Experian 2011 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2011 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

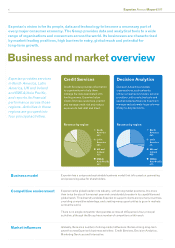

Introduction Business and market overview xx

7

Market influences

Credit Services and

Decision Analytics

Decision Analytics unlocks the value

of Experian’s vast databases of credit

and marketing information, as well

as clients’ data, by applying scoring,

expert consulting, analytical tools and

software to convert data into valuable

business decisions for organisations.

Description

Experian enables lending organisations

to make accurate and relevant

decisions at every stage of the

customer relationship; helping to

identify potentially profitable new

customers, to segment their existing

customers according to risk and

opportunity, to manage loan portfolios

and to undertake effective collections

actions. Decision Analytics products

are also used in the detection and

prevention of fraud.

Experian employs over one thousand

statisticians, mathematicians and

analysts globally creating both bespoke

and industry solutions. Experian builds

application processing, customer

management, fraud solutions and

collections software and systems.

l Application processing systems

enable organisations to balance

the requirement for speed and

competitiveness with the need

for careful risk assessment when

considering an applicant for credit.

l Customer management systems are

used to automate huge volumes of

day-to-day decisions. It’s about making

the right decision for each customer, in

a consistent and cost-efficient manner.

l Fraud solutions are used to

authenticate that people are who they

say they are and that the information

being provided is correct.

l Collections analytics and software

play an important part in helping

organisations establish an accurate

picture of a customer’s propensity to

pay, and therefore the amount likely to

be recovered.

Clients

Multinational clients often standardise

their lending operations on Experian’s

tools and software, helping to improve

strategic control and operating

effectiveness as well as helping to

satisfy regulatory obligations.

Financial characteristics

Credit scores and fraud checks are

sold on a transactional volume-

tiered basis, whilst revenue from

software and systems consists partly

of implementation fees and partly of

contractually recurring licence fees.

Experian is a market leading provider

of Decision Analytics in all its major

geographies excluding the US, where

Fair Isaac Corporation is the market

leader. Competition in individual

markets comes from smaller, local

players.

Competitive environment

Decision Analytics

The addressable market for Experian’s

data and analytics is expanding in

emerging markets and new customer

segments. There is greater demand

for risk management, fraud prevention

and customer segmentation tools.

Globally, adoption of best practices

for risk management creates new

opportunities, as is evident today

in India and Brazil.

Business model

Decision

Analytics Contribution to

Group revenue

10%