MoneyGram 2011 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2011 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

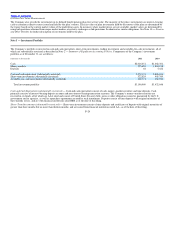

Table of Contents

from independent sources, including a pricing service. Because market quotes are generally not readily available or accessible for these specific

securities, the pricing service generally measures fair value through the use of pricing models and observable inputs for similar assets and market

data. Accordingly, these securities are classified as Level 2 financial instruments. The Company periodically corroborates the valuations provided

by the pricing service through internal valuations utilizing externally developed cash flow models, comparison to actual transaction prices for any

sold securities and any broker quotes received on the same security.

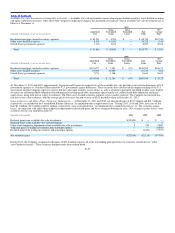

For other asset−backed securities, investments in limited partnerships and trading investments, market quotes are generally not available. If

available, the Company will utilize a fair value measurement from a pricing service. The pricing service utilizes a pricing model based on market

observable data and indices, such as quotes for comparable securities, yield curves, default indices, interest rates and historical prepayment speeds.

If a fair value measurement is not available from the pricing service, the Company will utilize a broker quote if available. Due to a general lack of

transparency in the process that the brokers use to develop prices, most valuations that are based on brokers’ quotes are classified as Level 3. If no

broker quote is available, or if such quote cannot be corroborated by market data or internal valuations, the Company will perform internal

valuations utilizing externally developed cash flow models. These pricing models are based on market observable spreads and, when available,

observable market indices. The pricing models also use inputs such as the rate of future prepayments and expected default rates on the principal,

which are derived by the Company based on the characteristics of the underlying structure and historical prepayment speeds experienced at the

interest rate levels projected for the underlying collateral. The pricing models for certain asset−backed securities also include significant

non−observable inputs such as internally assessed credit ratings for non−rated securities, combined with externally provided credit spreads.

Observability of market inputs to the valuation models used for pricing certain of the Company’s investments deteriorated with the disruption to

the credit markets as overall liquidity and trading activity in these sectors has been substantially reduced. Accordingly, securities valued using a

pricing model have consistently been classified as Level 3 financial instruments.

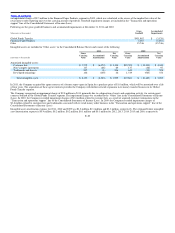

•Derivative Financial Instruments — Derivatives consist of forward contracts to hedge income statement exposure to foreign currency exchange

risk arising from the Company’s assets and liabilities denominated in foreign currencies. The Company’s forward contracts are well−established

products, allowing the use of standardized models with market−based inputs. These models do not contain a high level of subjectivity and the

inputs are readily observable. Accordingly, the Company has classified its forward contracts as Level 2 financial instruments. See Note 6 —

Derivative Financial Instruments for more information on the forward contracts.

•Other Financial Instruments — Other financial instruments consisted of put options related to trading investments. The fair value of the put

options related to trading investments were estimated using the expected cash flows from the instruments through their assumed exercise date.

These cash flows were discounted at a rate corroborated by market data for a financial institution comparable to the put option counter−party, as

well as the Company’s interest rate on its debt. The discounted cash flows of the put options were then reduced by the estimated fair value of the

related trading investments. Given the subjectivity of the discount rate and the estimated fair value of the trading investments, the Company

classified its put options related to trading investments as Level 3 financial instruments. The fair value of the put options is remeasured each

period, with the change in fair value recognized in the Consolidated Statements of Income.

•Deferred compensation — The assets associated with the deferred compensation plan which are funded through voluntary contributions by the

Company consist of investments in mutual funds. These investments were classified as Level 1 as there are quoted market prices for these funds.

F−21