in an aggregate amount not to exceed $25.0 million, subject to an incremental

build−up based on our consolidated net income in future periods. As a result, our ability to declare or pay dividends or distributions to the stockholders of

the Company’s common stock is materially limited at this time. No dividends were paid on our common stock in 2011 and 2010.

28