Experian 2011 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2011 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164

|

|

Financial statements 119

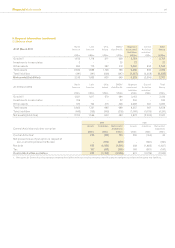

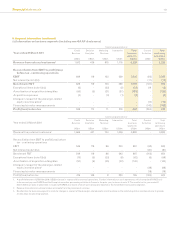

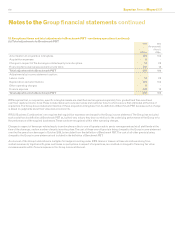

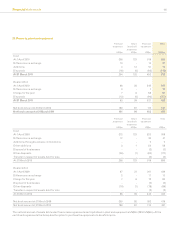

15. Tax charge/(credit) in the Group income statement (continued)

(c) Factors that may affect future tax charges

In the foreseeable future, the Group’s tax charge will continue to be inuenced by the prole of prots earned in the different countries in which

the Group’s businesses operate and could be affected by changes in tax law. In the UK, the main rate of corporation tax has been reduced from

28% to 26% with effect from 1 April 2011. Further proposed reductions to the main rate will reduce it by 1% per annum to 23% from 1 April 2014.

Each of these further proposed reductions is expected to be separately enacted and has not yet been substantively enacted.

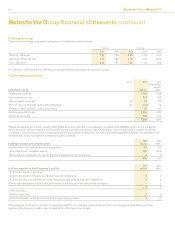

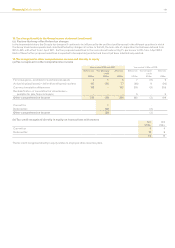

16. Tax recognised in other comprehensive income and directly in equity

(a) Tax recognised in other comprehensive income

Year ended 31 March 2011 Year ended 31 March 2010

Before tax

US$m

Tax (charge)/

credit

US$m

After tax

US$m

Before tax

US$m

Tax (charge)/

credit

US$m

After tax

US$m

Fair value gains – available for sale nancial assets 4 1 5 7 (2) 5

Actuarial gains/(losses) – dened benet pension plans 107 (30) 77 (28) 8 (20)

Currency translation differences 142 - 142 218 (9) 209

Reclassication of cumulative fair value losses –

available for sale nancial assets - - - 5 - 5

Other comprehensive income 253 (29) 224 202 (3) 199

Current tax 1-

Deferred tax (30) (3)

Other comprehensive income (29) (3)

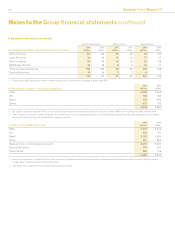

(b) Tax credit recognised directly in equity on transactions with owners 2011

US$m

2010

US$m

Current tax 5 4

Deferred tax 15 8

20 12

The tax credit recognised directly in equity relates to employee share incentive plans.